Digital asset custody provides enhanced security by storing cryptocurrencies in offline, cold environments, reducing the risk of hacks compared to hot wallet storage which remains connected to the internet for frequent transactions. Institutions often prefer custody solutions to safeguard significant holdings with regulatory compliance and multi-signature authorization features. Explore more insights into selecting the ideal storage method for your digital assets.

Why it is important

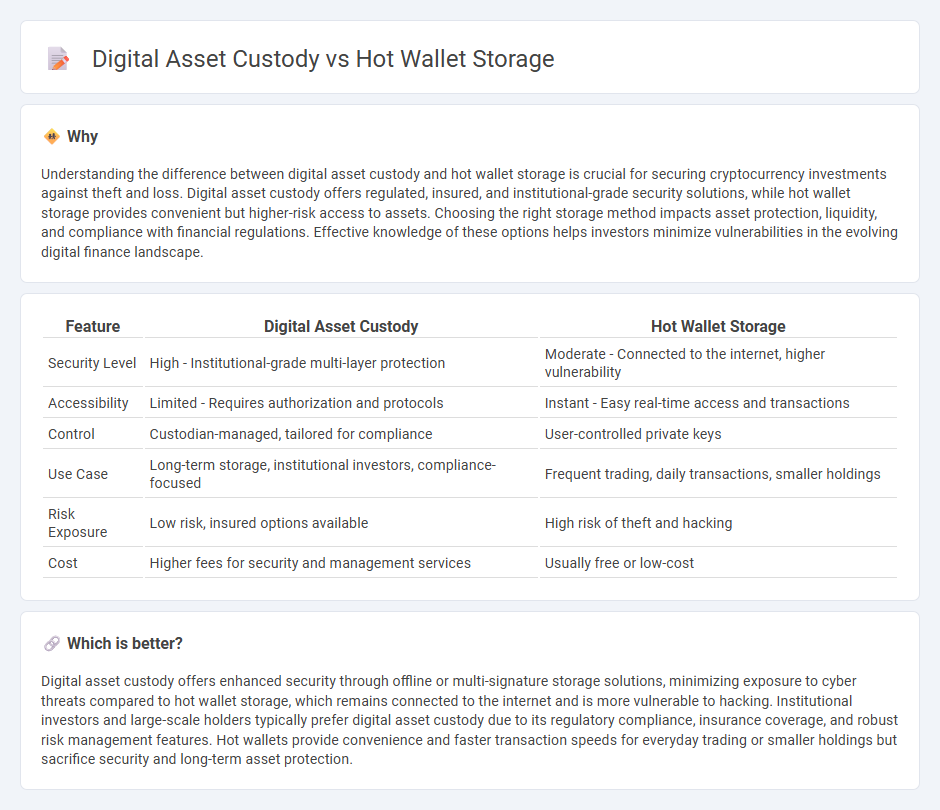

Understanding the difference between digital asset custody and hot wallet storage is crucial for securing cryptocurrency investments against theft and loss. Digital asset custody offers regulated, insured, and institutional-grade security solutions, while hot wallet storage provides convenient but higher-risk access to assets. Choosing the right storage method impacts asset protection, liquidity, and compliance with financial regulations. Effective knowledge of these options helps investors minimize vulnerabilities in the evolving digital finance landscape.

Comparison Table

| Feature | Digital Asset Custody | Hot Wallet Storage |

|---|---|---|

| Security Level | High - Institutional-grade multi-layer protection | Moderate - Connected to the internet, higher vulnerability |

| Accessibility | Limited - Requires authorization and protocols | Instant - Easy real-time access and transactions |

| Control | Custodian-managed, tailored for compliance | User-controlled private keys |

| Use Case | Long-term storage, institutional investors, compliance-focused | Frequent trading, daily transactions, smaller holdings |

| Risk Exposure | Low risk, insured options available | High risk of theft and hacking |

| Cost | Higher fees for security and management services | Usually free or low-cost |

Which is better?

Digital asset custody offers enhanced security through offline or multi-signature storage solutions, minimizing exposure to cyber threats compared to hot wallet storage, which remains connected to the internet and is more vulnerable to hacking. Institutional investors and large-scale holders typically prefer digital asset custody due to its regulatory compliance, insurance coverage, and robust risk management features. Hot wallets provide convenience and faster transaction speeds for everyday trading or smaller holdings but sacrifice security and long-term asset protection.

Connection

Digital asset custody involves securely storing cryptocurrencies and private keys, often utilizing hot wallet storage for immediate transaction access. Hot wallets, connected to the internet, enable quick asset transfers but require robust security measures to protect against cyber threats. Effective digital asset custody strategies balance the convenience of hot wallets with risk management to safeguard digital funds.

Key Terms

Private Key

Hot wallet storage involves keeping private keys online, allowing quick access but increasing vulnerability to cyber attacks and unauthorized access. Digital asset custody solutions emphasize secure management of private keys through hardware wallets or multi-signature protocols, minimizing risks by storing keys offline or in encrypted environments. Explore more to understand which approach best safeguards your digital assets and private keys.

Custodian

Hot wallet storage offers immediate access to digital assets through internet-connected devices, prioritizing convenience but exposing users to higher cybersecurity risks. Custodian services provide secure digital asset custody by utilizing cold storage and multi-signature authentication to protect assets from theft and unauthorized access. Explore how custodians enhance security and regulatory compliance in digital asset management.

Security Protocols

Hot wallet storage offers ease of access by maintaining private keys online but is more susceptible to hacking and phishing attacks due to constant connectivity. Digital asset custody employs advanced security protocols such as multisig authentication, cold storage integration, and insurance coverage to protect assets against unauthorized access and cyber threats. Explore the latest security measures in digital asset custody for enhanced protection and peace of mind.

Source and External Links

Hot vs cold crypto wallet: What's the difference? - Coinbase - Hot wallets are software wallets connected to the internet, generating and storing private keys online for convenient, frequent transactions, but with higher security risks compared to offline cold wallets, which store keys offline for better security and long-term storage.

What is a hot wallet? Convenient storage for cryptocurrency - A hot wallet is an internet-connected crypto wallet that enables quick sending, receiving, and management of assets, often accessible via mobile, desktop, or web apps, but it carries higher vulnerability due to its online connectivity.

Crypto Hot Wallet vs. Cold Wallet: The Biggest Differences - Hot wallets are free, internet-connected wallets ideal for frequent trading with moderate security risk, while cold wallets are physical devices for offline storage providing maximum security but less convenience for daily use.

dowidth.com

dowidth.com