AI-driven portfolios leverage advanced machine learning algorithms to analyze vast datasets and execute dynamic adjustments, aiming to optimize returns and manage risk more effectively than traditional methods. Buy-and-hold portfolios rely on a passive investment strategy focused on long-term growth by maintaining asset allocations despite market fluctuations. Explore how AI can revolutionize portfolio management for insights into smarter investment strategies.

Why it is important

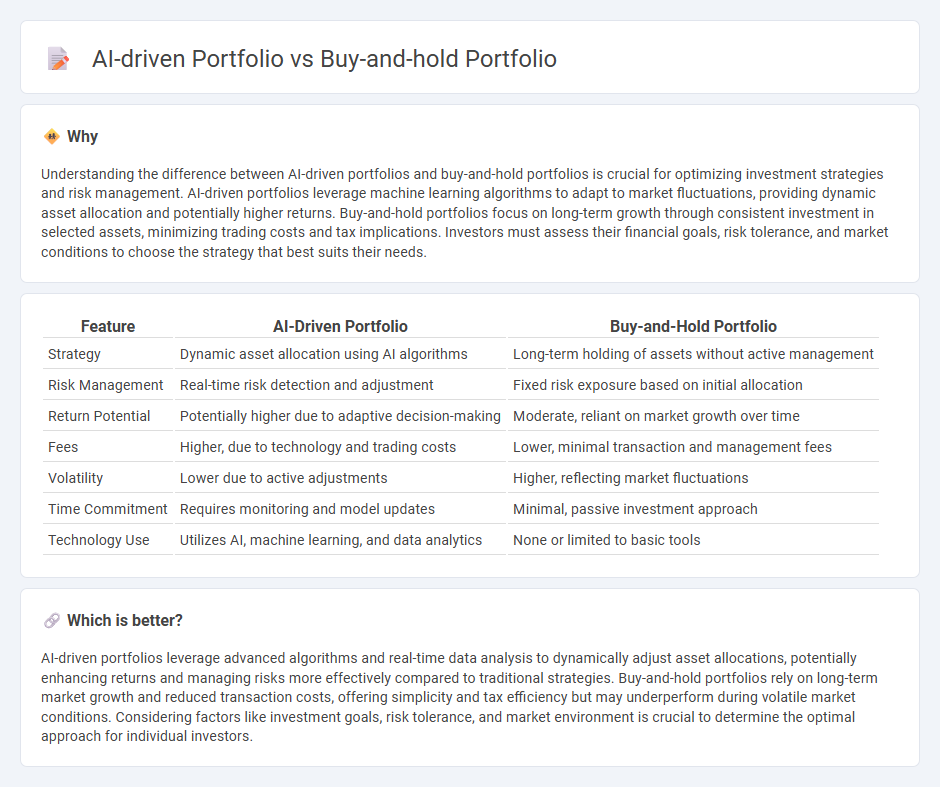

Understanding the difference between AI-driven portfolios and buy-and-hold portfolios is crucial for optimizing investment strategies and risk management. AI-driven portfolios leverage machine learning algorithms to adapt to market fluctuations, providing dynamic asset allocation and potentially higher returns. Buy-and-hold portfolios focus on long-term growth through consistent investment in selected assets, minimizing trading costs and tax implications. Investors must assess their financial goals, risk tolerance, and market conditions to choose the strategy that best suits their needs.

Comparison Table

| Feature | AI-Driven Portfolio | Buy-and-Hold Portfolio |

|---|---|---|

| Strategy | Dynamic asset allocation using AI algorithms | Long-term holding of assets without active management |

| Risk Management | Real-time risk detection and adjustment | Fixed risk exposure based on initial allocation |

| Return Potential | Potentially higher due to adaptive decision-making | Moderate, reliant on market growth over time |

| Fees | Higher, due to technology and trading costs | Lower, minimal transaction and management fees |

| Volatility | Lower due to active adjustments | Higher, reflecting market fluctuations |

| Time Commitment | Requires monitoring and model updates | Minimal, passive investment approach |

| Technology Use | Utilizes AI, machine learning, and data analytics | None or limited to basic tools |

Which is better?

AI-driven portfolios leverage advanced algorithms and real-time data analysis to dynamically adjust asset allocations, potentially enhancing returns and managing risks more effectively compared to traditional strategies. Buy-and-hold portfolios rely on long-term market growth and reduced transaction costs, offering simplicity and tax efficiency but may underperform during volatile market conditions. Considering factors like investment goals, risk tolerance, and market environment is crucial to determine the optimal approach for individual investors.

Connection

AI-driven portfolios leverage machine learning algorithms to analyze market trends and optimize asset allocation, enhancing potential returns compared to traditional buy-and-hold strategies. Buy-and-hold portfolios focus on long-term investment stability, while AI-driven approaches dynamically adjust holdings to mitigate risks and capitalize on emerging opportunities. Integrating AI technology into buy-and-hold portfolios can improve decision-making by identifying optimal entry and exit points within a long-term investment framework.

Key Terms

Passive management

Buy-and-hold portfolios emphasize long-term investment in diversified assets with minimal trading, fostering steady growth through market appreciation and compounding dividends. AI-driven portfolios leverage machine learning algorithms to adapt dynamically to market conditions, optimizing asset allocation and risk management in real time. Explore the benefits and challenges of passive management within these strategies to enhance portfolio performance.

Algorithmic trading

Algorithmic trading leverages AI-driven portfolios to execute trades with high precision and speed, utilizing machine learning models that analyze vast datasets for optimal timing and asset selection. Buy-and-hold portfolios prioritize long-term investment strategies by maintaining positions regardless of short-term market fluctuations, emphasizing stability and compounding growth. Explore the advantages and trade-offs of algorithmic trading versus buy-and-hold strategies to optimize your investment approach.

Market timing

A buy-and-hold portfolio relies on long-term market exposure, minimizing transaction frequency and reducing costs while benefiting from compound growth and market recovery after downturns. An AI-driven portfolio leverages machine learning algorithms to dynamically time entry and exit points, aiming to capitalize on short-term market fluctuations and optimize returns by adjusting holdings in real-time. Explore how AI enhances market timing strategies to maximize portfolio performance and mitigate risks.

Source and External Links

Ultimate Buy and Hold Portfolio - Paul Merriman - The Ultimate Buy and Hold Portfolio diversifies across 10 equity asset classes to maximize returns while managing risk, outpacing the S&P 500 over the long term with similar or lower volatility.

Buy and Hold: Definition, Advantages, Risks, How to Build One - Nasdaq - Buy and hold is a long-term investment strategy focused on purchasing securities and keeping them through market fluctuations to benefit from capital appreciation and reduced transaction costs, with diversification and regular reviews being key considerations.

Buy and Hold Practice Portfolios - StockTrak - The Buy and Hold portfolio model allows investors, including students, to hold a limited number of securities over an extended period with minimal trading, providing experience in passive investing and balancing active versus passive portfolio management.

dowidth.com

dowidth.com