Catastrophe bonds transfer insurance risks to investors, providing capital relief for insurers by offering high yields linked to specific natural disasters. Collateralized debt obligations pool various debt instruments, including mortgages and loans, to create diversified securities with varying risk profiles sold to investors. Explore the detailed differences and investment implications of catastrophe bonds versus CDOs to better understand their roles in financial markets.

Why it is important

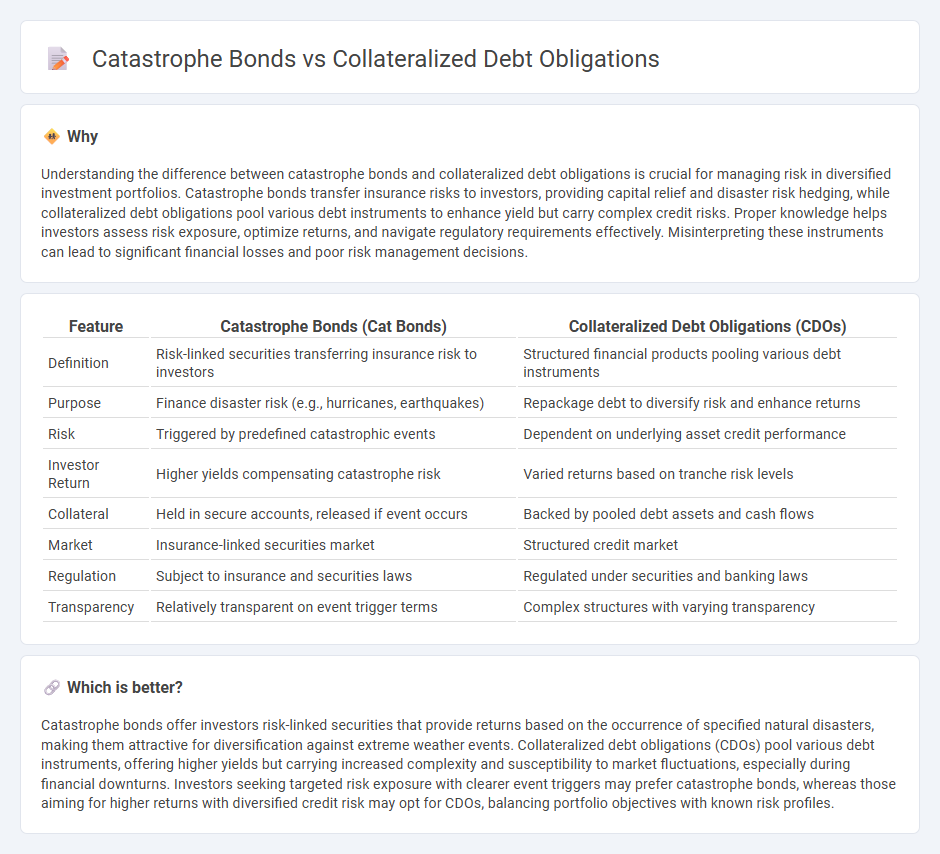

Understanding the difference between catastrophe bonds and collateralized debt obligations is crucial for managing risk in diversified investment portfolios. Catastrophe bonds transfer insurance risks to investors, providing capital relief and disaster risk hedging, while collateralized debt obligations pool various debt instruments to enhance yield but carry complex credit risks. Proper knowledge helps investors assess risk exposure, optimize returns, and navigate regulatory requirements effectively. Misinterpreting these instruments can lead to significant financial losses and poor risk management decisions.

Comparison Table

| Feature | Catastrophe Bonds (Cat Bonds) | Collateralized Debt Obligations (CDOs) |

|---|---|---|

| Definition | Risk-linked securities transferring insurance risk to investors | Structured financial products pooling various debt instruments |

| Purpose | Finance disaster risk (e.g., hurricanes, earthquakes) | Repackage debt to diversify risk and enhance returns |

| Risk | Triggered by predefined catastrophic events | Dependent on underlying asset credit performance |

| Investor Return | Higher yields compensating catastrophe risk | Varied returns based on tranche risk levels |

| Collateral | Held in secure accounts, released if event occurs | Backed by pooled debt assets and cash flows |

| Market | Insurance-linked securities market | Structured credit market |

| Regulation | Subject to insurance and securities laws | Regulated under securities and banking laws |

| Transparency | Relatively transparent on event trigger terms | Complex structures with varying transparency |

Which is better?

Catastrophe bonds offer investors risk-linked securities that provide returns based on the occurrence of specified natural disasters, making them attractive for diversification against extreme weather events. Collateralized debt obligations (CDOs) pool various debt instruments, offering higher yields but carrying increased complexity and susceptibility to market fluctuations, especially during financial downturns. Investors seeking targeted risk exposure with clearer event triggers may prefer catastrophe bonds, whereas those aiming for higher returns with diversified credit risk may opt for CDOs, balancing portfolio objectives with known risk profiles.

Connection

Catastrophe bonds (cat bonds) and collateralized debt obligations (CDOs) are both structured financial instruments that pool assets to redistribute risk to investors. Cat bonds transfer insurance risk related to natural disasters to the capital markets, while CDOs repackage various debt types into tranches based on risk levels. Their connection lies in the securitization process, using similar mechanisms to create investment-grade securities from high-risk underlying assets.

Key Terms

**Collateralized Debt Obligations:**

Collateralized Debt Obligations (CDOs) are structured financial products backed by a pool of loans, bonds, or other assets, segmented into tranches with varying risk levels and returns. They differ from catastrophe bonds, which are insurance-linked securities designed to transfer extreme event risks to investors, focusing instead on credit risk diversification and income generation. Explore the mechanics and investment strategies of CDOs to better understand how they fit into portfolio risk management.

Tranches

Collateralized debt obligations (CDOs) consist of tranches that prioritize debt repayments based on risk levels, with senior tranches receiving payments first and equity tranches absorbing initial losses. Catastrophe bonds (cat bonds) are structured with tranches linked to specific disaster risks, where higher-risk tranches offer elevated yields but face principal loss if trigger events like hurricanes occur. Explore detailed tranche comparisons to understand risk allocation and investor priorities in these financial instruments.

Credit Risk

Collateralized Debt Obligations (CDOs) concentrate credit risk by pooling various debt instruments and slicing them into tranches with distinct risk-return profiles, exposing investors to potential default risk primarily from corporate or mortgage loans. Catastrophe bonds, while transferring insurance risk related to natural disasters, also carry credit risk tied to the issuer's ability to repay bondholders if no catastrophe triggers a payout. Explore deeper insights into how these structured products manage and price credit risk in financial markets.

Source and External Links

Collateralized Debt Obligation (CDO) - Corporate Finance Institute - A CDO is a synthetic investment product bundling various loans together and selling them, with payments to investors prioritized by tranche based on cash flow from the underlying debt instruments.

Collateralized debt obligation - Wikipedia - CDOs are financial securities backed by pools of bonds, loans, or other assets, structured into types such as CLOs, CBOs, CSOs, and can even be backed by other CDO tranches, with complex collateral like mortgage-backed securities and corporate bonds.

Understanding Collateralized Loan Obligations (CLOs) - CLOs are a type of CDO backed mainly by leveraged loans, with tests like overcollateralization and interest coverage to manage risk and prioritize payments to senior debt investors.

dowidth.com

dowidth.com