Collateralized reinsurance involves securing reinsurance coverage with dedicated collateral funds to ensure claim payments, enhancing financial security for cedents and reinsurers. Parametric insurance offers predefined payouts based on triggering events tied to measurable parameters like hurricane wind speed or earthquake magnitude, enabling faster claims processing without traditional loss assessments. Explore the differences and benefits of each approach to optimize your risk transfer strategies.

Why it is important

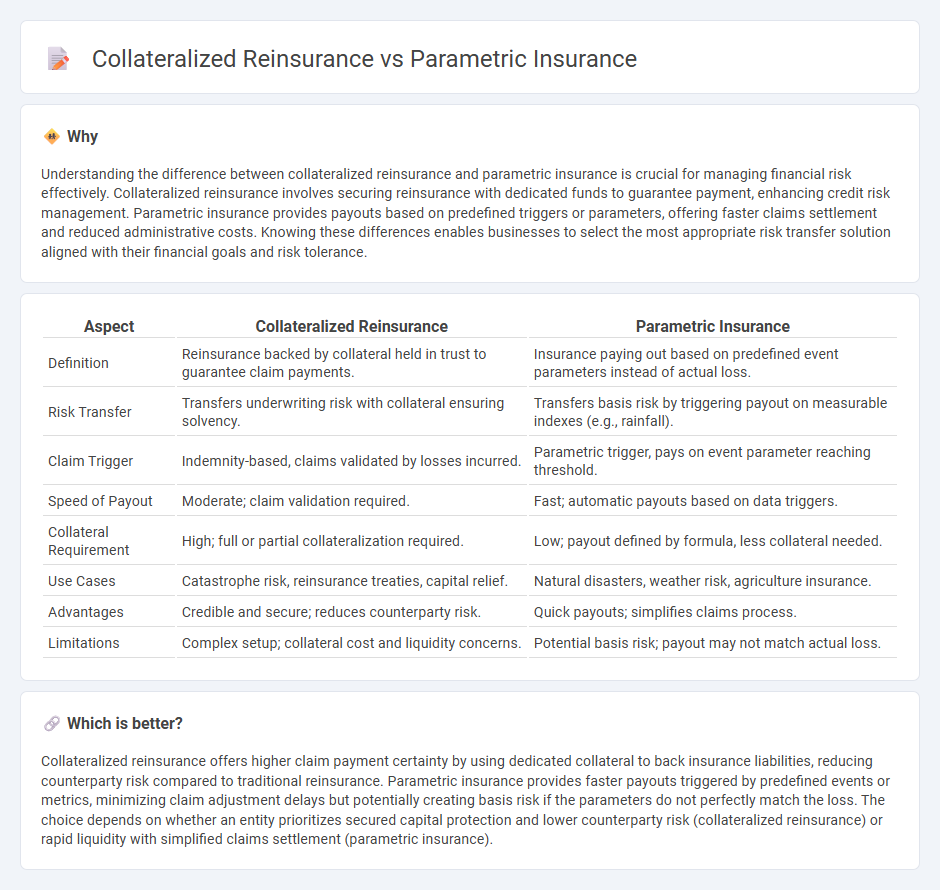

Understanding the difference between collateralized reinsurance and parametric insurance is crucial for managing financial risk effectively. Collateralized reinsurance involves securing reinsurance with dedicated funds to guarantee payment, enhancing credit risk management. Parametric insurance provides payouts based on predefined triggers or parameters, offering faster claims settlement and reduced administrative costs. Knowing these differences enables businesses to select the most appropriate risk transfer solution aligned with their financial goals and risk tolerance.

