Synthetic risk transfer involves transferring credit risk using financial derivatives without transferring the underlying assets, enhancing capital efficiency and risk management for financial institutions. Guarantees, on the other hand, involve a third party promising to cover a debt or obligation if the original party defaults, providing direct credit protection. Explore more to understand how these mechanisms impact financial stability and regulatory requirements.

Why it is important

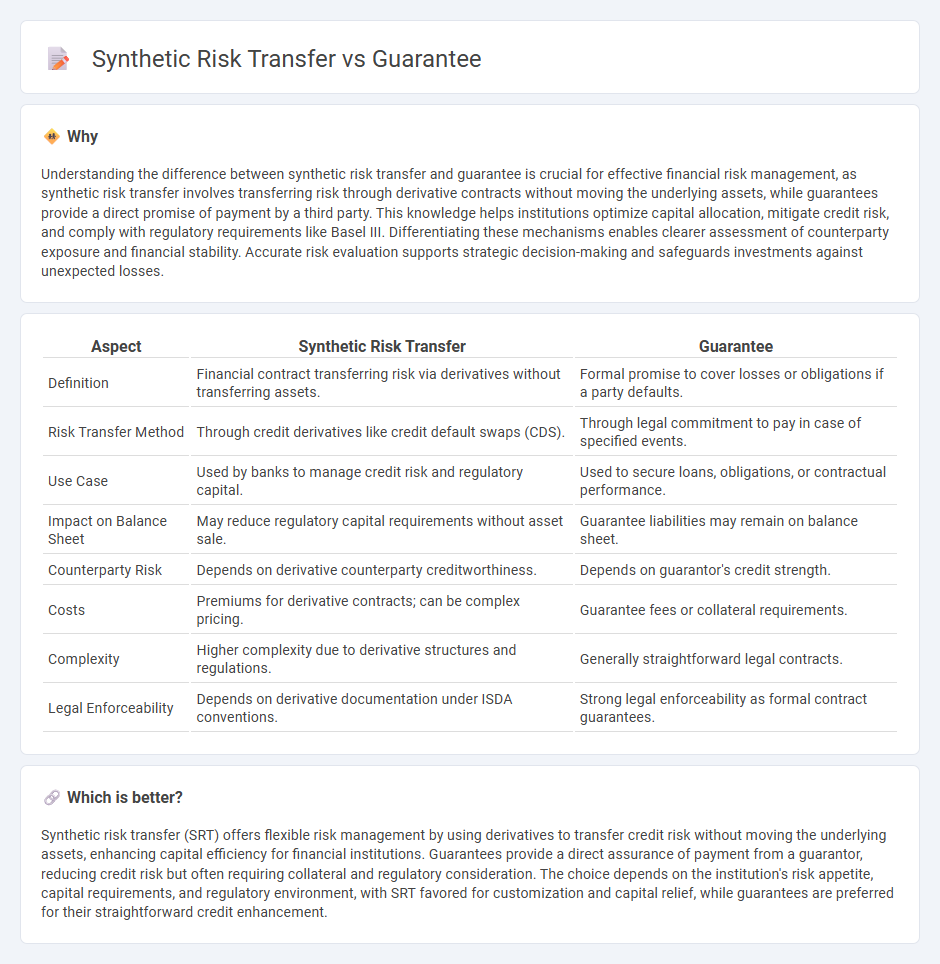

Understanding the difference between synthetic risk transfer and guarantee is crucial for effective financial risk management, as synthetic risk transfer involves transferring risk through derivative contracts without moving the underlying assets, while guarantees provide a direct promise of payment by a third party. This knowledge helps institutions optimize capital allocation, mitigate credit risk, and comply with regulatory requirements like Basel III. Differentiating these mechanisms enables clearer assessment of counterparty exposure and financial stability. Accurate risk evaluation supports strategic decision-making and safeguards investments against unexpected losses.

