Inflation swaps and equity swaps are financial derivatives used to manage different types of risk; inflation swaps allow parties to exchange fixed payments for payments linked to inflation rates, often useful for hedging against rising consumer prices. Equity swaps involve exchanging returns based on equity indices or stocks, enabling investors to gain exposure to equity markets without owning the underlying assets. Explore how these swaps function and their strategic applications in portfolio management.

Why it is important

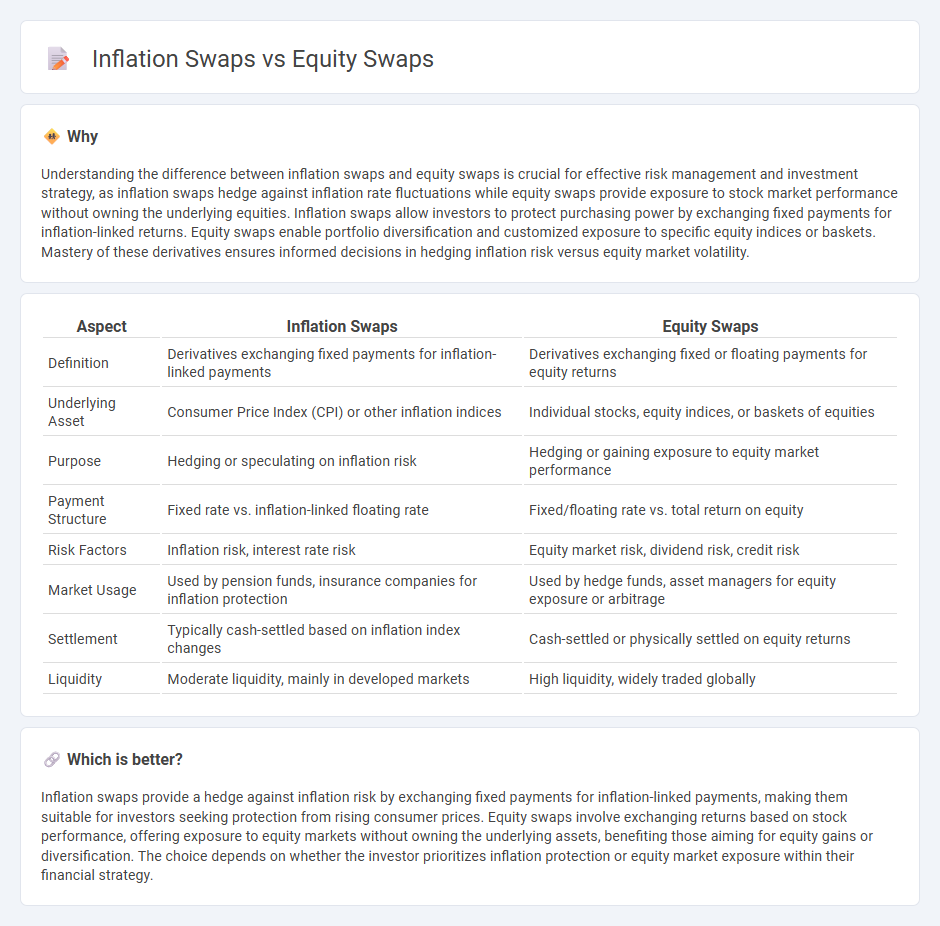

Understanding the difference between inflation swaps and equity swaps is crucial for effective risk management and investment strategy, as inflation swaps hedge against inflation rate fluctuations while equity swaps provide exposure to stock market performance without owning the underlying equities. Inflation swaps allow investors to protect purchasing power by exchanging fixed payments for inflation-linked returns. Equity swaps enable portfolio diversification and customized exposure to specific equity indices or baskets. Mastery of these derivatives ensures informed decisions in hedging inflation risk versus equity market volatility.

