Tokenized treasury bills transform traditional government debt into digital assets, enabling faster, more transparent trading with lower entry barriers. Treasury Inflation-Protected Securities (TIPS) offer investors inflation-adjusted returns to preserve purchasing power during fluctuating economic conditions. Explore the comparative benefits and risks of these financial instruments to enhance your investment strategy.

Why it is important

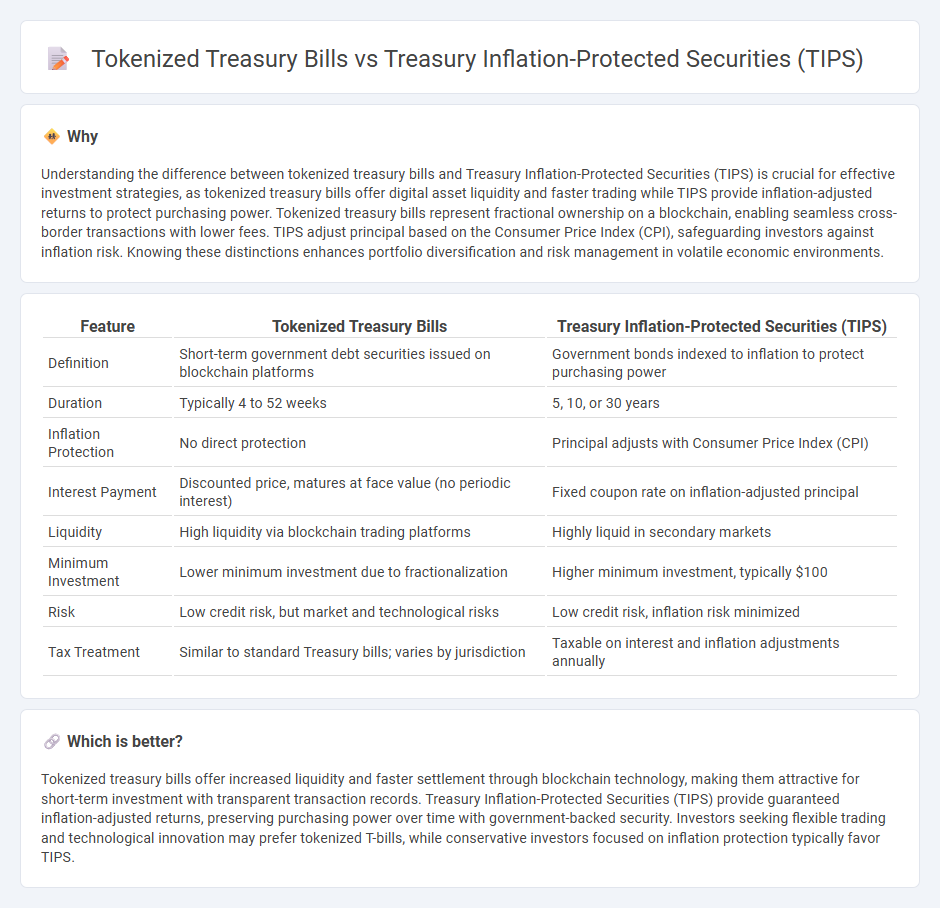

Understanding the difference between tokenized treasury bills and Treasury Inflation-Protected Securities (TIPS) is crucial for effective investment strategies, as tokenized treasury bills offer digital asset liquidity and faster trading while TIPS provide inflation-adjusted returns to protect purchasing power. Tokenized treasury bills represent fractional ownership on a blockchain, enabling seamless cross-border transactions with lower fees. TIPS adjust principal based on the Consumer Price Index (CPI), safeguarding investors against inflation risk. Knowing these distinctions enhances portfolio diversification and risk management in volatile economic environments.

