Robo advisory leverages advanced algorithms to provide automated, low-cost investment management, delivering personalized portfolios with minimal human intervention. Hybrid advisory combines the efficiency of robo advisors with expert financial planners, offering tailored advice alongside automated asset management. Explore the benefits and differences of these advisory models to find the ideal strategy for your financial goals.

Why it is important

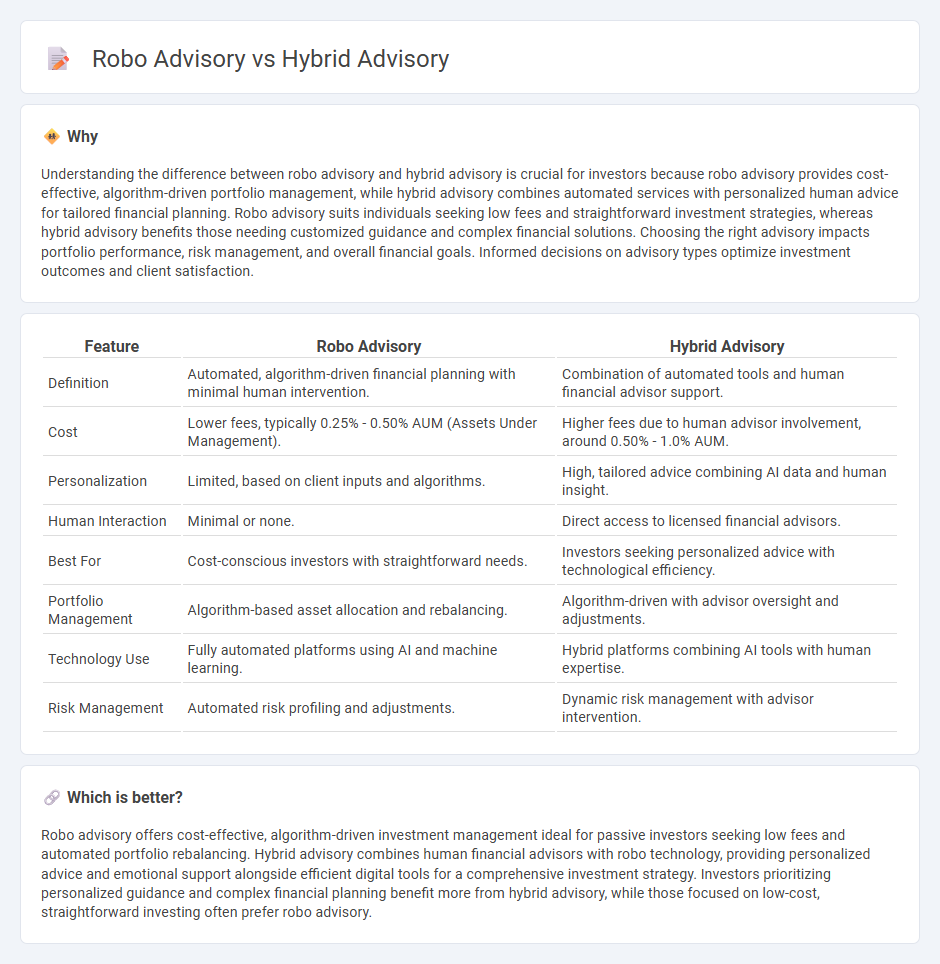

Understanding the difference between robo advisory and hybrid advisory is crucial for investors because robo advisory provides cost-effective, algorithm-driven portfolio management, while hybrid advisory combines automated services with personalized human advice for tailored financial planning. Robo advisory suits individuals seeking low fees and straightforward investment strategies, whereas hybrid advisory benefits those needing customized guidance and complex financial solutions. Choosing the right advisory impacts portfolio performance, risk management, and overall financial goals. Informed decisions on advisory types optimize investment outcomes and client satisfaction.

Comparison Table

| Feature | Robo Advisory | Hybrid Advisory |

|---|---|---|

| Definition | Automated, algorithm-driven financial planning with minimal human intervention. | Combination of automated tools and human financial advisor support. |

| Cost | Lower fees, typically 0.25% - 0.50% AUM (Assets Under Management). | Higher fees due to human advisor involvement, around 0.50% - 1.0% AUM. |

| Personalization | Limited, based on client inputs and algorithms. | High, tailored advice combining AI data and human insight. |

| Human Interaction | Minimal or none. | Direct access to licensed financial advisors. |

| Best For | Cost-conscious investors with straightforward needs. | Investors seeking personalized advice with technological efficiency. |

| Portfolio Management | Algorithm-based asset allocation and rebalancing. | Algorithm-driven with advisor oversight and adjustments. |

| Technology Use | Fully automated platforms using AI and machine learning. | Hybrid platforms combining AI tools with human expertise. |

| Risk Management | Automated risk profiling and adjustments. | Dynamic risk management with advisor intervention. |

Which is better?

Robo advisory offers cost-effective, algorithm-driven investment management ideal for passive investors seeking low fees and automated portfolio rebalancing. Hybrid advisory combines human financial advisors with robo technology, providing personalized advice and emotional support alongside efficient digital tools for a comprehensive investment strategy. Investors prioritizing personalized guidance and complex financial planning benefit more from hybrid advisory, while those focused on low-cost, straightforward investing often prefer robo advisory.

Connection

Robo advisory leverages algorithm-driven financial planning services that provide automated, low-cost portfolio management. Hybrid advisory combines robo advisory technology with human financial advisors, enhancing personalized investment strategies and client support. Together, they integrate automation with expert guidance to optimize wealth management and improve client outcomes.

Key Terms

Human Involvement

Hybrid advisory combines automated investment algorithms with personalized human financial advice, enhancing decision-making through expert insight. Robo advisory relies solely on technology-driven models to provide cost-efficient, automated portfolio management without direct human interaction. Explore the benefits and differences of hybrid versus robo advisory services to determine which approach suits your financial needs best.

Algorithm-Driven

Hybrid advisory combines personalized human financial advice with algorithm-driven portfolio management, offering a tailored investment experience supported by data analytics and machine learning. Robo advisory relies exclusively on automated algorithms to create and manage investment portfolios, ensuring efficiency, low costs, and round-the-clock service. Discover the advantages and applications of algorithm-driven advisory models to enhance your investment strategy.

Personalization

Hybrid advisory combines automated financial algorithms with personalized human guidance, offering tailored investment strategies that adapt to individual risk tolerance and financial goals. Robo advisory relies solely on algorithms, providing cost-effective, standardized portfolio management with limited client customization. Discover how personalized financial planning through hybrid advisory can better meet your unique needs.

Source and External Links

What is a Hybrid RIA? - Perennial Financial Services - A Hybrid Advisor is dually registered as both a Registered Investment Advisor (RIA) and a Broker/Dealer, allowing them to offer both fee-based fiduciary advice and commission-based services under a single firm's control, giving clients integrated financial management and flexible product options tailored to their needs.

How hybrid advisory models are transforming the industry (PDF) - Hybrid advisory models combine automated robo-advisor technology with human financial advice delivered digitally, blending cost efficiency and personalization, with major players like Vanguard offering such services targeting specific client segments.

What is a hybrid RIA? - Transition To RIA - Hybrid RIA advisors operate under both a broker/dealer registration (usually via Series 7) and an RIA registration, handling commission and fee-based accounts simultaneously, often within the structure of wirehouse or independent broker-dealer firms that maintain separate corporate RIA and broker/dealer entities.

dowidth.com

dowidth.com