Buy Now Pay Later (BNPL) integration offers consumers flexible payment options by splitting purchases into interest-free installments, enhancing affordability and driving higher conversion rates. eWallet integration provides instant, secure digital payments via stored card information or bank accounts, streamlining the checkout process and boosting transaction speed. Explore the advantages and insights of BNPL and eWallet solutions to optimize your finance strategy.

Why it is important

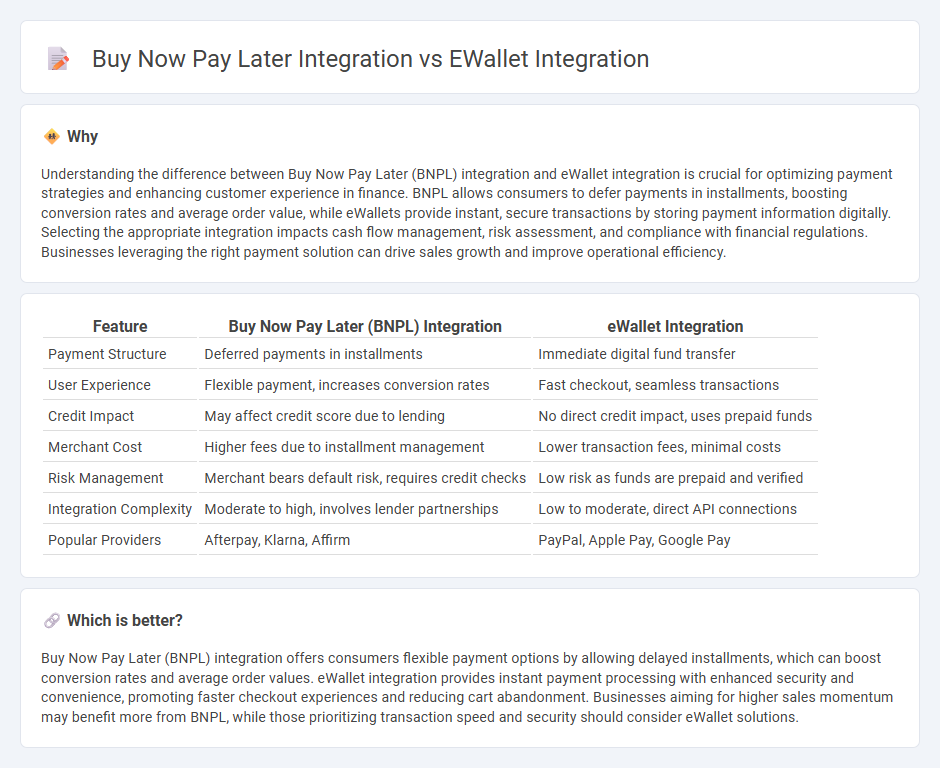

Understanding the difference between Buy Now Pay Later (BNPL) integration and eWallet integration is crucial for optimizing payment strategies and enhancing customer experience in finance. BNPL allows consumers to defer payments in installments, boosting conversion rates and average order value, while eWallets provide instant, secure transactions by storing payment information digitally. Selecting the appropriate integration impacts cash flow management, risk assessment, and compliance with financial regulations. Businesses leveraging the right payment solution can drive sales growth and improve operational efficiency.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) Integration | eWallet Integration |

|---|---|---|

| Payment Structure | Deferred payments in installments | Immediate digital fund transfer |

| User Experience | Flexible payment, increases conversion rates | Fast checkout, seamless transactions |

| Credit Impact | May affect credit score due to lending | No direct credit impact, uses prepaid funds |

| Merchant Cost | Higher fees due to installment management | Lower transaction fees, minimal costs |

| Risk Management | Merchant bears default risk, requires credit checks | Low risk as funds are prepaid and verified |

| Integration Complexity | Moderate to high, involves lender partnerships | Low to moderate, direct API connections |

| Popular Providers | Afterpay, Klarna, Affirm | PayPal, Apple Pay, Google Pay |

Which is better?

Buy Now Pay Later (BNPL) integration offers consumers flexible payment options by allowing delayed installments, which can boost conversion rates and average order values. eWallet integration provides instant payment processing with enhanced security and convenience, promoting faster checkout experiences and reducing cart abandonment. Businesses aiming for higher sales momentum may benefit more from BNPL, while those prioritizing transaction speed and security should consider eWallet solutions.

Connection

Buy Now Pay Later (BNPL) integration and eWallet integration intersect by streamlining payment processes, enhancing consumer flexibility, and expanding digital payment ecosystems. Combining BNPL services within eWallet platforms allows users to access installment plans seamlessly, improving checkout experiences and boosting conversion rates for merchants. This synergy leverages real-time transaction data and digital credit assessments, optimizing financial management and promoting widespread adoption of innovative payment solutions.

Key Terms

**eWallet integration:**

eWallet integration enables seamless, secure digital payments by linking users' bank accounts, credit cards, or stored value directly to online platforms, enhancing user experience through faster checkout and reduced transaction friction. Merchants benefit from improved transaction success rates and lower chargeback risks compared to traditional payment methods. Discover how eWallet integration can transform your payment processing and boost customer satisfaction.

Digital Wallet

Digital Wallet integration enhances user convenience by enabling instant, secure transactions through smartphones or wearable devices, supporting a variety of payment methods including credit cards, bank transfers, and cryptocurrencies. Buy Now Pay Later (BNPL) integration, while providing flexible financing options and boosting average order value, involves more complex credit assessments and regulatory compliance than Digital Wallets. Explore how Digital Wallet technology streamlines payment processing and transforms customer experience in the evolving digital commerce landscape.

Payment Gateway

eWallet integration streamlines transaction speed and enhances user convenience by securely storing multiple payment methods within a single platform, improving checkout efficiency through instant authorization via payment gateways. Buy Now Pay Later (BNPL) integration in payment gateways offers consumers flexible credit options directly at checkout, increasing average order value and conversion rates by splitting payments into manageable installments without requiring upfront full payment. Explore how choosing the right payment gateway integration between eWallet and BNPL solutions can optimize your business's payment process and customer experience.

Source and External Links

eWallet APIs 101: Integration, Pricing, & More - Nimble AppGenie - Integration of eWallet APIs involves understanding API documentation, planning the integration architecture, and ensuring security via HTTPS, OAuth2, and secure token handling to enable seamless payments, fund additions, and transfers.

eWallet App Development Company - Digital Wallets for Enterprise - Core eWallet app features for integration include smooth user registration/login, syncing multiple external accounts, backup for wallet data, and easy balance replenishment from various funding sources.

eWallet APIs Integration: All You Need to Know - JPLoft - Key components for integration are robust user authentication/authorization (using OTP, biometrics, MFA), and comprehensive account management including profile customization, bank/card linking, and transaction control to ensure secure, user-friendly experience.

dowidth.com

dowidth.com