Revenue-based financing offers flexible repayment tied to a company's monthly revenue, minimizing equity dilution and aligning investor returns with business performance. Convertible notes provide a debt instrument that converts into equity upon a future financing event, often favored for early-stage startups seeking simplicity and deferred valuation. Discover more about which financing option suits your business growth strategy.

Why it is important

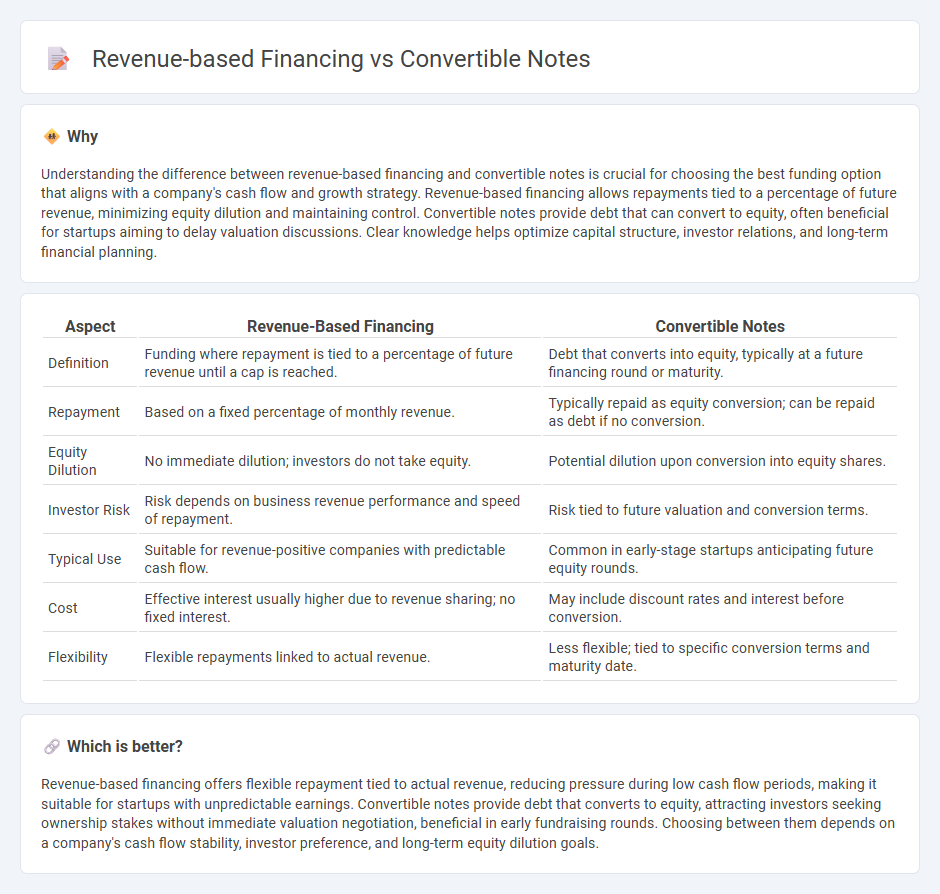

Understanding the difference between revenue-based financing and convertible notes is crucial for choosing the best funding option that aligns with a company's cash flow and growth strategy. Revenue-based financing allows repayments tied to a percentage of future revenue, minimizing equity dilution and maintaining control. Convertible notes provide debt that can convert to equity, often beneficial for startups aiming to delay valuation discussions. Clear knowledge helps optimize capital structure, investor relations, and long-term financial planning.

Comparison Table

| Aspect | Revenue-Based Financing | Convertible Notes |

|---|---|---|

| Definition | Funding where repayment is tied to a percentage of future revenue until a cap is reached. | Debt that converts into equity, typically at a future financing round or maturity. |

| Repayment | Based on a fixed percentage of monthly revenue. | Typically repaid as equity conversion; can be repaid as debt if no conversion. |

| Equity Dilution | No immediate dilution; investors do not take equity. | Potential dilution upon conversion into equity shares. |

| Investor Risk | Risk depends on business revenue performance and speed of repayment. | Risk tied to future valuation and conversion terms. |

| Typical Use | Suitable for revenue-positive companies with predictable cash flow. | Common in early-stage startups anticipating future equity rounds. |

| Cost | Effective interest usually higher due to revenue sharing; no fixed interest. | May include discount rates and interest before conversion. |

| Flexibility | Flexible repayments linked to actual revenue. | Less flexible; tied to specific conversion terms and maturity date. |

Which is better?

Revenue-based financing offers flexible repayment tied to actual revenue, reducing pressure during low cash flow periods, making it suitable for startups with unpredictable earnings. Convertible notes provide debt that converts to equity, attracting investors seeking ownership stakes without immediate valuation negotiation, beneficial in early fundraising rounds. Choosing between them depends on a company's cash flow stability, investor preference, and long-term equity dilution goals.

Connection

Revenue-based financing and convertible notes are connected through their role as alternative investment instruments that provide startups with flexible capital. Both methods allow investors to receive returns linked to a company's performance--revenue-based financing ties repayments directly to revenue percentages, while convertible notes convert debt into equity under predefined terms. This connection enables businesses to secure growth funding without immediate equity dilution, balancing investor risk and reward.

Key Terms

Conversion (Convertible Notes)

Convertible notes offer investors debt that converts into equity during a future financing round, typically at a discount or with a valuation cap, providing upside potential aligned with company growth. This conversion feature contrasts with revenue-based financing, where repayments are made as a fixed percentage of revenue without equity involvement. Explore how convertible note conversion terms can impact your startup's fundraising strategy and investor relations.

Equity Dilution (Convertible Notes)

Convertible notes often lead to equity dilution as they convert debt into shares during a future funding round, impacting ownership percentages for existing shareholders. Revenue-based financing avoids equity dilution by providing capital in exchange for a fixed percentage of future revenues until repayment, preserving founder equity. Explore detailed comparisons to determine the optimal funding structure for your startup.

Royalty Payments (Revenue-Based Financing)

Revenue-based financing involves royalty payments, where investors receive a fixed percentage of a company's ongoing gross revenues until a predetermined return is achieved, aligning repayment with business performance. Convertible notes, by contrast, are debt instruments that convert into equity, lacking direct royalty payments and focusing instead on future ownership stakes. Explore more about how royalty payments impact financing structures and growth strategies.

Source and External Links

Convertible Securities: SAFEs vs. Convertible Notes - Carta - A convertible note is a short-term debt that converts into equity during a future event, featuring interest, maturity date, valuation caps, and conversion discounts to reward early investors.

What is a convertible note? | Legal glossary - Convertible notes are debt instruments convertible to equity at future events with features like principal amount, accrued interest, maturity date, conversion discounts, and valuation caps that benefit both startups and investors.

The Pros and Cons of Convertible Notes | Toptal(r) - Convertible notes blend debt and equity, allowing investors to convert principal plus accrued interest into equity at a discount during qualified financings, protecting early investors and simplifying startup fundraising.

dowidth.com

dowidth.com