Risk parity portfolios allocate risk equally across asset classes to enhance diversification and improve risk-adjusted returns, contrasting with mean-variance optimized portfolios that focus on maximizing expected return for a given level of risk based on historical covariance and expected returns. Unlike mean-variance optimization, which can be sensitive to estimation errors and lead to concentrated allocations, risk parity aims for stability by balancing risk contributions rather than capital weights. Explore how these portfolio construction methods impact long-term investment performance and risk management strategies.

Why it is important

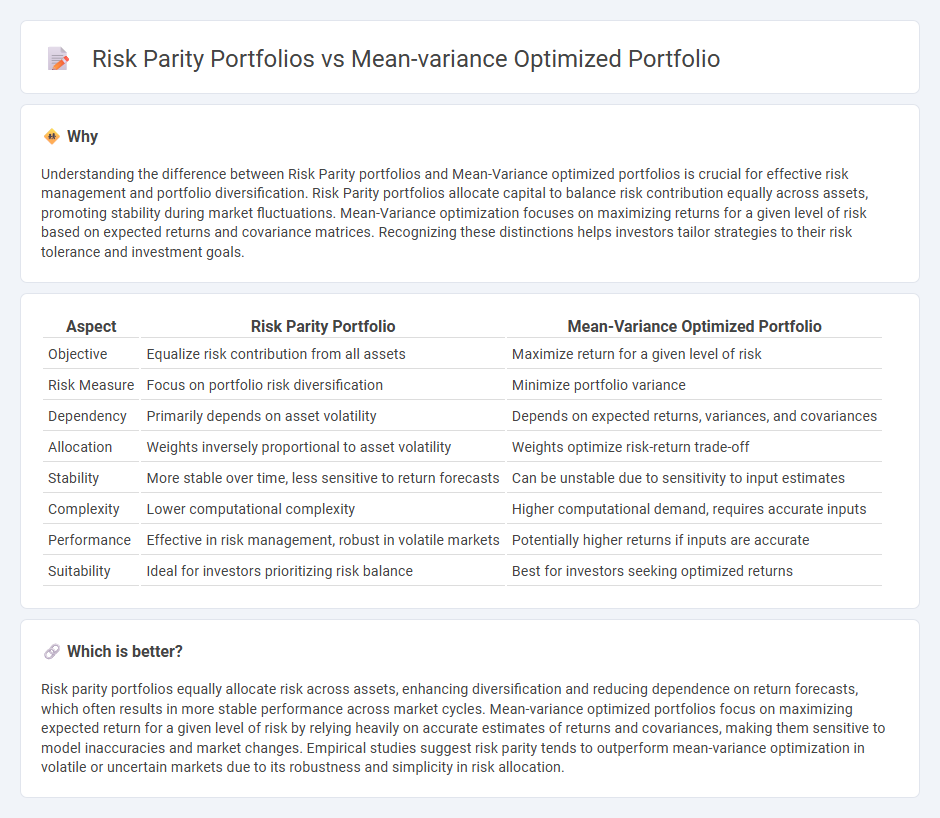

Understanding the difference between Risk Parity portfolios and Mean-Variance optimized portfolios is crucial for effective risk management and portfolio diversification. Risk Parity portfolios allocate capital to balance risk contribution equally across assets, promoting stability during market fluctuations. Mean-Variance optimization focuses on maximizing returns for a given level of risk based on expected returns and covariance matrices. Recognizing these distinctions helps investors tailor strategies to their risk tolerance and investment goals.

Comparison Table

| Aspect | Risk Parity Portfolio | Mean-Variance Optimized Portfolio |

|---|---|---|

| Objective | Equalize risk contribution from all assets | Maximize return for a given level of risk |

| Risk Measure | Focus on portfolio risk diversification | Minimize portfolio variance |

| Dependency | Primarily depends on asset volatility | Depends on expected returns, variances, and covariances |

| Allocation | Weights inversely proportional to asset volatility | Weights optimize risk-return trade-off |

| Stability | More stable over time, less sensitive to return forecasts | Can be unstable due to sensitivity to input estimates |

| Complexity | Lower computational complexity | Higher computational demand, requires accurate inputs |

| Performance | Effective in risk management, robust in volatile markets | Potentially higher returns if inputs are accurate |

| Suitability | Ideal for investors prioritizing risk balance | Best for investors seeking optimized returns |

Which is better?

Risk parity portfolios equally allocate risk across assets, enhancing diversification and reducing dependence on return forecasts, which often results in more stable performance across market cycles. Mean-variance optimized portfolios focus on maximizing expected return for a given level of risk by relying heavily on accurate estimates of returns and covariances, making them sensitive to model inaccuracies and market changes. Empirical studies suggest risk parity tends to outperform mean-variance optimization in volatile or uncertain markets due to its robustness and simplicity in risk allocation.

Connection

Risk parity portfolios and mean-variance optimized portfolios both aim to achieve efficient asset allocation by balancing risk and return, yet they approach diversification differently. Risk parity emphasizes equal risk contribution across assets, focusing on volatility parity, while mean-variance optimization relies on expected returns, variances, and covariances to maximize the Sharpe ratio. Understanding the link between these methods involves recognizing that risk parity can be interpreted as a constrained form of mean-variance optimization where the portfolio targets equal risk weights rather than weights based purely on expected returns.

Key Terms

Expected Return

Mean-variance optimized portfolios prioritize maximizing expected return relative to portfolio risk by leveraging covariance matrices and asset return estimates, often resulting in concentrated allocations to high-return assets with favorable risk profiles. Risk parity portfolios, in contrast, allocate capital to ensure equal risk contribution from each asset, emphasizing risk balance over maximizing expected return, leading to more diversified but potentially lower-expected-return allocations. Explore further to understand which strategy aligns best with your investment goals and risk tolerance.

Covariance Matrix

Mean-variance optimized portfolios prioritize maximizing returns for a given risk level by leveraging the covariance matrix to find the optimal asset weights that minimize portfolio variance. Risk parity portfolios, in contrast, allocate capital to ensure each asset contributes equally to overall portfolio risk, emphasizing risk balancing rather than return optimization. Explore further to understand how differences in covariance matrix estimation impact portfolio construction and risk management strategies.

Risk Budgeting

Mean-variance optimized portfolios allocate assets based on expected returns and covariance matrices to maximize returns for a given risk level, often resulting in concentrated risk exposures. Risk parity portfolios distribute risk equally across asset classes by adjusting weights so each contributes similarly to total portfolio volatility, enhancing diversification and stability. Explore deeper insights on risk budgeting techniques to refine portfolio construction strategies.

Source and External Links

Mean-Variance Portfolio Optimization - MATLAB & MathWorks - Provides a detailed overview of mean-variance portfolio optimization, describing how investors balance risk and return to achieve optimal allocations by specifying portfolio weights and constraints.

How Mean-Variance Optimization Works in Investing - SmartAsset - Explains that mean-variance optimization uses quadratic programming to find optimal asset weights that maximize expected return for a given risk or minimize risk for a desired return, integrating constraints like asset limits or short-selling rules.

Mean-Variance Optimization - an Overview - CFA, FRM, and ... - Describes mean-variance optimization as a process that shifts portfolio asset weights to maximize risk-adjusted returns, emphasizing diversification benefits and the need for expected returns, risks, correlations, and a risk aversion parameter.

dowidth.com

dowidth.com