Tokenized treasury bills offer enhanced liquidity and faster settlement compared to traditional municipal bonds, leveraging blockchain technology for secure, transparent transactions. Municipal bonds provide stable, tax-exempt income streams backed by government entities, appealing to risk-averse investors seeking predictable returns. Explore the advantages and risks of both options to determine the best fit for your investment portfolio.

Why it is important

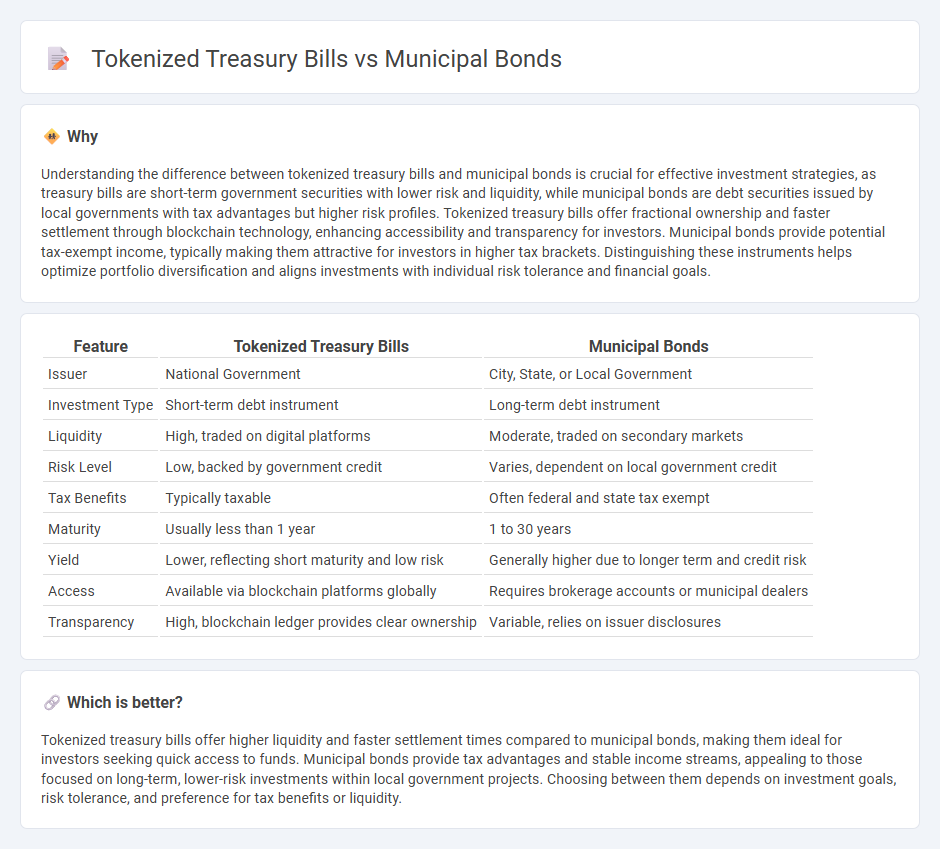

Understanding the difference between tokenized treasury bills and municipal bonds is crucial for effective investment strategies, as treasury bills are short-term government securities with lower risk and liquidity, while municipal bonds are debt securities issued by local governments with tax advantages but higher risk profiles. Tokenized treasury bills offer fractional ownership and faster settlement through blockchain technology, enhancing accessibility and transparency for investors. Municipal bonds provide potential tax-exempt income, typically making them attractive for investors in higher tax brackets. Distinguishing these instruments helps optimize portfolio diversification and aligns investments with individual risk tolerance and financial goals.

Comparison Table

| Feature | Tokenized Treasury Bills | Municipal Bonds |

|---|---|---|

| Issuer | National Government | City, State, or Local Government |

| Investment Type | Short-term debt instrument | Long-term debt instrument |

| Liquidity | High, traded on digital platforms | Moderate, traded on secondary markets |

| Risk Level | Low, backed by government credit | Varies, dependent on local government credit |

| Tax Benefits | Typically taxable | Often federal and state tax exempt |

| Maturity | Usually less than 1 year | 1 to 30 years |

| Yield | Lower, reflecting short maturity and low risk | Generally higher due to longer term and credit risk |

| Access | Available via blockchain platforms globally | Requires brokerage accounts or municipal dealers |

| Transparency | High, blockchain ledger provides clear ownership | Variable, relies on issuer disclosures |

Which is better?

Tokenized treasury bills offer higher liquidity and faster settlement times compared to municipal bonds, making them ideal for investors seeking quick access to funds. Municipal bonds provide tax advantages and stable income streams, appealing to those focused on long-term, lower-risk investments within local government projects. Choosing between them depends on investment goals, risk tolerance, and preference for tax benefits or liquidity.

Connection

Tokenized treasury bills and municipal bonds represent digital assets that leverage blockchain technology to increase liquidity and accessibility in traditional finance. Both instruments use tokenization to fractionalize ownership, enabling smaller investments and faster settlement times compared to conventional markets. This connection enhances transparency, reduces intermediaries, and broadens market participation for government debt securities.

Key Terms

Yield

Municipal bonds typically offer tax-exempt interest income, resulting in lower nominal yields compared to tokenized treasury bills, which provide higher yield potential due to their digital nature and shorter maturity periods. Tokenized treasury bills leverage blockchain technology to enhance liquidity and transparency, often attracting investors seeking quicker returns and streamlined trading. Explore our detailed analysis to understand which investment aligns best with your yield expectations.

Liquidity

Municipal bonds typically offer lower liquidity due to limited secondary markets and longer settlement periods, whereas tokenized treasury bills leverage blockchain technology for faster transactions and 24/7 trading, significantly enhancing liquidity. Tokenization enables fractional ownership and streamlined access for a broader pool of investors, reducing entry barriers compared to traditional municipal bonds. Explore the evolving landscape of tokenized assets to understand their impact on liquidity and investment strategies.

Regulation

Municipal bonds are regulated by the Securities and Exchange Commission (SEC) and subject to state and local government oversight, ensuring investor protections under established financial laws. Tokenized treasury bills operate within the digital asset regulatory framework, often navigating complex jurisdictions with emerging guidelines from bodies like the SEC and the Commodity Futures Trading Commission (CFTC). Explore the evolving regulatory landscape shaping these innovative investment instruments for a clearer perspective.

Source and External Links

Municipal bond - Wikipedia - Municipal bonds are debt securities issued by states, cities, or entities they create, generally categorized as general obligation bonds backed by taxing power or revenue bonds backed by specific income streams such as utilities or tolls.

Municipal Bonds - Fidelity Investments - Municipal bonds, or munis, are issued by public entities to fund projects, falling mainly into general obligation bonds secured by taxes or revenue bonds backed by project income, with differing tax treatments and risk profiles.

Municipal Bonds | Investor.gov - Municipal bonds fund government obligations and projects, with investor information and disclosures accessible via the EMMA website, managed by the MSRB under SEC oversight for market transparency.

dowidth.com

dowidth.com