Structured credit products, such as collateralized debt obligations (CDOs) and asset-backed securities (ABS), offer diversified exposure to pools of debt assets with varying risk profiles and maturities. Commercial paper represents short-term, unsecured promissory notes issued by corporations to meet immediate liquidity needs, typically with maturities under 270 days. Explore the distinct features, risk factors, and investment strategies associated with structured credit and commercial paper to enhance your financial decision-making.

Why it is important

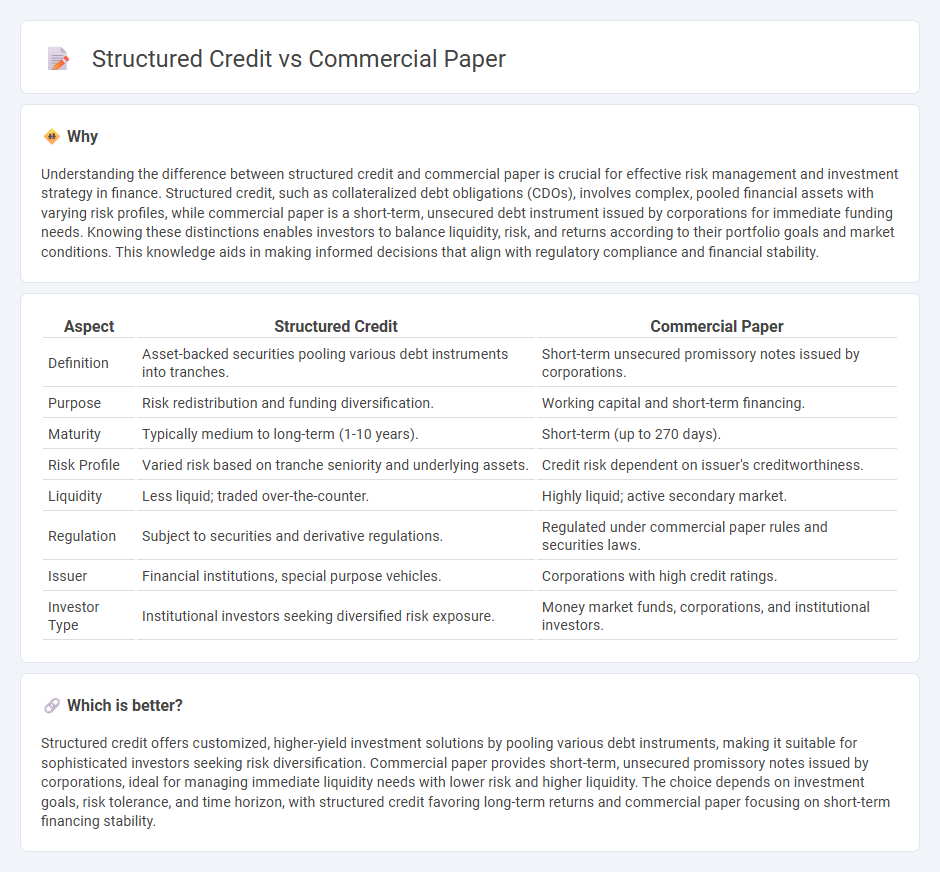

Understanding the difference between structured credit and commercial paper is crucial for effective risk management and investment strategy in finance. Structured credit, such as collateralized debt obligations (CDOs), involves complex, pooled financial assets with varying risk profiles, while commercial paper is a short-term, unsecured debt instrument issued by corporations for immediate funding needs. Knowing these distinctions enables investors to balance liquidity, risk, and returns according to their portfolio goals and market conditions. This knowledge aids in making informed decisions that align with regulatory compliance and financial stability.

Comparison Table

| Aspect | Structured Credit | Commercial Paper |

|---|---|---|

| Definition | Asset-backed securities pooling various debt instruments into tranches. | Short-term unsecured promissory notes issued by corporations. |

| Purpose | Risk redistribution and funding diversification. | Working capital and short-term financing. |

| Maturity | Typically medium to long-term (1-10 years). | Short-term (up to 270 days). |

| Risk Profile | Varied risk based on tranche seniority and underlying assets. | Credit risk dependent on issuer's creditworthiness. |

| Liquidity | Less liquid; traded over-the-counter. | Highly liquid; active secondary market. |

| Regulation | Subject to securities and derivative regulations. | Regulated under commercial paper rules and securities laws. |

| Issuer | Financial institutions, special purpose vehicles. | Corporations with high credit ratings. |

| Investor Type | Institutional investors seeking diversified risk exposure. | Money market funds, corporations, and institutional investors. |

Which is better?

Structured credit offers customized, higher-yield investment solutions by pooling various debt instruments, making it suitable for sophisticated investors seeking risk diversification. Commercial paper provides short-term, unsecured promissory notes issued by corporations, ideal for managing immediate liquidity needs with lower risk and higher liquidity. The choice depends on investment goals, risk tolerance, and time horizon, with structured credit favoring long-term returns and commercial paper focusing on short-term financing stability.

Connection

Structured credit products often include commercial paper as a short-term funding instrument to manage liquidity and refinance debt within collateralized debt obligations (CDOs) or asset-backed securities (ABS). Commercial paper, being unsecured and issued by corporations, provides flexibility and quick access to capital, supporting the issuance and performance of structured credit instruments. The integration of commercial paper into structured finance enhances yield and risk diversification for investors in complex credit portfolios.

Key Terms

Unsecured debt

Commercial paper represents short-term unsecured debt typically issued by corporations to finance immediate operational needs, with maturities usually under 270 days. Structured credit involves pools of unsecured debt obligations, such as asset-backed securities, engineered to redistribute risk and can have varied maturities and credit enhancements. Explore detailed comparisons and risk profiles of commercial paper and structured credit instruments to enhance your investment decisions.

Asset-backed securities

Asset-backed securities (ABS) are a type of structured credit instrument representing pooled financial assets like loans or receivables, offering investors cash flows from these underlying assets. In contrast, commercial paper is an unsecured, short-term debt instrument issued by corporations to finance immediate liabilities without asset backing. Explore the detailed differences and investment implications between commercial paper and asset-backed securities for optimized portfolio strategies.

Credit risk

Commercial paper presents credit risk primarily through issuer default, with risk mitigated by short maturities and high credit ratings from established corporations. Structured credit involves pooling various debt instruments, exposing investors to complex credit risk layers, including tranching, correlation risk, and potential downgrades of underlying assets. Explore in-depth analyses to understand how these distinct credit risk profiles impact investment decisions.

Source and External Links

Commercial paper - Wikipedia - Commercial paper is a short-term money-market security issued by large corporations, maturing before nine months, to fund operating expenses or current assets without needing SEC registration.

Commercial Paper - Overview, How It Works, Risks - Corporate Finance Institute - Commercial paper is an unsecured, short-term debt instrument with maturities up to 270 days, sold at a discount, mainly issued by highly rated corporations as an alternative to costlier funding.

The Fed - Commercial Paper Rates and Outstanding - Commercial paper consists of short-term promissory notes issued primarily by corporations, with maturities up to 270 days, commonly used as a lower-cost alternative to bank loans.

dowidth.com

dowidth.com