Buy Now Pay Later (BNPL) offers consumers short-term installment plans with minimal interest, enhancing purchasing power while managing cash flow. Store financing typically involves longer-term credit options directly through retailers, often with promotional rates and the convenience of in-store approval. Explore the differences and benefits of BNPL versus store financing to make informed financial decisions.

Why it is important

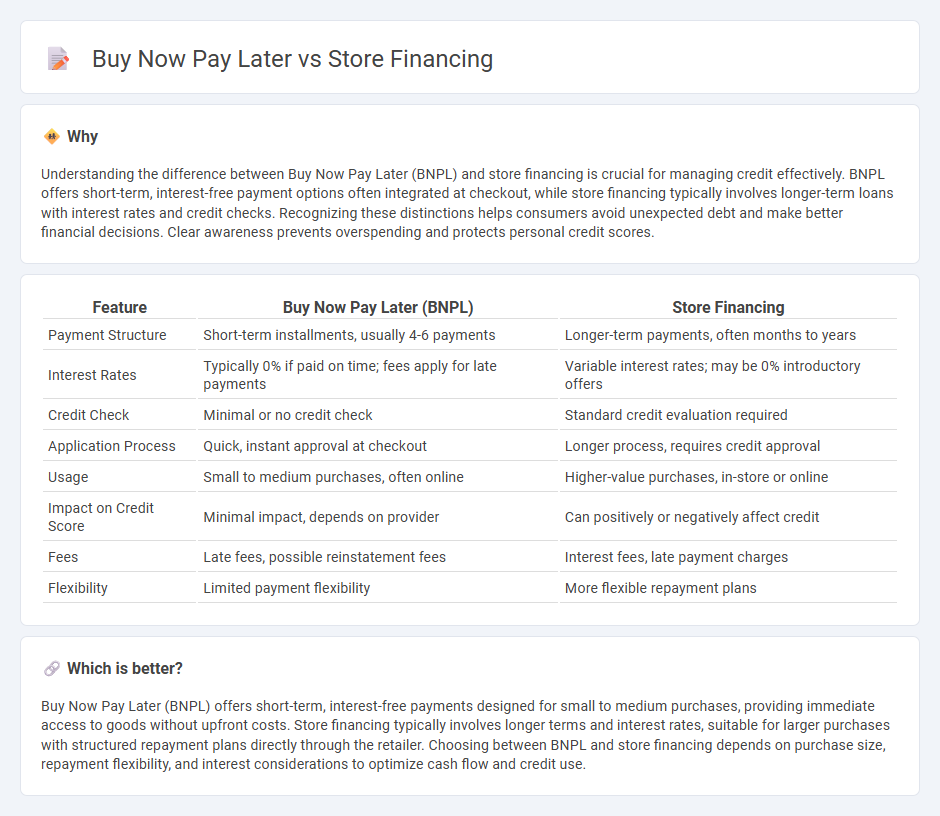

Understanding the difference between Buy Now Pay Later (BNPL) and store financing is crucial for managing credit effectively. BNPL offers short-term, interest-free payment options often integrated at checkout, while store financing typically involves longer-term loans with interest rates and credit checks. Recognizing these distinctions helps consumers avoid unexpected debt and make better financial decisions. Clear awareness prevents overspending and protects personal credit scores.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) | Store Financing |

|---|---|---|

| Payment Structure | Short-term installments, usually 4-6 payments | Longer-term payments, often months to years |

| Interest Rates | Typically 0% if paid on time; fees apply for late payments | Variable interest rates; may be 0% introductory offers |

| Credit Check | Minimal or no credit check | Standard credit evaluation required |

| Application Process | Quick, instant approval at checkout | Longer process, requires credit approval |

| Usage | Small to medium purchases, often online | Higher-value purchases, in-store or online |

| Impact on Credit Score | Minimal impact, depends on provider | Can positively or negatively affect credit |

| Fees | Late fees, possible reinstatement fees | Interest fees, late payment charges |

| Flexibility | Limited payment flexibility | More flexible repayment plans |

Which is better?

Buy Now Pay Later (BNPL) offers short-term, interest-free payments designed for small to medium purchases, providing immediate access to goods without upfront costs. Store financing typically involves longer terms and interest rates, suitable for larger purchases with structured repayment plans directly through the retailer. Choosing between BNPL and store financing depends on purchase size, repayment flexibility, and interest considerations to optimize cash flow and credit use.

Connection

Buy Now Pay Later (BNPL) and store financing both offer consumers flexible payment options by allowing purchases to be paid over time instead of upfront. BNPL typically involves short-term, interest-free installments facilitated by third-party platforms, whereas store financing often provides longer-term credit with interest rates managed directly through the retailer. Both methods enhance purchasing power and improve cash flow management, driving increased sales and customer retention for businesses.

Key Terms

Interest Rate

Store financing typically offers lower interest rates compared to buy now pay later (BNPL) options, which often come with higher or deferred interest if payments are missed. BNPL services provide short-term credit with fixed payment schedules but can result in expensive fees and increased rates if not paid on time. Explore how interest rates impact your repayment plans and discover the best choice for your financial needs.

Credit Approval

Store financing often requires a thorough credit approval process involving credit checks, income verification, and sometimes collateral assessment, ensuring borrowers meet specific lending criteria. Buy Now Pay Later (BNPL) services typically perform a lighter credit check or none at all, enabling quicker approval but with lower credit limits. Explore detailed comparisons of approval processes to determine which option best fits your financial needs.

Repayment Terms

Store financing typically offers longer repayment terms ranging from 6 to 36 months with fixed or variable interest rates, making it suitable for larger purchases. Buy now, pay later (BNPL) services often provide shorter, interest-free repayment plans divided into 4 to 6 installments over weeks or months. Explore the advantages and fine print details to choose the best repayment option for your financial needs.

Source and External Links

Snap Finance - Perfect Credit Not Required - Snap Finance offers lease-to-own financing and installment loans for store purchases, approved quickly without impacting your credit score, including flexible payment plans like a 100-day option to save on lease costs.

Ashley Advantage(r) Online Financing & Lease-to-Own - Ashley Furniture provides multiple financing options including special financing periods, lease-to-own plans, and uses a cascade application to maximize approval chances across several lenders.

How Does Best Buy Financing Work? - Best Buy offers deferred interest financing through its My Best Buy(r) Credit Cards, where no interest is charged if the balance is paid within the promotional term; otherwise, interest accrues at the annual rate.

dowidth.com

dowidth.com