Dark pool trading offers institutional investors the ability to execute large orders anonymously, minimizing market impact and information leakage compared to traditional order book trading, which provides transparency and immediate order visibility on public exchanges. Order books display real-time bid and ask prices, enabling price discovery and liquidity assessment, while dark pools operate off-exchange to protect trading strategies from market scrutiny. Explore further to understand the advantages, risks, and regulatory considerations of both trading mechanisms.

Why it is important

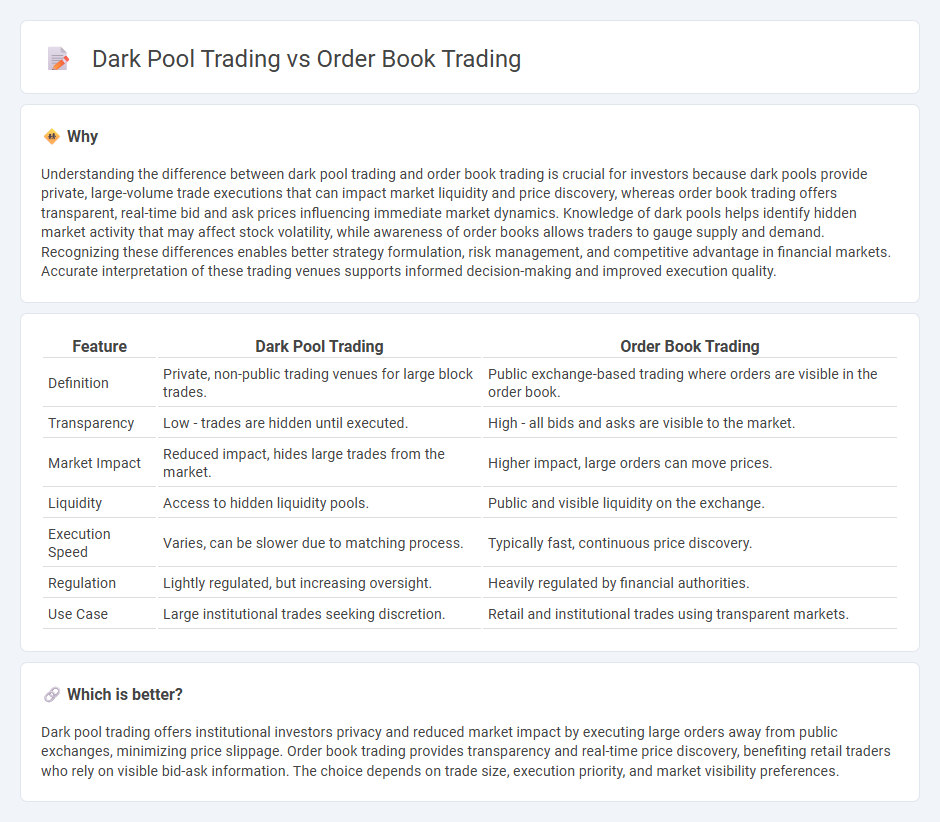

Understanding the difference between dark pool trading and order book trading is crucial for investors because dark pools provide private, large-volume trade executions that can impact market liquidity and price discovery, whereas order book trading offers transparent, real-time bid and ask prices influencing immediate market dynamics. Knowledge of dark pools helps identify hidden market activity that may affect stock volatility, while awareness of order books allows traders to gauge supply and demand. Recognizing these differences enables better strategy formulation, risk management, and competitive advantage in financial markets. Accurate interpretation of these trading venues supports informed decision-making and improved execution quality.

Comparison Table

| Feature | Dark Pool Trading | Order Book Trading |

|---|---|---|

| Definition | Private, non-public trading venues for large block trades. | Public exchange-based trading where orders are visible in the order book. |

| Transparency | Low - trades are hidden until executed. | High - all bids and asks are visible to the market. |

| Market Impact | Reduced impact, hides large trades from the market. | Higher impact, large orders can move prices. |

| Liquidity | Access to hidden liquidity pools. | Public and visible liquidity on the exchange. |

| Execution Speed | Varies, can be slower due to matching process. | Typically fast, continuous price discovery. |

| Regulation | Lightly regulated, but increasing oversight. | Heavily regulated by financial authorities. |

| Use Case | Large institutional trades seeking discretion. | Retail and institutional trades using transparent markets. |

Which is better?

Dark pool trading offers institutional investors privacy and reduced market impact by executing large orders away from public exchanges, minimizing price slippage. Order book trading provides transparency and real-time price discovery, benefiting retail traders who rely on visible bid-ask information. The choice depends on trade size, execution priority, and market visibility preferences.

Connection

Dark pool trading and order book trading intersect as both involve the execution of large financial transactions, yet dark pools provide a private environment away from the public order books. Dark pools allow institutional investors to trade substantial blocks of shares without revealing their intentions, reducing market impact and price slippage often seen in visible order book trades. The relationship enhances overall market liquidity and price discovery by balancing transparency with the need for confidentiality in large trades.

Key Terms

Liquidity

Order book trading offers transparent liquidity with visible bid and ask prices, enabling traders to gauge market depth and price levels effectively. Dark pool trading provides hidden liquidity, allowing large orders to execute anonymously without impacting public market prices, reducing slippage and market impact. Explore how liquidity dynamics differ between these trading venues to optimize your strategy.

Transparency

Order book trading offers full transparency by displaying all buy and sell orders publicly, enabling traders to assess market depth and price levels in real time. Dark pool trading, in contrast, operates with limited transparency, as trades occur privately, reducing market impact but obscuring price discovery. Explore the key differences to understand how transparency affects trading strategies.

Market Impact

Order book trading provides transparency by displaying real-time buy and sell orders, which allows traders to gauge market depth and potential price movement, but large orders can cause significant market impact and price slippage. Dark pool trading minimizes market impact by executing large trades privately away from the public order book, reducing the risk of revealing trading intentions and preventing adverse price movements. Explore how these trading venues influence market impact to optimize your trading strategies.

Source and External Links

Understanding the Order Book: How It Impacts Trading - An order book is a real-time list of buy and sell limit orders for an asset, showing prices and volumes on both bid (buy) and ask (sell) sides, reflecting market liquidity and depth.

What Is an Order Book and How Does It Work? - Order books provide traders insight into market liquidity and trends by listing all current buy and sell orders, helping to identify support, resistance, and market depth.

What is an Order Book and How Does it Work? - The order book matches buy and sell orders dynamically via algorithms, ensuring market orders execute at the best available prices by pairing high bids and low asks efficiently.

dowidth.com

dowidth.com