Liability driven investing (LDI) focuses on aligning investment strategies with future financial obligations, prioritizing risk management and cash flow matching to ensure liabilities are met. Total return investing seeks to maximize overall portfolio returns through diversified asset allocation, often balancing growth and income to achieve superior performance. Explore how these distinct approaches can shape your investment strategy and financial planning.

Why it is important

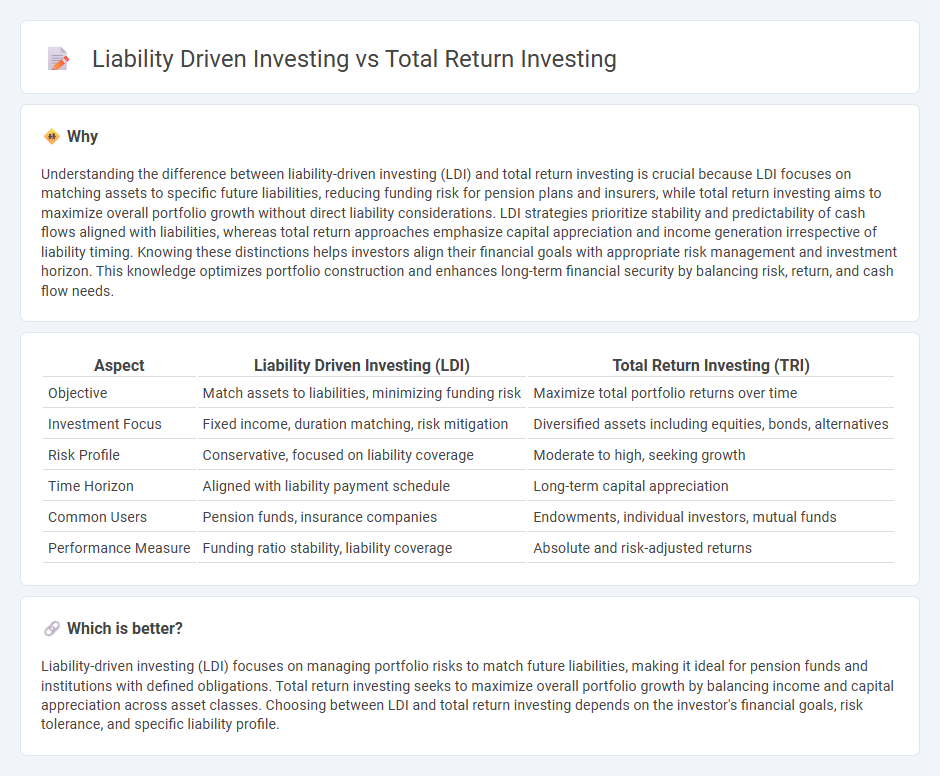

Understanding the difference between liability-driven investing (LDI) and total return investing is crucial because LDI focuses on matching assets to specific future liabilities, reducing funding risk for pension plans and insurers, while total return investing aims to maximize overall portfolio growth without direct liability considerations. LDI strategies prioritize stability and predictability of cash flows aligned with liabilities, whereas total return approaches emphasize capital appreciation and income generation irrespective of liability timing. Knowing these distinctions helps investors align their financial goals with appropriate risk management and investment horizon. This knowledge optimizes portfolio construction and enhances long-term financial security by balancing risk, return, and cash flow needs.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Total Return Investing (TRI) |

|---|---|---|

| Objective | Match assets to liabilities, minimizing funding risk | Maximize total portfolio returns over time |

| Investment Focus | Fixed income, duration matching, risk mitigation | Diversified assets including equities, bonds, alternatives |

| Risk Profile | Conservative, focused on liability coverage | Moderate to high, seeking growth |

| Time Horizon | Aligned with liability payment schedule | Long-term capital appreciation |

| Common Users | Pension funds, insurance companies | Endowments, individual investors, mutual funds |

| Performance Measure | Funding ratio stability, liability coverage | Absolute and risk-adjusted returns |

Which is better?

Liability-driven investing (LDI) focuses on managing portfolio risks to match future liabilities, making it ideal for pension funds and institutions with defined obligations. Total return investing seeks to maximize overall portfolio growth by balancing income and capital appreciation across asset classes. Choosing between LDI and total return investing depends on the investor's financial goals, risk tolerance, and specific liability profile.

Connection

Liability-driven investing (LDI) and total return investing (TRI) are connected through their shared objective of meeting future financial obligations while managing risk and return. LDI focuses on aligning asset portfolios with specific liabilities, using strategies like bond matching to minimize funding gaps, whereas TRI emphasizes maximizing overall portfolio growth by balancing income generation and capital appreciation. Combining LDI's risk management with TRI's growth potential enables investors, particularly pension funds, to achieve stable returns that cover liabilities efficiently.

Key Terms

Asset Allocation

Total return investing emphasizes maximizing portfolio growth by selecting high-performing assets across equities, bonds, and alternative investments with a flexible asset allocation strategy. Liability-driven investing prioritizes matching assets to future liabilities, often using interest rate-sensitive bonds and derivatives to manage risk and ensure funding targets are met. Discover how tailoring asset allocation strategies can optimize outcomes for your specific investment goals.

Yield Curve

Total return investing emphasizes maximizing overall portfolio returns by actively managing asset allocation across equities, bonds, and alternative investments, seeking to outperform benchmarks regardless of interest rate movements. Liability-driven investing (LDI) prioritizes aligning assets with future liabilities, primarily focusing on interest rate risk by closely tracking the yield curve to ensure sufficient funding of obligations as rates shift. Explore how yield curve strategies distinctly impact these investment approaches for more efficient portfolio management and risk mitigation.

Duration Matching

Total return investing seeks to maximize portfolio gains through capital appreciation and income, often with a flexible risk tolerance and asset allocation strategy. Liability-driven investing (LDI), on the other hand, prioritizes matching portfolio duration with liabilities' duration to minimize interest rate risk and ensure funding stability. Explore in-depth strategies to optimize duration matching and manage liability risks effectively.

Source and External Links

What Is Total Return? (Definition, Formula and Examples) - Total return measures the overall return on an investment by combining capital gains and other financial rewards such as interest or dividends, representing the complete growth of the investment over a period.

Total Return Investing - Total return investing is a strategy aiming to outperform benchmarks by combining capital appreciation and income distributions, offering a comprehensive view of investment performance beyond just price growth.

How to Use a Total-Return Approach for Retirement Income - The total return approach integrates income and growth sources from a diversified portfolio to generate cash flow in retirement, balancing capital preservation and income generation across asset classes.

dowidth.com

dowidth.com