Tokenization transforms traditional assets into digital tokens on blockchain platforms, enhancing liquidity and accessibility while reducing transaction costs. Unlike traditional assets, which often require intermediaries and involve lengthy settlement times, tokenized assets enable faster, transparent, and fractional ownership through smart contracts. Explore how tokenization is revolutionizing asset management and investment opportunities.

Why it is important

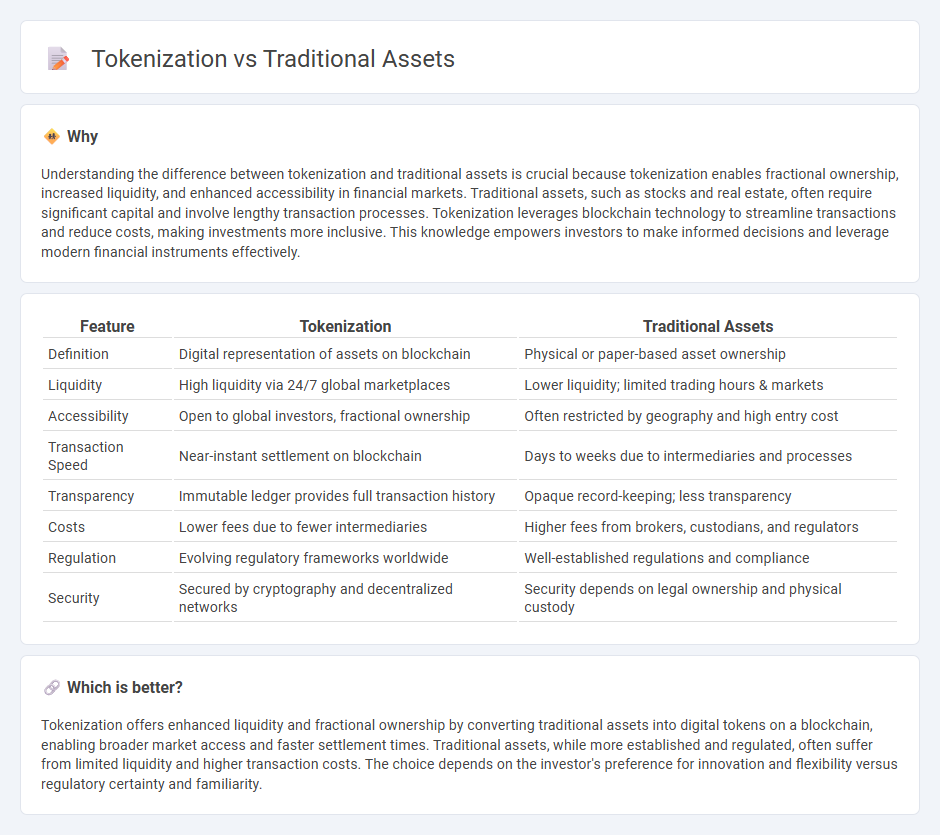

Understanding the difference between tokenization and traditional assets is crucial because tokenization enables fractional ownership, increased liquidity, and enhanced accessibility in financial markets. Traditional assets, such as stocks and real estate, often require significant capital and involve lengthy transaction processes. Tokenization leverages blockchain technology to streamline transactions and reduce costs, making investments more inclusive. This knowledge empowers investors to make informed decisions and leverage modern financial instruments effectively.

Comparison Table

| Feature | Tokenization | Traditional Assets |

|---|---|---|

| Definition | Digital representation of assets on blockchain | Physical or paper-based asset ownership |

| Liquidity | High liquidity via 24/7 global marketplaces | Lower liquidity; limited trading hours & markets |

| Accessibility | Open to global investors, fractional ownership | Often restricted by geography and high entry cost |

| Transaction Speed | Near-instant settlement on blockchain | Days to weeks due to intermediaries and processes |

| Transparency | Immutable ledger provides full transaction history | Opaque record-keeping; less transparency |

| Costs | Lower fees due to fewer intermediaries | Higher fees from brokers, custodians, and regulators |

| Regulation | Evolving regulatory frameworks worldwide | Well-established regulations and compliance |

| Security | Secured by cryptography and decentralized networks | Security depends on legal ownership and physical custody |

Which is better?

Tokenization offers enhanced liquidity and fractional ownership by converting traditional assets into digital tokens on a blockchain, enabling broader market access and faster settlement times. Traditional assets, while more established and regulated, often suffer from limited liquidity and higher transaction costs. The choice depends on the investor's preference for innovation and flexibility versus regulatory certainty and familiarity.

Connection

Tokenization transforms traditional assets like real estate, stocks, and bonds into digital tokens on blockchain platforms, enabling increased liquidity and fractional ownership. This innovation bridges conventional finance with decentralized systems by providing transparent, secure, and efficient asset management. Investors gain access to diversified portfolios and streamlined transactions through tokenized representations of traditional financial instruments.

Key Terms

Liquidity

Traditional assets such as real estate and stocks often suffer from limited liquidity due to high transaction costs, long settlement times, and market accessibility constraints. Tokenization transforms these assets into digital tokens on blockchain platforms, drastically enhancing liquidity by enabling fractional ownership, 24/7 trading, and faster settlement. Explore how tokenization reshapes liquidity dynamics across markets and drives new investment opportunities.

Custody

Traditional assets rely on physical or centralized custody systems involving banks or custodians that secure assets through legal contracts and regulated frameworks. Tokenization transforms asset ownership into digital tokens stored on blockchain-based custody platforms, enabling enhanced security, transparency, and faster settlement. Explore the advantages of tokenized custody solutions and their impact on asset management by learning more about evolving custody technologies.

Fractional Ownership

Traditional assets often require full ownership, limiting investment opportunities to those with significant capital. Tokenization enables fractional ownership by dividing assets into smaller, tradable digital tokens, increasing accessibility and liquidity. Explore the advantages of fractional ownership through tokenization to transform your investment strategy.

Source and External Links

Traditional investments - Wikipedia - Traditional assets are well-known financial instruments such as bonds, cash, real estate, and equity shares, used with expectations of capital appreciation, dividends, and interest earnings.

Alternative Investments and Traditional ones | MHG Wealth - Traditional investments include familiar asset classes like stocks, bonds, and mutual funds characterized by high liquidity, transparency, regulation, risk-adjusted returns, and broad accessibility.

Alternative Investments vs. Traditional Investments - Long Angle - Traditional investments comprise stocks, bonds, mutual funds, ETFs, and cash equivalents that suit investors seeking liquidity, risk aversion, diversification, or long-term growth.

dowidth.com

dowidth.com