Tokenized treasury bills represent government debt securities digitized on blockchain, offering enhanced liquidity and transparency compared to traditional paper-based bills. Asset-backed securities (ABS) are financial instruments secured by a pool of underlying assets such as loans or receivables, providing diversified risk exposure to investors. Explore the distinct advantages and mechanisms of tokenized treasury bills versus asset-backed securities to deepen your understanding of modern investment options.

Why it is important

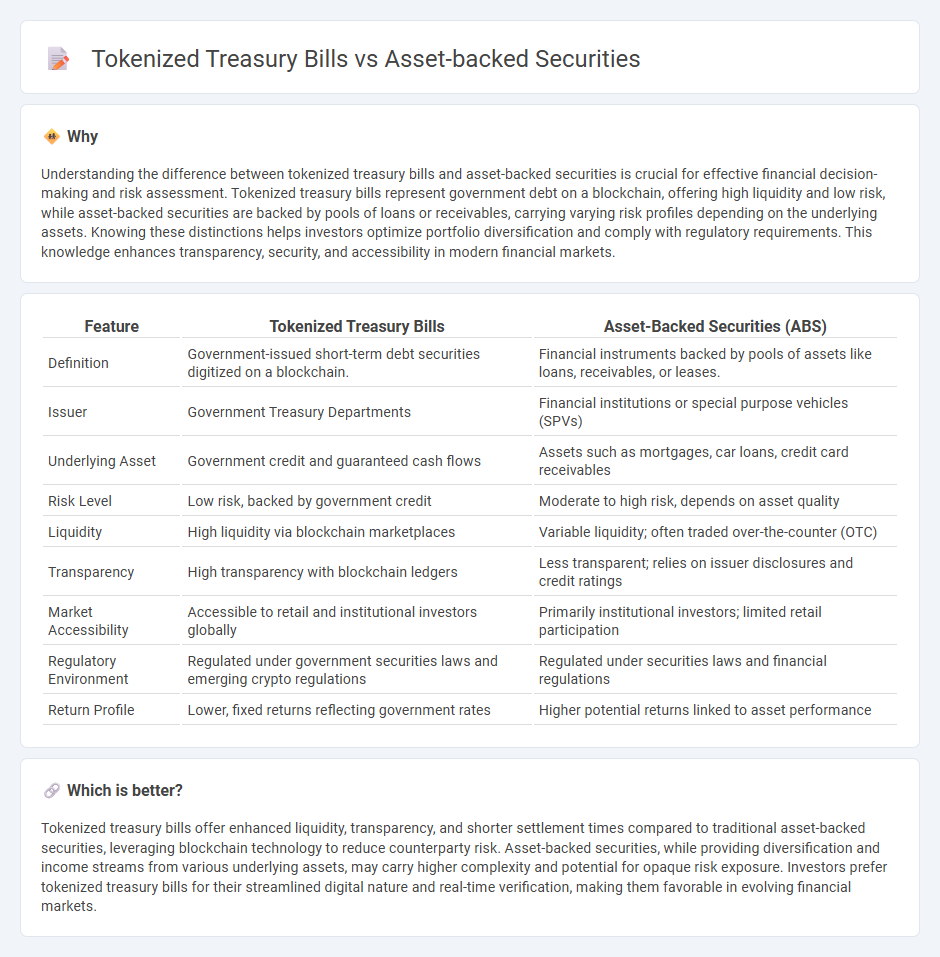

Understanding the difference between tokenized treasury bills and asset-backed securities is crucial for effective financial decision-making and risk assessment. Tokenized treasury bills represent government debt on a blockchain, offering high liquidity and low risk, while asset-backed securities are backed by pools of loans or receivables, carrying varying risk profiles depending on the underlying assets. Knowing these distinctions helps investors optimize portfolio diversification and comply with regulatory requirements. This knowledge enhances transparency, security, and accessibility in modern financial markets.

