Dark pool routing enables institutional investors to execute large trades anonymously within private exchanges, minimizing market impact and price slippage. Request for Quote (RFQ) systems facilitate price discovery by allowing buyers to solicit bids from multiple dealers, enhancing transparency and competitive pricing. Explore how these trading mechanisms influence liquidity and execution strategies in modern financial markets.

Why it is important

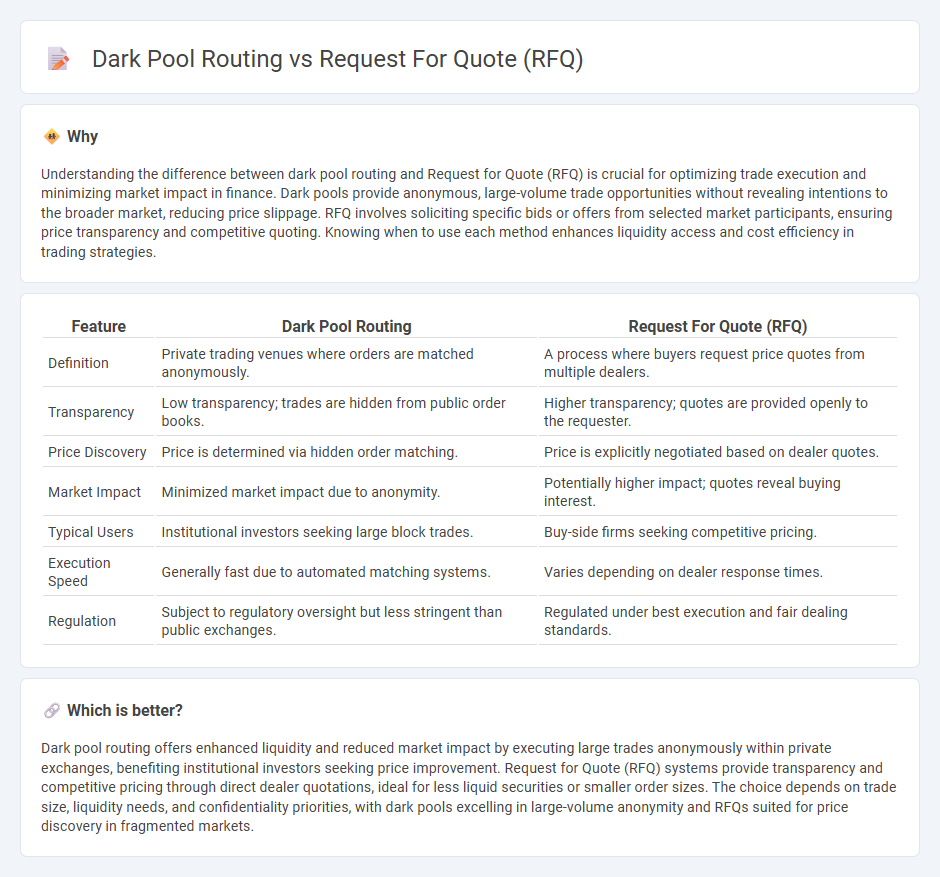

Understanding the difference between dark pool routing and Request for Quote (RFQ) is crucial for optimizing trade execution and minimizing market impact in finance. Dark pools provide anonymous, large-volume trade opportunities without revealing intentions to the broader market, reducing price slippage. RFQ involves soliciting specific bids or offers from selected market participants, ensuring price transparency and competitive quoting. Knowing when to use each method enhances liquidity access and cost efficiency in trading strategies.

Comparison Table

| Feature | Dark Pool Routing | Request For Quote (RFQ) |

|---|---|---|

| Definition | Private trading venues where orders are matched anonymously. | A process where buyers request price quotes from multiple dealers. |

| Transparency | Low transparency; trades are hidden from public order books. | Higher transparency; quotes are provided openly to the requester. |

| Price Discovery | Price is determined via hidden order matching. | Price is explicitly negotiated based on dealer quotes. |

| Market Impact | Minimized market impact due to anonymity. | Potentially higher impact; quotes reveal buying interest. |

| Typical Users | Institutional investors seeking large block trades. | Buy-side firms seeking competitive pricing. |

| Execution Speed | Generally fast due to automated matching systems. | Varies depending on dealer response times. |

| Regulation | Subject to regulatory oversight but less stringent than public exchanges. | Regulated under best execution and fair dealing standards. |

Which is better?

Dark pool routing offers enhanced liquidity and reduced market impact by executing large trades anonymously within private exchanges, benefiting institutional investors seeking price improvement. Request for Quote (RFQ) systems provide transparency and competitive pricing through direct dealer quotations, ideal for less liquid securities or smaller order sizes. The choice depends on trade size, liquidity needs, and confidentiality priorities, with dark pools excelling in large-volume anonymity and RFQs suited for price discovery in fragmented markets.

Connection

Dark pool routing and request for quote (RFQ) systems are connected through their roles in facilitating large, discreet trading transactions. Dark pool routing directs large orders to private trading venues to minimize market impact, while RFQ enables traders to solicit specific price quotes from liquidity providers within these venues. This combination enhances trade execution efficiency and price discovery in less transparent market segments.

Key Terms

Liquidity

Request for quote (RFQ) systems provide access to liquidity by soliciting price quotes from multiple dealers, ensuring transparent and competitive pricing for large institutional orders. Dark pool routing, in contrast, targets hidden liquidity pools where orders are matched anonymously, minimizing market impact but often lacking full price transparency. Explore how these liquidity mechanisms influence trade execution strategies and market efficiency.

Order Execution

Request for Quote (RFQ) involves soliciting price quotes from multiple dealers or liquidity providers to achieve optimal trade execution, emphasizing transparency and price improvement. Dark pool routing directs orders to private, non-transparent trading venues aiming to minimize market impact and preserve confidentiality during order execution. Explore how choosing between RFQ and dark pool routing strategies can enhance your trade execution efficiency and outcomes.

Price Discovery

Request for Quote (RFQ) systems enhance price discovery by actively sourcing competitive bids from multiple market participants, resulting in transparent and efficient pricing mechanisms. Dark pool routing, in contrast, prioritizes execution anonymity and large block trades, which can obscure true market prices and reduce overall price transparency. Explore the nuances of RFQ and dark pool routing to better understand their impact on market price discovery.

Source and External Links

Request for quotation - Wikipedia - A request for quotation (RfQ) is a business process where a company requests a quote from suppliers for the purchase of specific products or services, typically including price, payment terms, and quality details, often with detailed specifications to ensure accurate and comparable bids.

Request for Quote (RFQ) - Fairmarkit - An RFQ is a document sent to suppliers asking for price quotes to fulfill a task or project, focusing primarily on cost and used when product or service requirements are precisely known, sometimes as part of or preceding an RFP process.

The Request for Quotation (RFQ) Process in 6 Steps - Sievo - An RFQ is a competitive bid document used for inviting price bids on standardized or repetitive products or services, typically for high-volume/low-value items, and involves providing technical specifications and commercial requirements to suppliers.

dowidth.com

dowidth.com