Retail algorithmic trading leverages automated systems to execute orders at optimal prices based on predefined strategies and market data analysis. Market making involves continuously providing bid and ask quotes, ensuring liquidity and narrowing spreads while managing inventory risk. Discover how these distinct approaches impact market efficiency and trading outcomes.

Why it is important

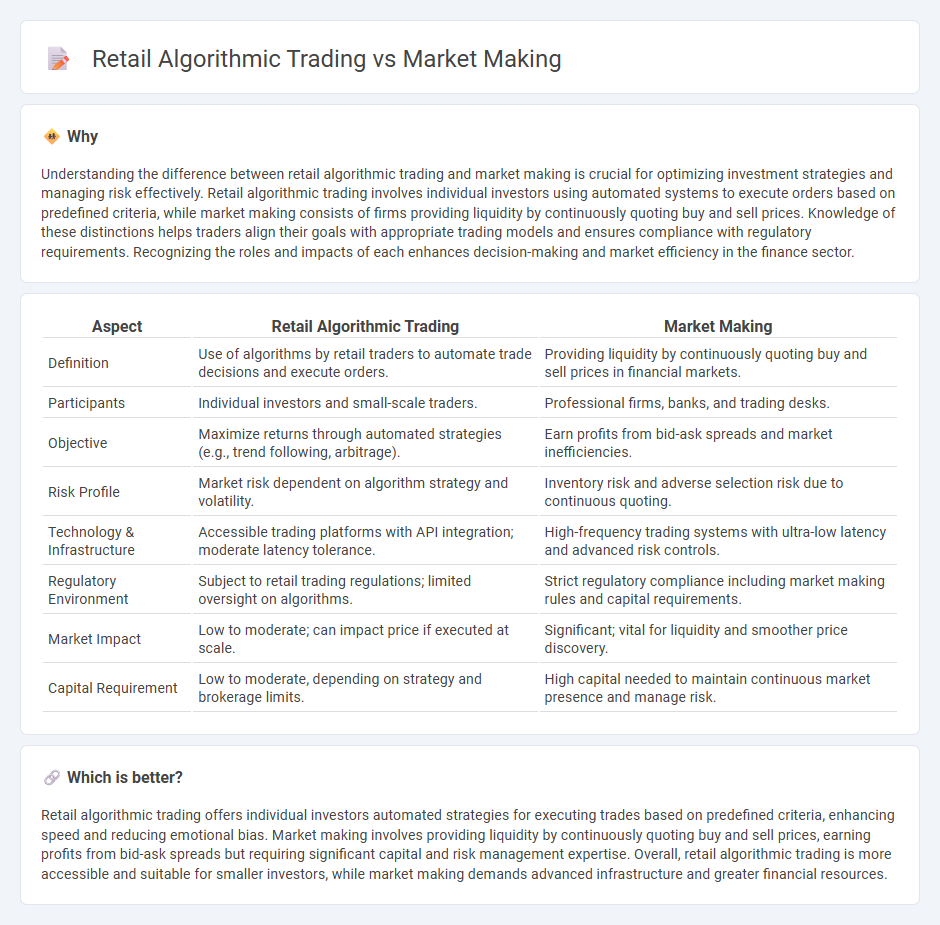

Understanding the difference between retail algorithmic trading and market making is crucial for optimizing investment strategies and managing risk effectively. Retail algorithmic trading involves individual investors using automated systems to execute orders based on predefined criteria, while market making consists of firms providing liquidity by continuously quoting buy and sell prices. Knowledge of these distinctions helps traders align their goals with appropriate trading models and ensures compliance with regulatory requirements. Recognizing the roles and impacts of each enhances decision-making and market efficiency in the finance sector.

Comparison Table

| Aspect | Retail Algorithmic Trading | Market Making |

|---|---|---|

| Definition | Use of algorithms by retail traders to automate trade decisions and execute orders. | Providing liquidity by continuously quoting buy and sell prices in financial markets. |

| Participants | Individual investors and small-scale traders. | Professional firms, banks, and trading desks. |

| Objective | Maximize returns through automated strategies (e.g., trend following, arbitrage). | Earn profits from bid-ask spreads and market inefficiencies. |

| Risk Profile | Market risk dependent on algorithm strategy and volatility. | Inventory risk and adverse selection risk due to continuous quoting. |

| Technology & Infrastructure | Accessible trading platforms with API integration; moderate latency tolerance. | High-frequency trading systems with ultra-low latency and advanced risk controls. |

| Regulatory Environment | Subject to retail trading regulations; limited oversight on algorithms. | Strict regulatory compliance including market making rules and capital requirements. |

| Market Impact | Low to moderate; can impact price if executed at scale. | Significant; vital for liquidity and smoother price discovery. |

| Capital Requirement | Low to moderate, depending on strategy and brokerage limits. | High capital needed to maintain continuous market presence and manage risk. |

Which is better?

Retail algorithmic trading offers individual investors automated strategies for executing trades based on predefined criteria, enhancing speed and reducing emotional bias. Market making involves providing liquidity by continuously quoting buy and sell prices, earning profits from bid-ask spreads but requiring significant capital and risk management expertise. Overall, retail algorithmic trading is more accessible and suitable for smaller investors, while market making demands advanced infrastructure and greater financial resources.

Connection

Retail algorithmic trading leverages automated systems to execute orders at optimal prices, enhancing market efficiency and liquidity. Market making involves providing continuous bid and ask quotes, facilitating smoother transactions and reducing spreads in financial markets. Both activities rely on advanced algorithms and high-frequency data processing to drive faster execution and improved price discovery.

Key Terms

**Market Making:**

Market making involves continuously providing buy and sell quotes to capture the bid-ask spread, ensuring liquidity in financial markets. This strategy relies on advanced algorithms that swiftly adjust prices based on order flow and market conditions, optimizing risk exposure while maintaining inventory balance. Discover how market making leverages high-frequency trading technologies to enhance market efficiency and gain deeper insights into its mechanisms.

Bid-Ask Spread

Market making centers on profiting from the bid-ask spread by continuously providing liquidity and setting both buy and sell prices to capture consistent, small margins. Retail algorithmic trading often aims to exploit short-term price movements, but typically lacks the scale and speed to effectively capitalize on the bid-ask spread like professional market makers do. Explore the nuances and strategies behind these trading methods to better understand their impact on market efficiency and personal trading outcomes.

Liquidity Provision

Market making involves continuously quoting bid and ask prices to provide liquidity and facilitate smooth trading in financial markets, ensuring tighter spreads and reduced volatility. Retail algorithmic trading typically focuses on executing predefined strategies for individual investors, often lacking the obligation to maintain liquidity but aiming to optimize trade execution and reduce costs. Explore in-depth how liquidity provision differentiates these approaches and impacts market efficiency.

Source and External Links

Mastering the Market Maker Trading Strategy | EPAM SolutionsHub - Market makers profit primarily from the bid-ask spread by buying securities at bid prices and selling at higher ask prices, also managing inventory risk and analyzing order flow to anticipate market movements while providing liquidity.

Market maker: What it is, importance, benefits & examples - StoneX - A market maker continuously quotes buy and sell prices, facilitating immediate trades by holding inventory and profiting from the bid-ask spread while managing risks using algorithms and strategies.

Market Maker - Definition, Role, How They Work - Market makers are firms or individuals providing two-sided quotes in securities, earning profits from bid-ask spreads and maintaining market liquidity by executing trades for themselves and others.

dowidth.com

dowidth.com