Zero-day options expire within a single trading day, offering traders rapid opportunities for profit or loss due to their extremely short lifespan and heightened volatility. Exotic options, such as barrier or Asian options, feature complex structures and payoff conditions that differ from standard options, catering to sophisticated risk management and speculative strategies. Explore the distinct advantages and applications of zero-day and exotic options to enhance your financial trading toolkit.

Why it is important

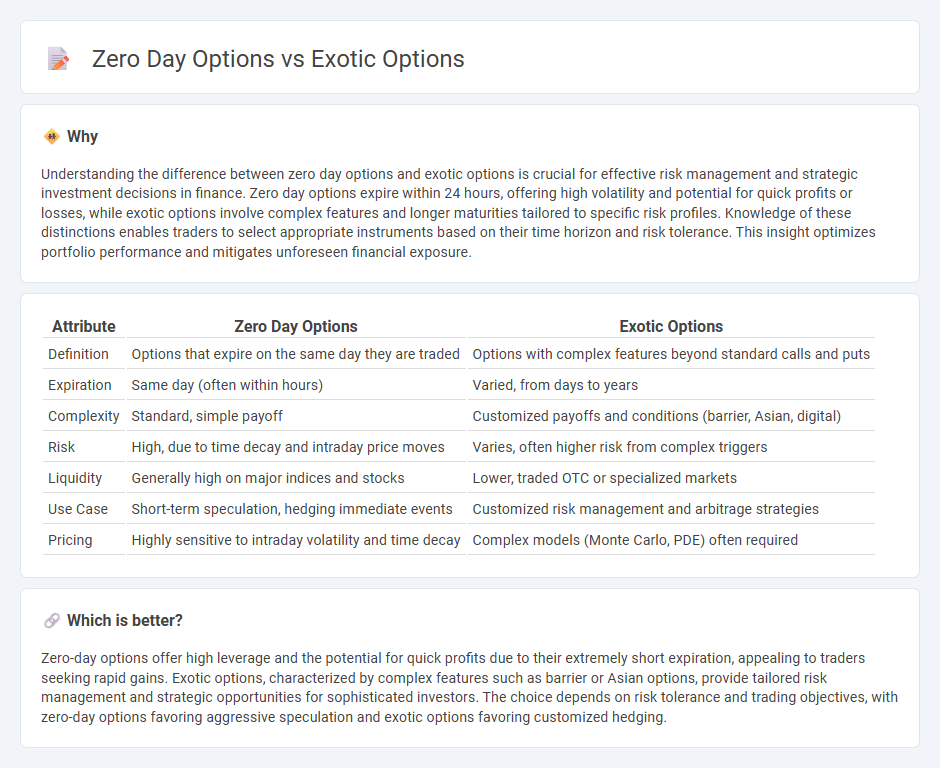

Understanding the difference between zero day options and exotic options is crucial for effective risk management and strategic investment decisions in finance. Zero day options expire within 24 hours, offering high volatility and potential for quick profits or losses, while exotic options involve complex features and longer maturities tailored to specific risk profiles. Knowledge of these distinctions enables traders to select appropriate instruments based on their time horizon and risk tolerance. This insight optimizes portfolio performance and mitigates unforeseen financial exposure.

Comparison Table

| Attribute | Zero Day Options | Exotic Options |

|---|---|---|

| Definition | Options that expire on the same day they are traded | Options with complex features beyond standard calls and puts |

| Expiration | Same day (often within hours) | Varied, from days to years |

| Complexity | Standard, simple payoff | Customized payoffs and conditions (barrier, Asian, digital) |

| Risk | High, due to time decay and intraday price moves | Varies, often higher risk from complex triggers |

| Liquidity | Generally high on major indices and stocks | Lower, traded OTC or specialized markets |

| Use Case | Short-term speculation, hedging immediate events | Customized risk management and arbitrage strategies |

| Pricing | Highly sensitive to intraday volatility and time decay | Complex models (Monte Carlo, PDE) often required |

Which is better?

Zero-day options offer high leverage and the potential for quick profits due to their extremely short expiration, appealing to traders seeking rapid gains. Exotic options, characterized by complex features such as barrier or Asian options, provide tailored risk management and strategic opportunities for sophisticated investors. The choice depends on risk tolerance and trading objectives, with zero-day options favoring aggressive speculation and exotic options favoring customized hedging.

Connection

Zero day options and exotic options are both specialized financial derivatives used to manage risk and speculate on market movements. Zero day options, expiring on the same day they are traded, offer high liquidity and rapid time decay, while exotic options feature complex payoff structures like barriers or Asians that tailor risk-reward profiles. Traders often combine zero day options with exotic options strategies to exploit short-term market inefficiencies and enhance portfolio diversification in volatile conditions.

Key Terms

Payoff Structure

Exotic options feature complex payoff structures including barriers, lookbacks, or Asians, allowing for tailored risk and reward profiles beyond standard call and put options. Zero-day options, expiring within a day, rely on rapid price movements and possess highly sensitive time-decay characteristics, resulting in distinct payoff dynamics compared to longer-dated exotic options. Explore deeper insights into how payoff structures influence trading strategies and risk management in these option types.

Maturity/Expiration

Exotic options often feature customized maturity periods tailored to specific investment strategies, enabling traders to manage risk with more flexibility compared to zero day options, which expire within the same trading day and offer high-risk, high-reward opportunities due to their ultra-short lifespan. The expiration structure of exotic options can extend from weekly to multiple years, providing leverage for long-term hedging or speculative plays, whereas zero day options are primarily favored for rapid, speculative trading focused on intraday price movements. Explore the detailed differences in maturity and expiration to optimize your options trading approach.

Risk Profile

Exotic options, such as barrier options or Asian options, present complex risk profiles due to their path-dependent features and conditional payoffs, making them more sensitive to market volatility and less liquid than standard options. Zero-day options have extremely high gamma and theta decay, leading to substantial risk exposure over very short time frames and requiring precise market timing. Explore detailed analyses to better understand the nuanced risk characteristics and strategic applications of both exotic and zero-day options.

Source and External Links

What Are Exotic Options? 11 Types of Exotic Options - SoFi - Exotic options are hybrid securities with unique, often customizable payment structures, expiration dates, and strike prices, including types like Asian, Barrier, Basket, and Bermuda options, providing tailored risk and payoff profiles beyond standard options.

Exploring Exotic Options (2025): Strategies, Risk and Rewards - Exotic options are complex derivatives offering customized features and payoffs that enable traders to address specific investment goals and risk management needs that standard vanilla options cannot efficiently meet.

Exotic Options - Definition, Types, Differences, Features - Exotic options differ from plain-vanilla options in exercise styles, expiration dates, payoffs, and underlying assets, often requiring sophisticated valuation and offering opportunities for enhanced returns and hedging.

dowidth.com

dowidth.com