Thematic ETFs focus on specific trends or sectors such as technology, clean energy, or healthcare, offering targeted exposure to growth opportunities. Commodity ETFs invest directly in physical goods like gold, oil, or agricultural products, providing a hedge against inflation and market volatility. Explore the key differences and benefits to determine which ETF aligns with your investment strategy.

Why it is important

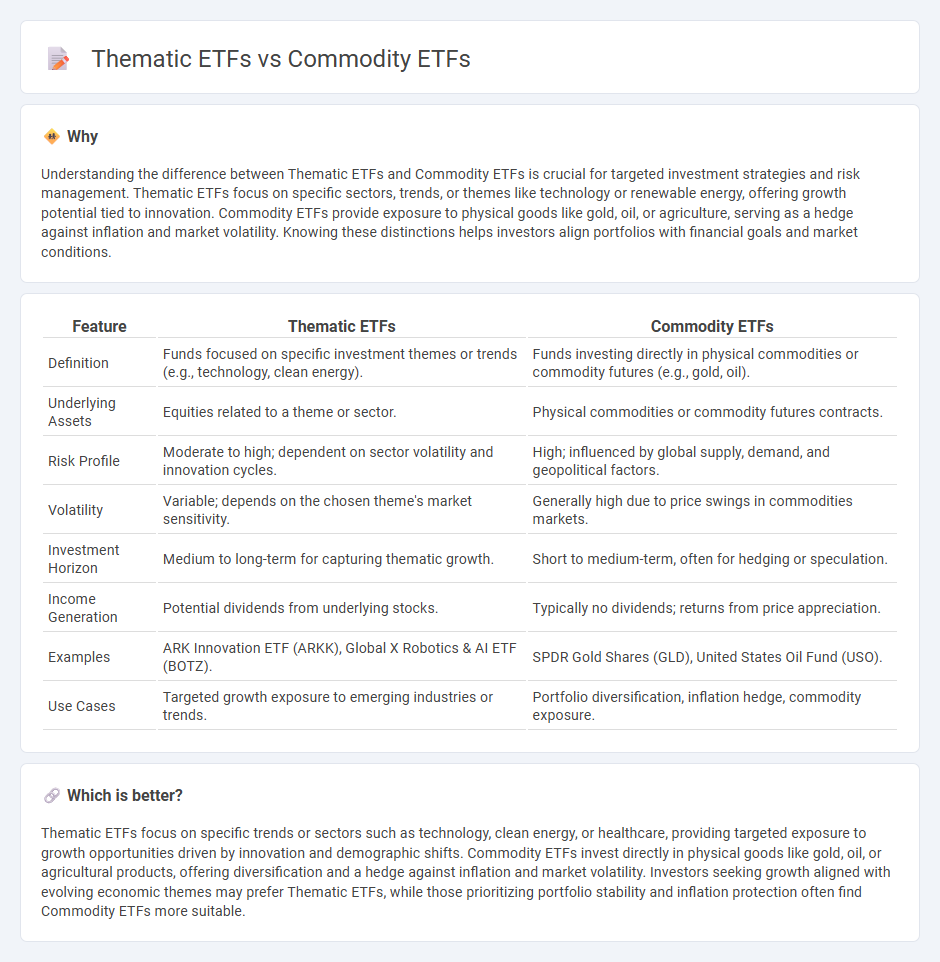

Understanding the difference between Thematic ETFs and Commodity ETFs is crucial for targeted investment strategies and risk management. Thematic ETFs focus on specific sectors, trends, or themes like technology or renewable energy, offering growth potential tied to innovation. Commodity ETFs provide exposure to physical goods like gold, oil, or agriculture, serving as a hedge against inflation and market volatility. Knowing these distinctions helps investors align portfolios with financial goals and market conditions.