Comparison Table

| Feature | Tokenized Treasury Bills | Treasury Inflation-Protected Securities (TIPS) |

|---|---|---|

| Definition | Short-term government debt securities issued on blockchain platforms | Government bonds indexed to inflation to protect purchasing power |

| Duration | Typically 4 to 52 weeks | 5, 10, or 30 years |

| Inflation Protection | No direct protection | Principal adjusts with Consumer Price Index (CPI) |

| Interest Payment | Discounted price, matures at face value (no periodic interest) | Fixed coupon rate on inflation-adjusted principal |

| Liquidity | High liquidity via blockchain trading platforms | Highly liquid in secondary markets |

| Minimum Investment | Lower minimum investment due to fractionalization | Higher minimum investment, typically $100 |

| Risk | Low credit risk, but market and technological risks | Low credit risk, inflation risk minimized |

| Tax Treatment | Similar to standard Treasury bills; varies by jurisdiction | Taxable on interest and inflation adjustments annually |

Which is better?

Tokenized treasury bills offer increased liquidity and faster settlement through blockchain technology, making them attractive for short-term investment with transparent transaction records. Treasury Inflation-Protected Securities (TIPS) provide guaranteed inflation-adjusted returns, preserving purchasing power over time with government-backed security. Investors seeking flexible trading and technological innovation may prefer tokenized T-bills, while conservative investors focused on inflation protection typically favor TIPS.

Connection

Tokenized treasury bills represent a digital form of government debt securities, enabling fractional ownership and enhanced liquidity through blockchain technology. Treasury Inflation-Protected Securities (TIPS) are government bonds indexed to inflation, ensuring real return protection by adjusting principal based on the Consumer Price Index (CPI). The connection lies in their role as secure investment vehicles issued by governments, with tokenization modernizing their distribution and trading, while TIPS specifically shield investors from inflation risk.

Key Terms

Inflation Protection

Treasury Inflation-Protected Securities (TIPS) offer direct inflation protection by adjusting principal based on the Consumer Price Index, ensuring real return preservation during inflationary periods. Tokenized treasury bills provide improved liquidity and fractional ownership but lack intrinsic inflation adjustment mechanisms, making them less effective as inflation hedges. Explore detailed comparisons to understand how each instrument manages inflation risk and fits your investment strategy.

Tokenization

Tokenized Treasury bills use blockchain technology to digitize and fractionalize traditional government debt, enhancing liquidity and accessibility for a broader range of investors compared to Treasury Inflation-Protected Securities (TIPS), which offer inflation-adjusted returns backed by the U.S. government. This tokenization process enables faster settlement, reduced transaction costs, and increased transparency through immutable ledgers, contrasting with the conventional mechanisms governing TIPS. Explore the evolving landscape of tokenized government securities to understand how digital innovation is transforming investment opportunities.

Yield

Treasury Inflation-Protected Securities (TIPS) offer yields adjusted for inflation, providing investors protection against purchasing power erosion, with returns linked to the Consumer Price Index (CPI). Tokenized treasury bills, meanwhile, represent digital ownership of short-term government debt, often providing fixed yields that can vary slightly based on blockchain platform efficiencies and market demand. Explore deeper insights into the yield dynamics and risk profiles of TIPS versus tokenized treasury bills to optimize your investment strategy.

Source and External Links

What are TIPS? - Treasury Inflation-Protected Securities (TIPS) are U.S. Treasury bonds indexed to inflation, adjusting principal based on the Consumer Price Index to protect investors' purchasing power, with fixed coupon rates paid on adjusted principals and principal repayment at maturity guaranteed to be at least the original amount invested.

Treasury Inflation-Protected Securities (TIPS) - TreasuryDirect - TIPS are marketable securities issued for 5, 10, or 30 years with principal adjusted up or down according to inflation, paying a fixed interest rate semiannually on the adjusted principal, ensuring protection against inflation and federal tax due annually on interest and principal adjustments.

Understanding Treasury Inflation-Protected Securities (TIPS) - TIPS are bonds issued by the U.S. Treasury with principal linked to the Consumer Price Index, paying interest on the inflation-adjusted principal, providing a real rate of return by protecting investors from inflation erosion compared to traditional nominal bonds.

dowidth.com

dowidth.com