Payment for order flow involves brokers receiving compensation from third parties for directing client orders, potentially influencing trade execution quality. Agency trading prioritizes executing client orders directly on exchanges without external financial incentives, promoting transparency and best execution practices. Learn more about how these trading models impact market dynamics and investor outcomes.

Why it is important

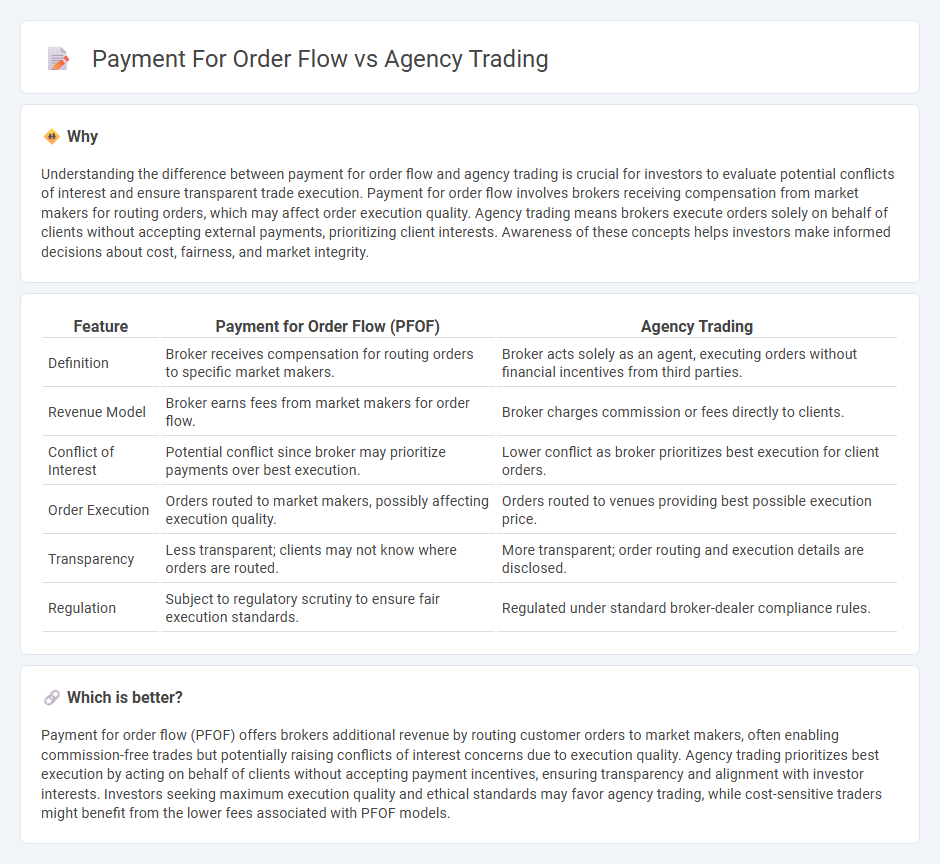

Understanding the difference between payment for order flow and agency trading is crucial for investors to evaluate potential conflicts of interest and ensure transparent trade execution. Payment for order flow involves brokers receiving compensation from market makers for routing orders, which may affect order execution quality. Agency trading means brokers execute orders solely on behalf of clients without accepting external payments, prioritizing client interests. Awareness of these concepts helps investors make informed decisions about cost, fairness, and market integrity.

Comparison Table

| Feature | Payment for Order Flow (PFOF) | Agency Trading |

|---|---|---|

| Definition | Broker receives compensation for routing orders to specific market makers. | Broker acts solely as an agent, executing orders without financial incentives from third parties. |

| Revenue Model | Broker earns fees from market makers for order flow. | Broker charges commission or fees directly to clients. |

| Conflict of Interest | Potential conflict since broker may prioritize payments over best execution. | Lower conflict as broker prioritizes best execution for client orders. |

| Order Execution | Orders routed to market makers, possibly affecting execution quality. | Orders routed to venues providing best possible execution price. |

| Transparency | Less transparent; clients may not know where orders are routed. | More transparent; order routing and execution details are disclosed. |

| Regulation | Subject to regulatory scrutiny to ensure fair execution standards. | Regulated under standard broker-dealer compliance rules. |

Which is better?

Payment for order flow (PFOF) offers brokers additional revenue by routing customer orders to market makers, often enabling commission-free trades but potentially raising conflicts of interest concerns due to execution quality. Agency trading prioritizes best execution by acting on behalf of clients without accepting payment incentives, ensuring transparency and alignment with investor interests. Investors seeking maximum execution quality and ethical standards may favor agency trading, while cost-sensitive traders might benefit from the lower fees associated with PFOF models.

Connection

Payment for order flow involves brokers receiving compensation for directing client orders to specific market makers, while agency trading refers to brokers executing trades on behalf of clients without taking a position. The connection lies in how brokers may use payment for order flow as an incentive to route agency trades to particular venues, impacting execution quality and market transparency. Understanding this link is crucial for assessing potential conflicts of interest and regulatory considerations in the trading ecosystem.

Key Terms

Broker-Dealer

Broker-dealers differ significantly in their revenue models, with agency trading involving executing client orders on behalf without taking market risk, ensuring transparent pricing and best execution. In contrast, payment for order flow (PFOF) entails broker-dealers receiving compensation from market makers for directing orders to them, potentially impacting order execution quality. Explore the implications of these approaches on broker-dealer practices and investor outcomes.

Best Execution

Agency trading prioritizes best execution by placing client interests above all, ensuring orders are routed to venues offering optimal price, speed, and reliability. Payment for order flow (PFOF) involves brokers receiving compensation from market makers for directing orders, which may create potential conflicts impacting execution quality. Explore how these trading models influence execution standards and client outcomes for a deeper understanding.

Order Routing

Agency trading involves brokers executing orders on behalf of clients, prioritizing best execution through transparent order routing to various exchanges and liquidity pools. Payment for order flow (PFOF) occurs when brokers receive compensation from market makers for routing client orders to them, potentially affecting the order execution quality due to conflicts of interest. Explore the detailed impact of order routing strategies on trade execution quality and investor outcomes.

Source and External Links

Agency Trading Explained | Northern Trust - Agency trading is a model where traders act only on explicit client instructions, earning commissions only when executing client orders, ensuring objectivity, cost transparency, and protection of confidential client information without conflicts of interest.

Principal vs. Agency Trading: Which Strategy is Right for You? - Agency trading involves brokers executing trades on a client's behalf without proprietary risk, prioritizing the client's best interests, offering transparency and cost efficiency, but may have limited profit margins and some delay in order timing.

Principal Trading vs Agency Trading | QuestDB - Agency trading is executing trades solely on behalf of clients without taking ownership or market risk, earning commissions through best execution, contrasting with principal trading where firms trade for their own account and risk.

dowidth.com

dowidth.com