Web scraping for stock data offers real-time access to diverse market information without upfront licensing costs, enabling agile data collection from multiple sources. Database licensing provides structured, reliable, and compliant datasets with guaranteed uptime and quality, essential for institutional-grade financial analysis. Explore the advantages and drawbacks of each method to determine the best approach for your investment strategy and data needs.

Why it is important

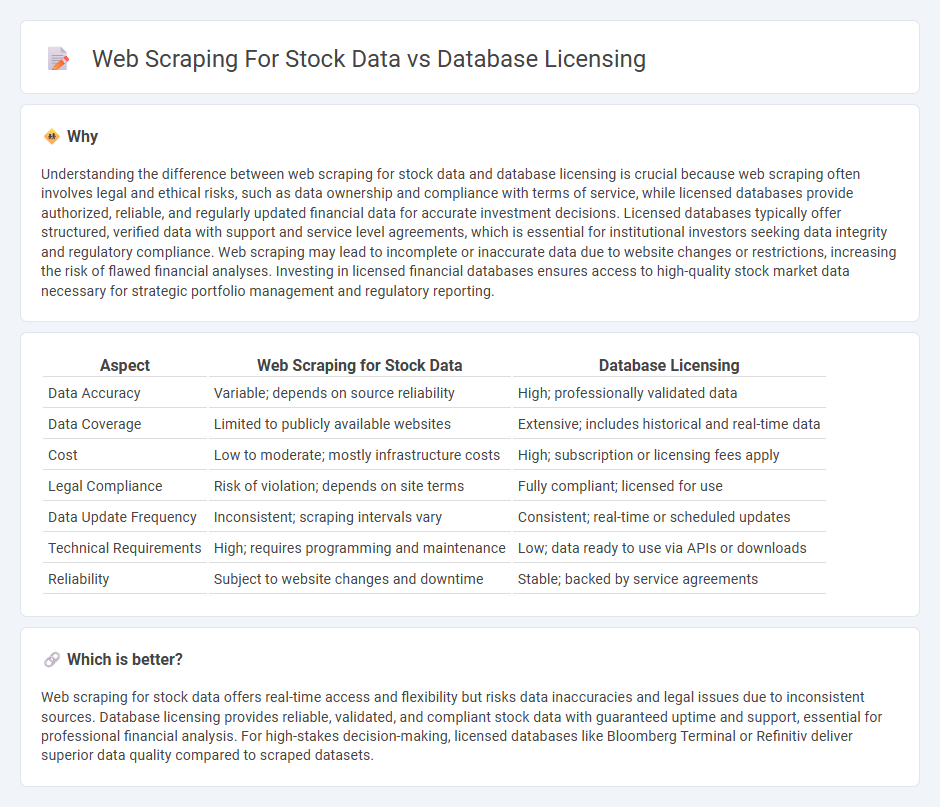

Understanding the difference between web scraping for stock data and database licensing is crucial because web scraping often involves legal and ethical risks, such as data ownership and compliance with terms of service, while licensed databases provide authorized, reliable, and regularly updated financial data for accurate investment decisions. Licensed databases typically offer structured, verified data with support and service level agreements, which is essential for institutional investors seeking data integrity and regulatory compliance. Web scraping may lead to incomplete or inaccurate data due to website changes or restrictions, increasing the risk of flawed financial analyses. Investing in licensed financial databases ensures access to high-quality stock market data necessary for strategic portfolio management and regulatory reporting.

Comparison Table

| Aspect | Web Scraping for Stock Data | Database Licensing |

|---|---|---|

| Data Accuracy | Variable; depends on source reliability | High; professionally validated data |

| Data Coverage | Limited to publicly available websites | Extensive; includes historical and real-time data |

| Cost | Low to moderate; mostly infrastructure costs | High; subscription or licensing fees apply |

| Legal Compliance | Risk of violation; depends on site terms | Fully compliant; licensed for use |

| Data Update Frequency | Inconsistent; scraping intervals vary | Consistent; real-time or scheduled updates |

| Technical Requirements | High; requires programming and maintenance | Low; data ready to use via APIs or downloads |

| Reliability | Subject to website changes and downtime | Stable; backed by service agreements |

Which is better?

Web scraping for stock data offers real-time access and flexibility but risks data inaccuracies and legal issues due to inconsistent sources. Database licensing provides reliable, validated, and compliant stock data with guaranteed uptime and support, essential for professional financial analysis. For high-stakes decision-making, licensed databases like Bloomberg Terminal or Refinitiv deliver superior data quality compared to scraped datasets.

Connection

Web scraping for stock data enables continuous extraction of real-time financial information, which can be systematically stored and managed through database licensing agreements. Licensed databases provide structured access to verified stock market data, ensuring compliance with legal and proprietary constraints while supporting data integrity for financial analysis. Integrating web-scraped data with licensed databases enhances the accuracy and scalability of stock market analytics platforms.

Key Terms

Intellectual Property Rights

Database licensing ensures access to stock data while protecting Intellectual Property Rights (IPR) through legally binding agreements that define usage terms, restrictions, and data ownership. Web scraping stock data, however, poses significant IPR challenges, often violating terms of service and risking legal actions due to unauthorized extraction of proprietary information. Explore comprehensive strategies to balance data needs with IPR compliance for informed decision-making.

Data Usage Agreements

Database licensing for stock data ensures compliance with Data Usage Agreements by granting explicit permissions and defining usage limits, avoiding legal risks associated with unauthorized data extraction. Web scraping often violates these agreements, risking service bans, legal action, and unreliable, incomplete data sets due to dynamic website structures. Explore the nuances of these approaches to make informed decisions about secure, compliant stock data acquisition.

Compliance Risk

Database licensing for stock data involves obtaining legal permissions to access structured and constantly updated financial information, thereby minimizing compliance risks associated with unauthorized data use. Web scraping, although potentially cost-effective, often entails significant compliance risks due to terms of service violations, data ownership issues, and changing website structures that can lead to legal disputes or data accuracy concerns. Explore our detailed analysis to understand how compliance considerations impact your choice between database licensing and web scraping for stock data acquisition.

Source and External Links

Six Oracle Database Licensing Models and Costs - 2025 - Oracle database licensing primarily uses processor and named user plus models, with licensing costs varying based on infrastructure, number of cores, users, and chosen edition (Enterprise or Standard).

Oracle Database Licensing Guide - Oracle licensing has two main metrics: Processor licenses (based on physical cores adjusted by a core factor) and Named User Plus licenses (based on the number of users), applicable to Enterprise Edition and Standard Edition 2 databases.

Oracle Licensing: 5 Common Types of Database Licenses - NPI - There are various Oracle licensing options including Cloud BYOL (Bring Your Own License), which allows using on-premise licenses for cloud deployments, with specific rules applying depending on cloud vendor and usage rights.

dowidth.com

dowidth.com