Altcoins staking involves locking up cryptocurrency tokens to support blockchain network operations and earn rewards, promoting network security and stability. Liquidity mining requires providing assets to decentralized finance (DeFi) protocols to facilitate trading and earn yield through transaction fees or token incentives. Explore deeper insights to understand which strategy aligns best with your investment goals.

Why it is important

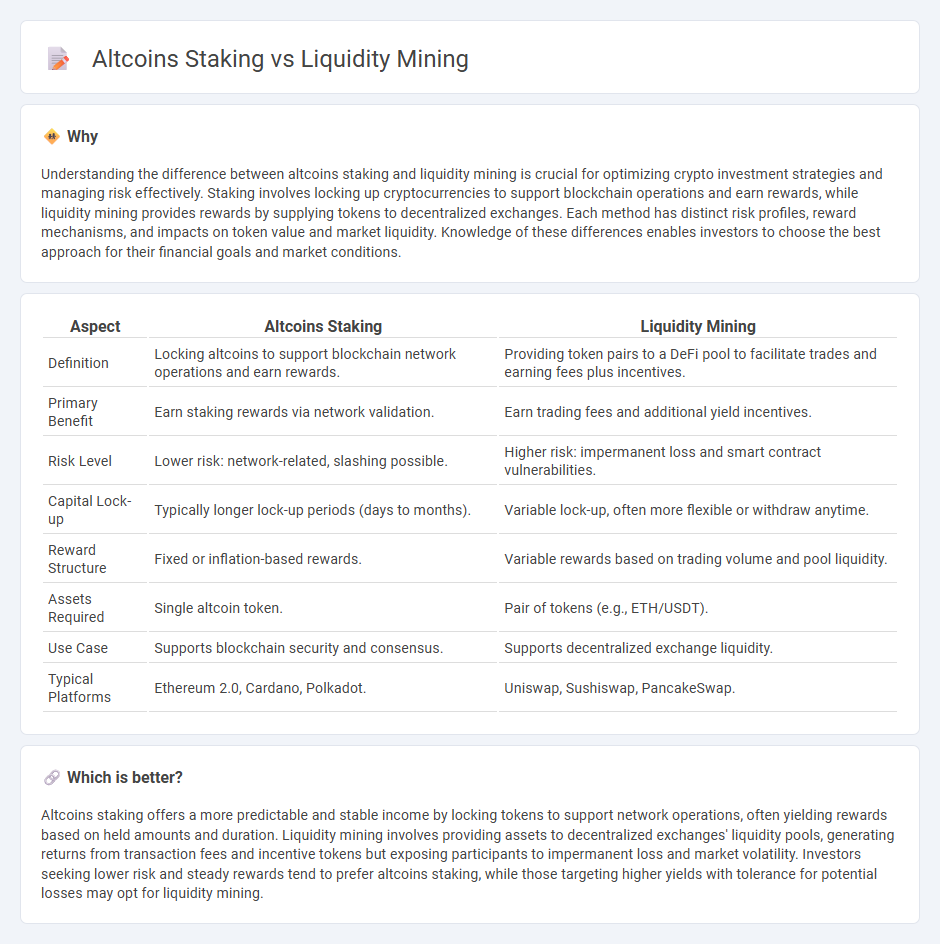

Understanding the difference between altcoins staking and liquidity mining is crucial for optimizing crypto investment strategies and managing risk effectively. Staking involves locking up cryptocurrencies to support blockchain operations and earn rewards, while liquidity mining provides rewards by supplying tokens to decentralized exchanges. Each method has distinct risk profiles, reward mechanisms, and impacts on token value and market liquidity. Knowledge of these differences enables investors to choose the best approach for their financial goals and market conditions.

Comparison Table

| Aspect | Altcoins Staking | Liquidity Mining |

|---|---|---|

| Definition | Locking altcoins to support blockchain network operations and earn rewards. | Providing token pairs to a DeFi pool to facilitate trades and earning fees plus incentives. |

| Primary Benefit | Earn staking rewards via network validation. | Earn trading fees and additional yield incentives. |

| Risk Level | Lower risk: network-related, slashing possible. | Higher risk: impermanent loss and smart contract vulnerabilities. |

| Capital Lock-up | Typically longer lock-up periods (days to months). | Variable lock-up, often more flexible or withdraw anytime. |

| Reward Structure | Fixed or inflation-based rewards. | Variable rewards based on trading volume and pool liquidity. |

| Assets Required | Single altcoin token. | Pair of tokens (e.g., ETH/USDT). |

| Use Case | Supports blockchain security and consensus. | Supports decentralized exchange liquidity. |

| Typical Platforms | Ethereum 2.0, Cardano, Polkadot. | Uniswap, Sushiswap, PancakeSwap. |

Which is better?

Altcoins staking offers a more predictable and stable income by locking tokens to support network operations, often yielding rewards based on held amounts and duration. Liquidity mining involves providing assets to decentralized exchanges' liquidity pools, generating returns from transaction fees and incentive tokens but exposing participants to impermanent loss and market volatility. Investors seeking lower risk and steady rewards tend to prefer altcoins staking, while those targeting higher yields with tolerance for potential losses may opt for liquidity mining.

Connection

Altcoins staking and liquidity mining both generate passive income by locking cryptocurrencies, but they serve different functions within decentralized finance (DeFi). Staking involves validating transactions on a blockchain to earn rewards, enhancing network security and decentralization, while liquidity mining incentivizes users to provide assets to decentralized exchanges, improving market liquidity and trading efficiency. Both strategies contribute to the growth and stability of altcoin ecosystems by encouraging user participation and asset utilization.

Key Terms

Yield

Liquidity mining offers higher yield potentials by providing rewards for supplying assets to decentralized finance (DeFi) protocols, often paid in governance tokens or platform fees. Altcoins staking generates yield through locking assets to support blockchain network operations, typically offering more predictable, fixed returns with lower risk. Explore detailed comparisons to understand which strategy maximizes your yield goals.

Lock-up period

Liquidity mining often requires users to lock up their crypto assets in decentralized finance (DeFi) protocols for a specific period, varying from days to several months, to provide liquidity and earn rewards. Altcoins staking typically involves locking tokens within a blockchain network to support operations and secure the network, with lock-up periods ranging widely depending on the coin, often from a few days to over a year. Explore detailed comparisons of lock-up durations and their impact on your crypto investment strategy for more insights.

Token rewards

Liquidity mining offers token rewards by providing users with incentives for supplying assets to decentralized finance (DeFi) pools, often yielding higher returns due to active trading fees and token incentives. Altcoins staking involves locking up coins to support network security and operations, earning rewards that typically depend on the staked amount and network inflation rates. Explore detailed comparisons and maximize your crypto earnings by understanding the nuances of liquidity mining and altcoins staking rewards.

Source and External Links

Staking vs Yield Farming vs Liquidity Mining - Liquidity mining is a DeFi mechanism where users supply liquidity to decentralized exchanges (DEXs) and earn rewards in the platform's native tokens alongside fees, effectively incentivizing liquidity provision and supporting decentralized trading without intermediaries.

Liquidity Mining - What It Means and How It Works? - Liquidity mining allows investors to earn cryptocurrency rewards by lending tokens to exchanges or DeFi applications to increase liquidity, often earning passive income and enhancing token tradability with minimal risk.

What is Yield Farming and Liquidity Mining in DeFi? - Liquidity mining specifically involves providing liquidity to DEX pools to earn trading fees and reward tokens, playing a crucial role in enabling smooth decentralized exchange operations and resembling the function of market makers in traditional finance.

dowidth.com

dowidth.com