Impact investing directs capital toward companies generating measurable social and environmental benefits alongside financial returns, focusing on sustainable growth and innovation. Venture philanthropy applies venture capital principles to charitable activities by providing funding, expertise, and strategic support to nonprofit organizations for long-term impact. Discover how these approaches differ and transform the future of finance and social change.

Why it is important

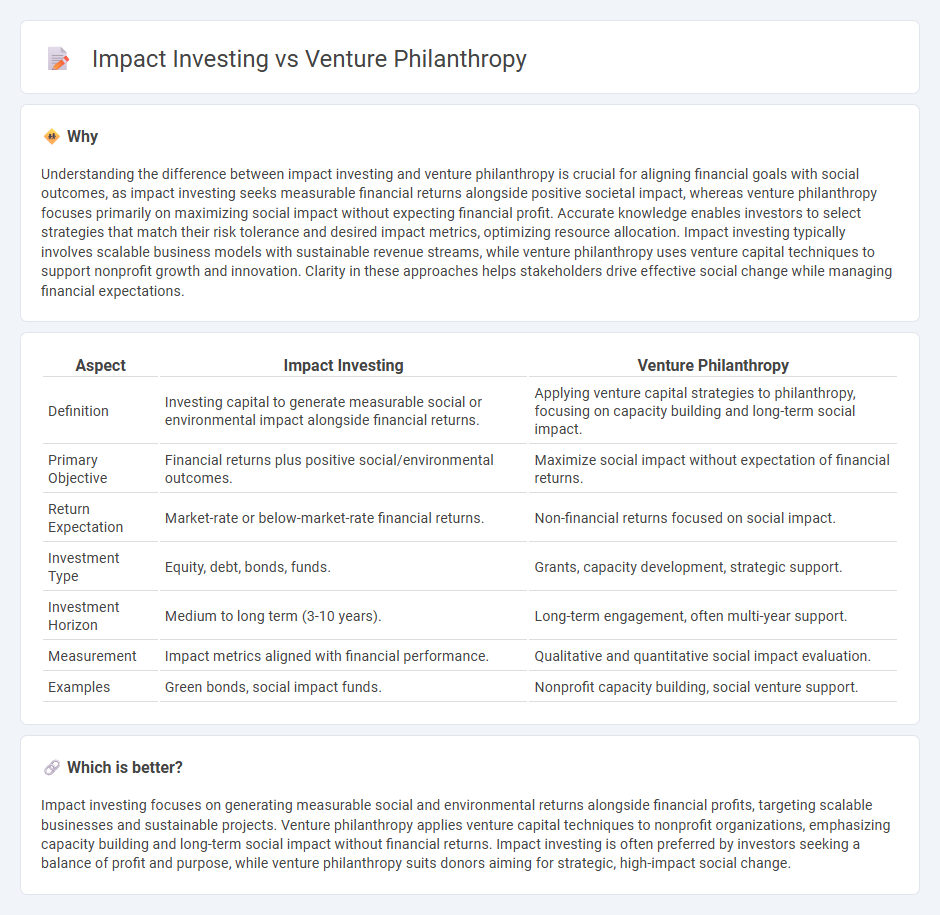

Understanding the difference between impact investing and venture philanthropy is crucial for aligning financial goals with social outcomes, as impact investing seeks measurable financial returns alongside positive societal impact, whereas venture philanthropy focuses primarily on maximizing social impact without expecting financial profit. Accurate knowledge enables investors to select strategies that match their risk tolerance and desired impact metrics, optimizing resource allocation. Impact investing typically involves scalable business models with sustainable revenue streams, while venture philanthropy uses venture capital techniques to support nonprofit growth and innovation. Clarity in these approaches helps stakeholders drive effective social change while managing financial expectations.

Comparison Table

| Aspect | Impact Investing | Venture Philanthropy |

|---|---|---|

| Definition | Investing capital to generate measurable social or environmental impact alongside financial returns. | Applying venture capital strategies to philanthropy, focusing on capacity building and long-term social impact. |

| Primary Objective | Financial returns plus positive social/environmental outcomes. | Maximize social impact without expectation of financial returns. |

| Return Expectation | Market-rate or below-market-rate financial returns. | Non-financial returns focused on social impact. |

| Investment Type | Equity, debt, bonds, funds. | Grants, capacity development, strategic support. |

| Investment Horizon | Medium to long term (3-10 years). | Long-term engagement, often multi-year support. |

| Measurement | Impact metrics aligned with financial performance. | Qualitative and quantitative social impact evaluation. |

| Examples | Green bonds, social impact funds. | Nonprofit capacity building, social venture support. |

Which is better?

Impact investing focuses on generating measurable social and environmental returns alongside financial profits, targeting scalable businesses and sustainable projects. Venture philanthropy applies venture capital techniques to nonprofit organizations, emphasizing capacity building and long-term social impact without financial returns. Impact investing is often preferred by investors seeking a balance of profit and purpose, while venture philanthropy suits donors aiming for strategic, high-impact social change.

Connection

Impact investing channels capital into companies and organizations generating measurable social and environmental benefits alongside financial returns, while venture philanthropy applies venture capital principles to philanthropic efforts, focusing on strategic support and capacity building. Both approaches prioritize outcomes that combine profit with positive societal change, driving sustainable growth in sectors such as renewable energy, healthcare, and education. The convergence of impact investing and venture philanthropy fosters innovative solutions by leveraging financial resources for scalable and accountable social impact.

Key Terms

Social Return on Investment (SROI)

Venture philanthropy prioritizes maximizing Social Return on Investment (SROI) by strategically funding social enterprises with hands-on support and capacity building to ensure measurable social impact. Impact investing combines financial returns with social or environmental benefits, assessing SROI alongside financial performance to attract diverse investors seeking both profit and purpose. Explore how these approaches differ in driving sustainable social change through optimized capital allocation.

Risk Tolerance

Venture philanthropy typically involves high-risk tolerance by prioritizing social impact over financial returns, often supporting early-stage or experimental initiatives with uncertain outcomes. Impact investing balances financial performance and social/environmental impact, targeting projects with measurable returns and moderate risk profiles. Explore deeper insights on risk tolerance and strategic approaches in these funding models to make informed decisions.

Exit Strategy

Venture philanthropy prioritizes social impact with flexible exit strategies focused on sustaining long-term benefits rather than financial returns, often reinvesting funds to maximize social value. Impact investing combines financial returns with measurable social or environmental outcomes, structuring exits to balance profit realization and continued impact growth. Explore how different exit strategies influence the success of social ventures and investment goals.

Source and External Links

Venture Philanthropy - Nonprofit Fundraising Glossary - Venture philanthropy merges traditional charitable giving with venture capital strategies, providing nonprofits not only funding but also strategic support, mentorship, and expecting measurable social impact and sometimes financial returns to enable sustainability and scalability.

What Is Venture Philanthropy? (Definition and Examples) | Indeed.com - Venture philanthropy involves customized financing, nonfinancial support like consulting and coaching, and rigorous impact measurement to help charitable organizations create lasting social change.

Venture Philanthropy: Pioneering Impact Investments - Sopact - This approach applies venture capital principles to philanthropy by giving nonprofits financial and non-financial resources for long-term transformative impact, focusing on social returns rather than financial gains.

dowidth.com

dowidth.com