Revenue-based financing offers businesses capital by allowing investors to receive a percentage of ongoing gross revenues until a predetermined amount is repaid, providing flexible repayment tied directly to income. Crowdfunding, on the other hand, raises funds through small contributions from a large number of people, often in exchange for rewards or equity, making it ideal for startups and creative projects. Explore the differences between these funding methods to determine which best suits your financial strategy.

Why it is important

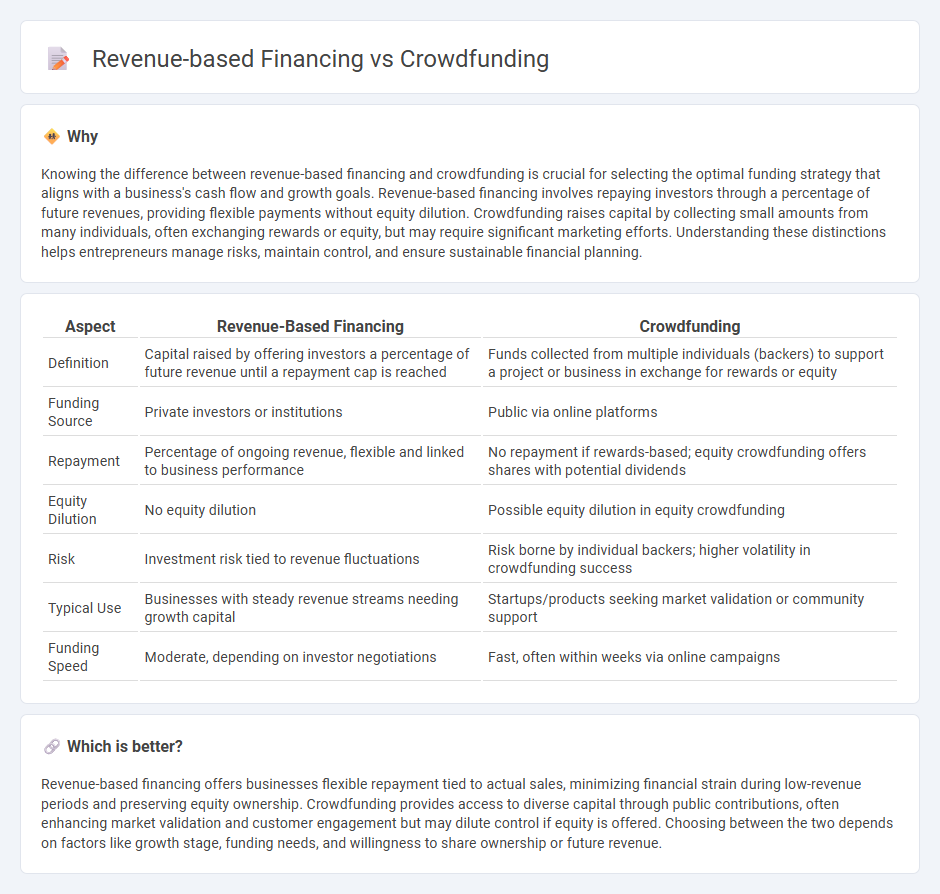

Knowing the difference between revenue-based financing and crowdfunding is crucial for selecting the optimal funding strategy that aligns with a business's cash flow and growth goals. Revenue-based financing involves repaying investors through a percentage of future revenues, providing flexible payments without equity dilution. Crowdfunding raises capital by collecting small amounts from many individuals, often exchanging rewards or equity, but may require significant marketing efforts. Understanding these distinctions helps entrepreneurs manage risks, maintain control, and ensure sustainable financial planning.

Comparison Table

| Aspect | Revenue-Based Financing | Crowdfunding |

|---|---|---|

| Definition | Capital raised by offering investors a percentage of future revenue until a repayment cap is reached | Funds collected from multiple individuals (backers) to support a project or business in exchange for rewards or equity |

| Funding Source | Private investors or institutions | Public via online platforms |

| Repayment | Percentage of ongoing revenue, flexible and linked to business performance | No repayment if rewards-based; equity crowdfunding offers shares with potential dividends |

| Equity Dilution | No equity dilution | Possible equity dilution in equity crowdfunding |

| Risk | Investment risk tied to revenue fluctuations | Risk borne by individual backers; higher volatility in crowdfunding success |

| Typical Use | Businesses with steady revenue streams needing growth capital | Startups/products seeking market validation or community support |

| Funding Speed | Moderate, depending on investor negotiations | Fast, often within weeks via online campaigns |

Which is better?

Revenue-based financing offers businesses flexible repayment tied to actual sales, minimizing financial strain during low-revenue periods and preserving equity ownership. Crowdfunding provides access to diverse capital through public contributions, often enhancing market validation and customer engagement but may dilute control if equity is offered. Choosing between the two depends on factors like growth stage, funding needs, and willingness to share ownership or future revenue.

Connection

Revenue-based financing and crowdfunding both provide alternative capital sources by leveraging future revenue streams and community investment, respectively. Revenue-based financing repays investors through a percentage of ongoing revenue, aligning payment with business performance, while crowdfunding pools funds from a large group of backers typically in exchange for rewards or equity. Both models enable startups and small businesses to access flexible funding without traditional loan obligations or equity dilution.

Key Terms

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, and it involves three main actors: the project initiator, supporters, and a moderating platform.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding is a method for startups and projects to raise capital through collective efforts of individuals, often online, which contrasts with traditional funding from select investors or institutions.

Crowdfunding explained - European Commission - Crowdfunding involves raising money via online platforms from many people, often used by startups and SMEs to access alternative funding and gather market insights and community support.

dowidth.com

dowidth.com