Comparison Table

| Aspect | Inflation Swaps | Equity Swaps |

|---|---|---|

| Definition | Derivatives exchanging fixed payments for inflation-linked payments | Derivatives exchanging fixed or floating payments for equity returns |

| Underlying Asset | Consumer Price Index (CPI) or other inflation indices | Individual stocks, equity indices, or baskets of equities |

| Purpose | Hedging or speculating on inflation risk | Hedging or gaining exposure to equity market performance |

| Payment Structure | Fixed rate vs. inflation-linked floating rate | Fixed/floating rate vs. total return on equity |

| Risk Factors | Inflation risk, interest rate risk | Equity market risk, dividend risk, credit risk |

| Market Usage | Used by pension funds, insurance companies for inflation protection | Used by hedge funds, asset managers for equity exposure or arbitrage |

| Settlement | Typically cash-settled based on inflation index changes | Cash-settled or physically settled on equity returns |

| Liquidity | Moderate liquidity, mainly in developed markets | High liquidity, widely traded globally |

Which is better?

Inflation swaps provide a hedge against inflation risk by exchanging fixed payments for inflation-linked payments, making them suitable for investors seeking protection from rising consumer prices. Equity swaps involve exchanging returns based on stock performance, offering exposure to equity markets without owning the underlying assets, benefiting those aiming for equity gains or diversification. The choice depends on whether the investor prioritizes inflation protection or equity market exposure within their financial strategy.

Connection

Inflation swaps and equity swaps are connected through their role as derivative instruments used for hedging and speculation on market risks. Inflation swaps enable parties to exchange fixed-rate payments for inflation-linked payments, while equity swaps involve exchanging cash flows based on the performance of an equity asset or index. Both swaps facilitate risk management by allowing investors to isolate and transfer specific financial exposures, such as inflation risk or equity price risk, without trading the underlying assets directly.

Key Terms

Notional Principal

Equity swaps involve a notional principal that remains unchanged throughout the contract, serving as the basis for exchanging returns linked to stock indices or equity performance. Inflation swaps feature a notional principal that is adjusted for inflation, reflecting changes in consumer price indices to preserve real value. Explore the distinctions and applications of notional principal in equity and inflation swaps to optimize financial strategies.

Reference Index (Equity Index vs. Inflation Index)

Equity swaps reference an equity index such as the S&P 500, allowing parties to exchange returns based on stock market performance, while inflation swaps reference an inflation index like the Consumer Price Index (CPI) to hedge or speculate on inflation rates. The choice of reference index impacts risk exposure, cash flow structures, and valuation methodologies, with equity swaps focusing on capital market fluctuations and inflation swaps centering on price level movements. Explore further to understand how these indices influence swap strategies and financial outcomes.

Cash Flows

Equity swaps involve exchanging returns based on equity indices or individual stocks, generating cash flows linked to equity performance, including dividends and capital gains. Inflation swaps consist of exchanging fixed payments for cash flows tied to inflation rates, typically measured by consumer price indices, to hedge against inflation risk. Explore detailed comparisons to understand which swap aligns with your financial strategy and risk management goals.

Source and External Links

Equity Swap Contract - Defintion, Example, Pros - An equity swap is a derivative contract where two parties exchange streams of cash flows, typically one based on equity performance and the other on fixed-income, allowing synthetic equity exposure without exchanging principal amounts, commonly used for hedging or avoiding transaction costs.

What is an Equity Swap? - Vintti - Equity swaps allow parties to gain exposure to stocks or indices without purchasing them directly, by swapping fixed cash payments for variable payments linked to equity returns, useful for diversification, hedging, and speculation but carrying interest rate and counterparty risks.

Equity Swaps Explained - Warrior Trading - Equity swaps enable hedge funds and institutional investors to take large long or short positions on stocks without actual ownership, thereby avoiding regulatory requirements and market impact, as these over-the-counter contracts exchange payments based on underlying stock performance.

dowidth.com

dowidth.com