Comparison Table

| Feature | Thematic ETFs | Commodity ETFs |

|---|---|---|

| Definition | Funds focused on specific investment themes or trends (e.g., technology, clean energy). | Funds investing directly in physical commodities or commodity futures (e.g., gold, oil). |

| Underlying Assets | Equities related to a theme or sector. | Physical commodities or commodity futures contracts. |

| Risk Profile | Moderate to high; dependent on sector volatility and innovation cycles. | High; influenced by global supply, demand, and geopolitical factors. |

| Volatility | Variable; depends on the chosen theme's market sensitivity. | Generally high due to price swings in commodities markets. |

| Investment Horizon | Medium to long-term for capturing thematic growth. | Short to medium-term, often for hedging or speculation. |

| Income Generation | Potential dividends from underlying stocks. | Typically no dividends; returns from price appreciation. |

| Examples | ARK Innovation ETF (ARKK), Global X Robotics & AI ETF (BOTZ). | SPDR Gold Shares (GLD), United States Oil Fund (USO). |

| Use Cases | Targeted growth exposure to emerging industries or trends. | Portfolio diversification, inflation hedge, commodity exposure. |

Which is better?

Thematic ETFs focus on specific trends or sectors such as technology, clean energy, or healthcare, providing targeted exposure to growth opportunities driven by innovation and demographic shifts. Commodity ETFs invest directly in physical goods like gold, oil, or agricultural products, offering diversification and a hedge against inflation and market volatility. Investors seeking growth aligned with evolving economic themes may prefer Thematic ETFs, while those prioritizing portfolio stability and inflation protection often find Commodity ETFs more suitable.

Connection

Thematic ETFs often include commodity ETFs within their portfolios to capitalize on sector-specific trends such as energy, agriculture, or precious metals markets. Commodity ETFs provide exposure to raw materials, aligning with thematic investing strategies focused on inflation hedging, sustainability, or global supply chain shifts. This integration enhances diversification and risk management in thematic investment approaches, leveraging both market fundamentals and macroeconomic factors.

Key Terms

Diversification

Commodity ETFs provide exposure to raw materials such as gold, oil, or agricultural products, allowing investors to diversify across physical assets that often have low correlation with stocks or bonds. Thematic ETFs target specific trends or sectors like clean energy, technology innovation, or demographic shifts, offering concentrated exposure to growth narratives but with higher sector-specific risk. Explore deeper insights into how these ETF types can balance diversification and risk in your investment portfolio.

Underlying assets

Commodity ETFs primarily invest in physical goods like gold, oil, or agricultural products, offering direct exposure to market price fluctuations. Thematic ETFs concentrate on specific trends or sectors such as clean energy, artificial intelligence, or healthcare innovation, relying on underlying equities that align with the theme. Explore detailed comparisons of asset structures and performance metrics to understand which ETF type fits your investment goals.

Sector exposure

Commodity ETFs provide direct exposure to physical assets like gold, oil, or agricultural products, making them ideal for investors seeking to hedge against inflation and diversify portfolios with tangible resources. Thematic ETFs concentrate on specific sectors or trends such as technology, clean energy, or healthcare, offering targeted investment opportunities aligned with evolving market dynamics. Explore the distinct benefits of commodity and thematic ETFs to tailor your investment strategy effectively.

Source and External Links

Commodity ETFs - Commodity ETFs (a type of exchange-traded product) provide exposure to raw materials like metals, agriculture, and energy either by holding physical commodities or futures contracts, offering investors diversification and access to these asset classes.

5 Best Commodity ETFs to Buy Now - Some commodity ETFs, such as Direxion Auspice Broad Commodity Strategy ETF, use dynamic futures-based strategies to invest across multiple commodity sectors and manage risk by adjusting exposure during market downtrends.

Commodity ETF List - Commodity ETFs vary in focus, some targeting single commodities while others provide broad exposure to baskets including metals, oil, grains, and livestock, with detailed information available on performance and holdings.

dowidth.com

dowidth.com