Buy Now Pay Later (BNPL) integration offers consumers the flexibility to split payments over time without immediate financial strain, enhancing purchasing power and boosting conversion rates for merchants. Direct Debit integration, on the other hand, ensures automated, secure, and reliable payments by directly pulling funds from customers' bank accounts, reducing the risk of defaults and administrative overhead. Explore the benefits and drawbacks of each payment method to determine the optimal solution for your business needs.

Why it is important

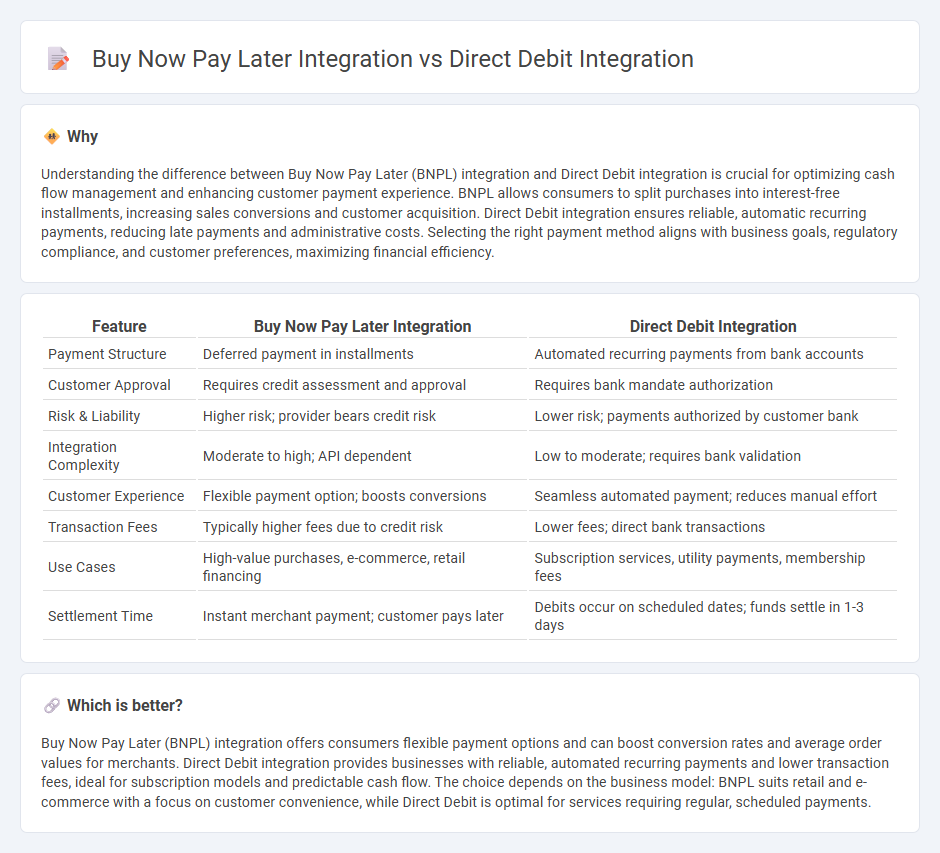

Understanding the difference between Buy Now Pay Later (BNPL) integration and Direct Debit integration is crucial for optimizing cash flow management and enhancing customer payment experience. BNPL allows consumers to split purchases into interest-free installments, increasing sales conversions and customer acquisition. Direct Debit integration ensures reliable, automatic recurring payments, reducing late payments and administrative costs. Selecting the right payment method aligns with business goals, regulatory compliance, and customer preferences, maximizing financial efficiency.

Comparison Table

| Feature | Buy Now Pay Later Integration | Direct Debit Integration |

|---|---|---|

| Payment Structure | Deferred payment in installments | Automated recurring payments from bank accounts |

| Customer Approval | Requires credit assessment and approval | Requires bank mandate authorization |

| Risk & Liability | Higher risk; provider bears credit risk | Lower risk; payments authorized by customer bank |

| Integration Complexity | Moderate to high; API dependent | Low to moderate; requires bank validation |

| Customer Experience | Flexible payment option; boosts conversions | Seamless automated payment; reduces manual effort |

| Transaction Fees | Typically higher fees due to credit risk | Lower fees; direct bank transactions |

| Use Cases | High-value purchases, e-commerce, retail financing | Subscription services, utility payments, membership fees |

| Settlement Time | Instant merchant payment; customer pays later | Debits occur on scheduled dates; funds settle in 1-3 days |

Which is better?

Buy Now Pay Later (BNPL) integration offers consumers flexible payment options and can boost conversion rates and average order values for merchants. Direct Debit integration provides businesses with reliable, automated recurring payments and lower transaction fees, ideal for subscription models and predictable cash flow. The choice depends on the business model: BNPL suits retail and e-commerce with a focus on customer convenience, while Direct Debit is optimal for services requiring regular, scheduled payments.

Connection

Buy Now Pay Later (BNPL) integration and Direct Debit integration are connected through their impact on seamless payment processing and improved cash flow management for businesses. BNPL offers consumers flexible credit options at checkout, while Direct Debit automates recurring payments, reducing transaction friction and enhancing collection efficiency. Combining these integrations enables merchants to provide diverse payment solutions, optimize customer retention, and stabilize revenue streams.

Key Terms

Payment Authorization

Direct debit integration enables automatic, recurring payment authorization by securely linking bank accounts and streamlining transaction approvals. Buy now pay later (BNPL) integration facilitates flexible payment authorization by allowing consumers to split purchases into installments, often requiring real-time credit checks. Discover the key differences in payment authorization mechanisms between direct debit and BNPL integrations.

Settlement Process

Direct debit integration involves automatic withdrawal of funds from a customer's bank account on the settlement date, ensuring timely and secure payment processing with minimal manual intervention. Buy now pay later (BNPL) integration requires coordination of multiple payment schedules, often involving installment settlements managed by third-party providers, which can complicate reconciliation and delay final settlement. Explore the detailed differences in settlement processes between these payment methods to enhance your payment system efficiency.

Credit Risk

Direct debit integration offers predictable cash flow by authorizing automatic payments from customers' bank accounts, reducing the risk of missed payments and chargebacks. Buy now pay later (BNPL) integration introduces higher credit risk as it often involves deferred payments without immediate fund collection, relying heavily on rigorous credit assessments and fraud detection. Discover how effective credit risk management varies between direct debit and BNPL solutions to safeguard your business.

Source and External Links

Integrate Direct Debit | Frontend Capabilities - Chargebee - This tutorial explains how to integrate Direct Debit payments via various schemes like SEPA, ACH, Bacs, and Autogiro on your website using Chargebee.js, supporting multiple providers including Stripe, GoCardless, and Adyen.

Automated vs. integrated Direct Debit - what's the difference? - GoCardless - Integrated Direct Debit connects payment gateways with billing software to streamline payments, offering benefits like automated cash flow updates, payment buttons in invoices, and real-time accounting visibility.

ACH Direct Debit | Stripe Documentation - Stripe provides ACH Direct Debit integration for US bank accounts, describing the payment flow, setup, and how to accept reusable delayed-notification payments via their front-end products or API.

dowidth.com

dowidth.com