Comparison Table

| Feature | Tokenized Treasury Bills | Asset-Backed Securities (ABS) |

|---|---|---|

| Definition | Government-issued short-term debt securities digitized on a blockchain. | Financial instruments backed by pools of assets like loans, receivables, or leases. |

| Issuer | Government Treasury Departments | Financial institutions or special purpose vehicles (SPVs) |

| Underlying Asset | Government credit and guaranteed cash flows | Assets such as mortgages, car loans, credit card receivables |

| Risk Level | Low risk, backed by government credit | Moderate to high risk, depends on asset quality |

| Liquidity | High liquidity via blockchain marketplaces | Variable liquidity; often traded over-the-counter (OTC) |

| Transparency | High transparency with blockchain ledgers | Less transparent; relies on issuer disclosures and credit ratings |

| Market Accessibility | Accessible to retail and institutional investors globally | Primarily institutional investors; limited retail participation |

| Regulatory Environment | Regulated under government securities laws and emerging crypto regulations | Regulated under securities laws and financial regulations |

| Return Profile | Lower, fixed returns reflecting government rates | Higher potential returns linked to asset performance |

Which is better?

Tokenized treasury bills offer enhanced liquidity, transparency, and shorter settlement times compared to traditional asset-backed securities, leveraging blockchain technology to reduce counterparty risk. Asset-backed securities, while providing diversification and income streams from various underlying assets, may carry higher complexity and potential for opaque risk exposure. Investors prefer tokenized treasury bills for their streamlined digital nature and real-time verification, making them favorable in evolving financial markets.

Connection

Tokenized treasury bills and asset-backed securities are connected through their shared use of blockchain technology to enhance liquidity and transparency in financial markets. Tokenized treasury bills represent government debt in digital form, enabling fractional ownership and easier transferability, while asset-backed securities pool financial assets and issue tokenized shares that provide investors with securitized claims on underlying assets. Both instruments leverage smart contracts to automate settlements and reduce intermediaries, driving efficiency and accessibility in asset trading.

Key Terms

Securitization

Asset-backed securities (ABS) are financial instruments backed by a pool of underlying assets such as loans, leases, or receivables, creating liquidity through traditional securitization processes involving intermediaries and regulatory oversight. Tokenized treasury bills represent government debt simulated on blockchain platforms, enabling direct ownership through digital tokens, reducing intermediaries, and increasing transparency and efficiency in securitization. Explore the evolving landscape of securitization technology and finance for a deeper understanding of these innovations.

Blockchain

Asset-backed securities (ABS) represent financial instruments backed by pools of assets such as loans, leases, or receivables, traditionally managed through centralized financial institutions. Tokenized treasury bills leverage blockchain technology to create digital representations of government debt, offering enhanced transparency, real-time settlement, and increased accessibility for investors. Explore the transformative impact of blockchain on asset-backed securities and tokenized treasury bills to understand future financial markets.

Liquidity

Asset-backed securities (ABS) provide liquidity through traditional financial markets, often requiring intermediaries and longer settlement times, while tokenized treasury bills leverage blockchain technology for near-instantaneous trading and 24/7 market access. Tokenized treasury bills reduce counterparty risk and improve transparency, making them more attractive for investors seeking seamless liquidity. Explore our detailed comparison to understand how these innovations reshape market dynamics and liquidity.

Source and External Links

Asset-backed securities: Definition, types and examples - StoneX - Asset-backed securities (ABS) are finance pools of assets like auto loans, aircraft leases, credit card receivables, mortgages, and business loans, which represent contractual obligations to pay returns to investors, created through securitization to convert illiquid assets into liquid securities.

The ABCs of Asset-Backed Securities | Guggenheim Investments - ABS finance pools of familiar asset types and include investor-friendly features such as tranching of risk and overcollateralization, with investors focusing on analyzing cash flows rather than solely relying on ratings or market prices.

Asset-backed security - Wikipedia - ABS are securities backed by a pool of financial assets that may otherwise be illiquid, allowing originators to reduce risk and free up capital while investors gain exposure to different risk/return profiles through tranching.

dowidth.com

dowidth.com