Comparison Table

| Aspect | Synthetic Risk Transfer | Guarantee |

|---|---|---|

| Definition | Financial contract transferring risk via derivatives without transferring assets. | Formal promise to cover losses or obligations if a party defaults. |

| Risk Transfer Method | Through credit derivatives like credit default swaps (CDS). | Through legal commitment to pay in case of specified events. |

| Use Case | Used by banks to manage credit risk and regulatory capital. | Used to secure loans, obligations, or contractual performance. |

| Impact on Balance Sheet | May reduce regulatory capital requirements without asset sale. | Guarantee liabilities may remain on balance sheet. |

| Counterparty Risk | Depends on derivative counterparty creditworthiness. | Depends on guarantor's credit strength. |

| Costs | Premiums for derivative contracts; can be complex pricing. | Guarantee fees or collateral requirements. |

| Complexity | Higher complexity due to derivative structures and regulations. | Generally straightforward legal contracts. |

| Legal Enforceability | Depends on derivative documentation under ISDA conventions. | Strong legal enforceability as formal contract guarantees. |

Which is better?

Synthetic risk transfer (SRT) offers flexible risk management by using derivatives to transfer credit risk without moving the underlying assets, enhancing capital efficiency for financial institutions. Guarantees provide a direct assurance of payment from a guarantor, reducing credit risk but often requiring collateral and regulatory consideration. The choice depends on the institution's risk appetite, capital requirements, and regulatory environment, with SRT favored for customization and capital relief, while guarantees are preferred for their straightforward credit enhancement.

Connection

Synthetic risk transfer involves the use of financial derivatives to transfer credit risk from one party to another without transferring the underlying assets, often facilitated through credit default swaps or total return swaps. Guarantees function as credit enhancements by providing assurance or backing against potential losses, thereby reducing counterparty risk in synthetic risk transfer transactions. This synergy ensures risk mitigation while maintaining balance sheet flexibility for financial institutions.

Key Terms

Credit Enhancement

Guarantee structures provide credit enhancement by transferring risk through legally binding commitments from third parties, ensuring payment obligations are met even if the originator defaults. Synthetic risk transfer uses derivatives like credit default swaps to achieve credit enhancement by isolating and transferring credit risk without selling actual assets. Explore the nuances of these credit enhancement techniques to understand their impact on risk management strategies.

Credit Default Swap (CDS)

Credit Default Swaps (CDS) serve as a key instrument in both guarantee and synthetic risk transfer by enabling the transfer of credit risk without the direct sale of assets. Guarantee risk transfer involves a third-party assurance, while synthetic risk transfer uses CDS contracts to isolate and hedge credit exposure, enhancing capital efficiency for financial institutions. Explore how CDS structures differ in these mechanisms to optimize credit risk management and capital allocation.

Counterparty Risk

Guarantee and Synthetic Risk Transfer (SRT) mechanisms both aim to mitigate counterparty risk but operate differently; guarantees involve a direct promise by a third party to cover losses, ensuring credit protection, while SRT uses derivative contracts to transfer risk without altering the underlying asset ownership. Counterparty risk in guarantees is concentrated on the guarantor's creditworthiness, whereas in SRT, exposure depends on the derivative counterparty's ability to perform under contract terms. Explore the nuances and risk profiles of these risk transfer methods to enhance financial risk management strategies.

Source and External Links

Guarantee Overview, Corporate vs. Personal Guarantees - A guarantee is a legally binding agreement by a guarantor to repay a borrower's liabilities if the borrower defaults, serving as a form of indirect security for lenders.

GUARANTEE Definition & Meaning - A guarantee is a promise or assurance, often in writing, that something will meet specified quality, benefits, or obligations, or that another's obligations will be fulfilled.

Guarantee (Wikipedia) - In law, a guarantee is a contract by which a guarantor agrees to pay or perform an obligation if the primary party defaults, acting as a secondary obligation and collateral contract.

dowidth.com

dowidth.com