Basis trading involves exploiting the price difference between a futures contract and its underlying asset to generate risk-adjusted returns, making it a key strategy in fixed income and commodity markets. Merger arbitrage focuses on capitalizing on price discrepancies of a target company's stock before and after a merger or acquisition announcement, aiming to profit from the deal's successful closure. Explore more about these trading strategies to understand their distinct risk profiles and market applications.

Why it is important

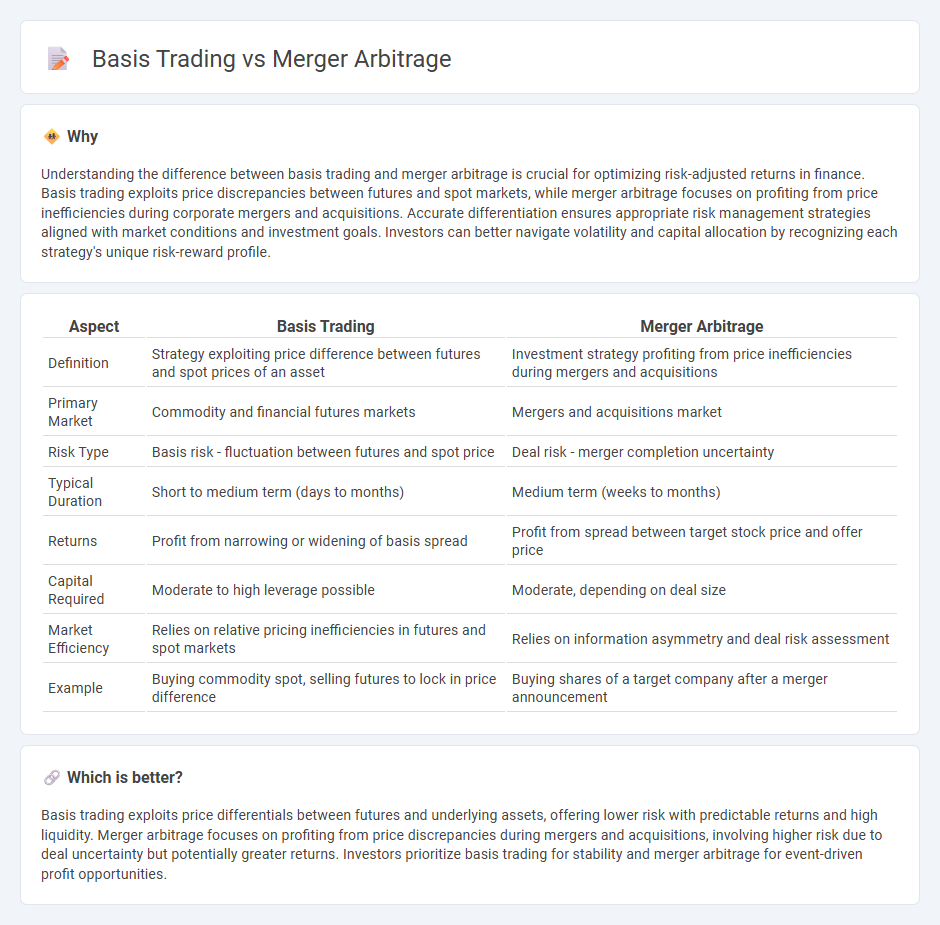

Understanding the difference between basis trading and merger arbitrage is crucial for optimizing risk-adjusted returns in finance. Basis trading exploits price discrepancies between futures and spot markets, while merger arbitrage focuses on profiting from price inefficiencies during corporate mergers and acquisitions. Accurate differentiation ensures appropriate risk management strategies aligned with market conditions and investment goals. Investors can better navigate volatility and capital allocation by recognizing each strategy's unique risk-reward profile.

Comparison Table

| Aspect | Basis Trading | Merger Arbitrage |

|---|---|---|

| Definition | Strategy exploiting price difference between futures and spot prices of an asset | Investment strategy profiting from price inefficiencies during mergers and acquisitions |

| Primary Market | Commodity and financial futures markets | Mergers and acquisitions market |

| Risk Type | Basis risk - fluctuation between futures and spot price | Deal risk - merger completion uncertainty |

| Typical Duration | Short to medium term (days to months) | Medium term (weeks to months) |

| Returns | Profit from narrowing or widening of basis spread | Profit from spread between target stock price and offer price |

| Capital Required | Moderate to high leverage possible | Moderate, depending on deal size |

| Market Efficiency | Relies on relative pricing inefficiencies in futures and spot markets | Relies on information asymmetry and deal risk assessment |

| Example | Buying commodity spot, selling futures to lock in price difference | Buying shares of a target company after a merger announcement |

Which is better?

Basis trading exploits price differentials between futures and underlying assets, offering lower risk with predictable returns and high liquidity. Merger arbitrage focuses on profiting from price discrepancies during mergers and acquisitions, involving higher risk due to deal uncertainty but potentially greater returns. Investors prioritize basis trading for stability and merger arbitrage for event-driven profit opportunities.

Connection

Basis trading and merger arbitrage both exploit pricing inefficiencies in financial markets by capitalizing on discrepancies between related asset prices. Basis trading focuses on the spread between a security and its derivative or related contract, while merger arbitrage targets the price difference between the current market value of a target company's shares and the acquisition price in a merger deal. Both strategies require careful risk management and market analysis to profit from convergences in asset pricing before deal completion or contract settlement.

Key Terms

**Merger Arbitrage:**

Merger arbitrage involves capitalizing on price discrepancies between the target company's current stock price and the acquisition price proposed in a merger or acquisition deal. This strategy requires analyzing deal terms, regulatory risks, and completion probabilities to assess potential returns. Explore more to understand how merger arbitrage can enhance portfolio performance in varying market conditions.

Deal Spread

Deal spread in merger arbitrage represents the difference between the target company's current stock price and the proposed acquisition price, capturing potential profit from the deal's successful completion. Basis trading focuses on exploiting the price differential between a futures contract and its underlying asset, emphasizing the convergence of these prices at contract maturity. Explore further to understand how deal spread dynamics influence risk and return in these trading strategies.

Target Price

Merger arbitrage centers on exploiting the difference between the target price of an acquisition deal and the current market price of the target company's stock, aiming to profit from deal completion. Basis trading involves capturing the spread between related securities' prices, such as futures and spot prices, without focusing on corporate events. Explore how each strategy leverages target price information to optimize risk and returns in equity markets.

Source and External Links

Merger arbitrage: Process, examples, types, and risks - Merger arbitrage is an event-driven investing strategy that seeks to profit from the difference between the target company's current stock price and its expected price after a successful merger, involving researching the target, analyzing risks, and monitoring the merger process with main types being cash and in-stock mergers.

Risk arbitrage - Wikipedia - Merger arbitrage (or risk arbitrage) involves buying the target's stock below the offer price, profiting as the stock approaches deal price upon merger completion, and in stock mergers also involves short-selling the acquirer's stock to hedge risks.

Merger Arbitrage - Overview, How it Works, Role - Merger arbitrage profits from the "spread" between the target stock price and the acquisition price, with arbitrageurs sometimes actively influencing merger outcomes by holding large shares of the target company.

dowidth.com

dowidth.com