Green bond laddering involves staggering maturity dates across a series of green bonds to manage interest rate risk and maintain steady cash flow, while the bullet strategy concentrates maturities at a single point, emphasizing a lump-sum payment. Laddering enhances portfolio diversification and liquidity, benefiting investors seeking gradual reinvestment opportunities aligned with sustainable projects. Explore the advantages and trade-offs of these strategies to optimize your green bond investment approach.

Why it is important

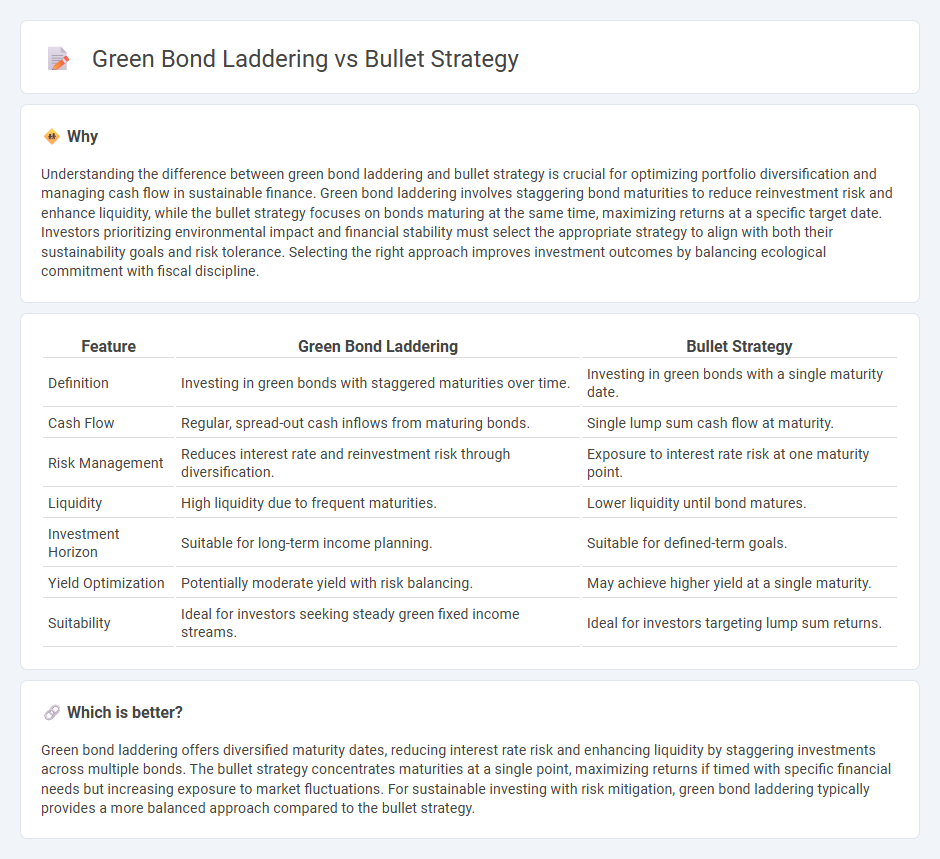

Understanding the difference between green bond laddering and bullet strategy is crucial for optimizing portfolio diversification and managing cash flow in sustainable finance. Green bond laddering involves staggering bond maturities to reduce reinvestment risk and enhance liquidity, while the bullet strategy focuses on bonds maturing at the same time, maximizing returns at a specific target date. Investors prioritizing environmental impact and financial stability must select the appropriate strategy to align with both their sustainability goals and risk tolerance. Selecting the right approach improves investment outcomes by balancing ecological commitment with fiscal discipline.

Comparison Table

| Feature | Green Bond Laddering | Bullet Strategy |

|---|---|---|

| Definition | Investing in green bonds with staggered maturities over time. | Investing in green bonds with a single maturity date. |

| Cash Flow | Regular, spread-out cash inflows from maturing bonds. | Single lump sum cash flow at maturity. |

| Risk Management | Reduces interest rate and reinvestment risk through diversification. | Exposure to interest rate risk at one maturity point. |

| Liquidity | High liquidity due to frequent maturities. | Lower liquidity until bond matures. |

| Investment Horizon | Suitable for long-term income planning. | Suitable for defined-term goals. |

| Yield Optimization | Potentially moderate yield with risk balancing. | May achieve higher yield at a single maturity. |

| Suitability | Ideal for investors seeking steady green fixed income streams. | Ideal for investors targeting lump sum returns. |

Which is better?

Green bond laddering offers diversified maturity dates, reducing interest rate risk and enhancing liquidity by staggering investments across multiple bonds. The bullet strategy concentrates maturities at a single point, maximizing returns if timed with specific financial needs but increasing exposure to market fluctuations. For sustainable investing with risk mitigation, green bond laddering typically provides a more balanced approach compared to the bullet strategy.

Connection

Green bond laddering and bullet strategy are connected through their distinct approaches to managing fixed-income green investments. The laddering strategy staggers maturities to balance risk and cash flow, enhancing portfolio diversification and liquidity by spreading green bonds over time. The bullet strategy concentrates maturities at a single point, optimizing yield and reinvestment timing while focusing on specific environmental projects with targeted funding horizons.

Key Terms

Cash Flow Timing

Bullet strategy in bond investing concentrates on purchasing bonds with a single maturity date, optimizing cash flow for a specific future time, while green bond laddering spreads investments across multiple maturities to ensure steady, staggered cash inflows aligned with sustainable projects. Bullet strategies maximize lump-sum returns at maturity but expose investors to reinvestment risk, whereas laddering mitigates interest rate risk and supports ongoing green initiatives funding. Explore the comparative advantages of these strategies to enhance your sustainable finance portfolio.

Risk Diversification

Bullet strategies concentrate maturity dates, increasing interest rate risk but offering predictable cash flows, while green bond laddering staggers maturities to enhance risk diversification and liquidity. Green bond laddering mitigates reinvestment risk and balances environmental impact with financial stability. Explore detailed comparisons to optimize your sustainable investment portfolio.

Sustainability

Bullet strategy in sustainable finance concentrates investments into a single maturity date, enhancing capital recycling aligned with project funding schedules for green initiatives. Green bond laddering spreads maturities across multiple dates, reducing interest rate risk and supporting a diversified portfolio of environment-focused projects. Explore how these strategies impact sustainable investment portfolios and risk management in the green finance sector.

Source and External Links

Bullet strategy - The bullet strategy involves investing in multiple securities that all mature around the same target date, minimizing interest rate risk while allowing for good returns, making it suitable for planning a windfall at a specific time.

The Hidden Power of the Silver Bullet Strategy - Full Guide - The Silver Bullet Strategy is an intraday trading method focused on liquidity sweeps, fair value gaps, and market structure shifts to identify high-probability trades with strict risk management rules.

ICT Silver Bullet Strategy Explained: How to Identify and Trade it - The ICT Silver Bullet strategy uses concepts of fair value gaps and liquidity to predict price movements across various markets, aiming to capitalize on price imbalances and smart money activity for effective trading.

dowidth.com

dowidth.com