Comparison Table

| Aspect | Collateralized Reinsurance | Parametric Insurance |

|---|---|---|

| Definition | Reinsurance backed by collateral held in trust to guarantee claim payments. | Insurance paying out based on predefined event parameters instead of actual loss. |

| Risk Transfer | Transfers underwriting risk with collateral ensuring solvency. | Transfers basis risk by triggering payout on measurable indexes (e.g., rainfall). |

| Claim Trigger | Indemnity-based, claims validated by losses incurred. | Parametric trigger, pays on event parameter reaching threshold. |

| Speed of Payout | Moderate; claim validation required. | Fast; automatic payouts based on data triggers. |

| Collateral Requirement | High; full or partial collateralization required. | Low; payout defined by formula, less collateral needed. |

| Use Cases | Catastrophe risk, reinsurance treaties, capital relief. | Natural disasters, weather risk, agriculture insurance. |

| Advantages | Credible and secure; reduces counterparty risk. | Quick payouts; simplifies claims process. |

| Limitations | Complex setup; collateral cost and liquidity concerns. | Potential basis risk; payout may not match actual loss. |

Which is better?

Collateralized reinsurance offers higher claim payment certainty by using dedicated collateral to back insurance liabilities, reducing counterparty risk compared to traditional reinsurance. Parametric insurance provides faster payouts triggered by predefined events or metrics, minimizing claim adjustment delays but potentially creating basis risk if the parameters do not perfectly match the loss. The choice depends on whether an entity prioritizes secured capital protection and lower counterparty risk (collateralized reinsurance) or rapid liquidity with simplified claims settlement (parametric insurance).

Connection

Collateralized reinsurance and parametric insurance both aim to enhance risk transfer efficiency by providing pre-funded mechanisms that reduce counterparty risk and expedite claims settlement. Collateralized reinsurance involves securing reinsurance obligations with collateral, ensuring liquidity and trust, while parametric insurance offers payouts based on predefined triggers, such as weather indices, enabling rapid disbursement without traditional loss adjustment. Their connection lies in the combination of financial security and objective risk metrics, which optimize capital management and improve the resilience of insurance portfolios against catastrophic events.

Key Terms

Trigger Event

Parametric insurance pays out benefits based on predefined triggers such as specific weather events or earthquake magnitudes, ensuring quick and transparent claim settlements without needing loss assessments. Collateralized reinsurance involves upfront capital held in a trust or escrow account to cover losses once a trigger event, determined by claims or loss assessments, occurs, offering security but with potentially slower payouts. Discover more about how these trigger mechanisms impact risk management strategies in insurance.

Indemnity

Parametric insurance provides payouts based on predefined triggering events measured by parameters, minimizing claims adjustment through objective data rather than actual loss verification. Collateralized reinsurance involves upfront capital to cover indemnity claims, allowing direct coverage of losses but requiring detailed loss assessment and collateral management. Explore the nuanced differences in indemnity mechanisms between these risk transfer solutions to optimize your risk strategy.

Special Purpose Vehicle (SPV)

Parametric insurance provides swift payouts based on pre-agreed triggering events such as earthquake magnitude or rainfall levels, minimizing claims adjustment delays. Collateralized reinsurance, often structured through Special Purpose Vehicles (SPVs), enhances risk transfer efficiency by isolating and managing specific reinsurance risks with dedicated capital reserves. Explore in-depth how SPVs optimize capital allocation and risk mitigation in these alternative insurance structures.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance is a type of coverage that pays out based on the occurrence of a defined event meeting or exceeding a set threshold (like an earthquake magnitude or wind speed) rather than indemnifying actual losses, enabling quicker and often predetermined payments.

Parametric Insurance Solutions - Amwins - This insurance pays based on pre-agreed triggers tied to event characteristics (e.g., wind speed or earthquake magnitude) and relies on near real-time objective data for fast claims processing without the need to prove exact losses.

Parametric insurance - Wikipedia - Parametric insurance offers upfront payouts once a trigger event is confirmed, allowing rapid liquidity for recovery, especially useful in catastrophic or hard-to-model risks, though it may not cover full actual damages due to basis risk.

dowidth.com

dowidth.com