Laddered bond ETFs offer diversified fixed-income exposure across staggered maturities, enhancing interest rate risk management and steady income streams. Emerging Markets Bond ETFs focus on sovereign and corporate debt from developing countries, presenting higher yield opportunities coupled with increased volatility and credit risk. Explore detailed comparisons to optimize your bond investment strategy.

Why it is important

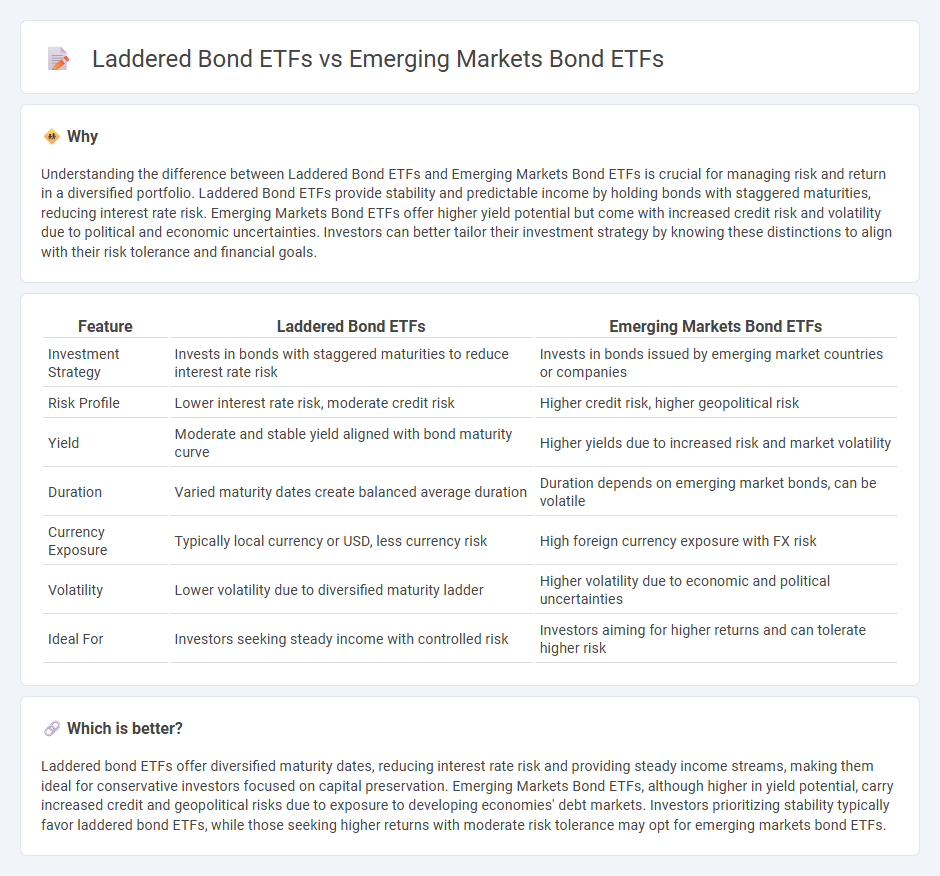

Understanding the difference between Laddered Bond ETFs and Emerging Markets Bond ETFs is crucial for managing risk and return in a diversified portfolio. Laddered Bond ETFs provide stability and predictable income by holding bonds with staggered maturities, reducing interest rate risk. Emerging Markets Bond ETFs offer higher yield potential but come with increased credit risk and volatility due to political and economic uncertainties. Investors can better tailor their investment strategy by knowing these distinctions to align with their risk tolerance and financial goals.

Comparison Table

| Feature | Laddered Bond ETFs | Emerging Markets Bond ETFs |

|---|---|---|

| Investment Strategy | Invests in bonds with staggered maturities to reduce interest rate risk | Invests in bonds issued by emerging market countries or companies |

| Risk Profile | Lower interest rate risk, moderate credit risk | Higher credit risk, higher geopolitical risk |

| Yield | Moderate and stable yield aligned with bond maturity curve | Higher yields due to increased risk and market volatility |

| Duration | Varied maturity dates create balanced average duration | Duration depends on emerging market bonds, can be volatile |

| Currency Exposure | Typically local currency or USD, less currency risk | High foreign currency exposure with FX risk |

| Volatility | Lower volatility due to diversified maturity ladder | Higher volatility due to economic and political uncertainties |

| Ideal For | Investors seeking steady income with controlled risk | Investors aiming for higher returns and can tolerate higher risk |

Which is better?

Laddered bond ETFs offer diversified maturity dates, reducing interest rate risk and providing steady income streams, making them ideal for conservative investors focused on capital preservation. Emerging Markets Bond ETFs, although higher in yield potential, carry increased credit and geopolitical risks due to exposure to developing economies' debt markets. Investors prioritizing stability typically favor laddered bond ETFs, while those seeking higher returns with moderate risk tolerance may opt for emerging markets bond ETFs.

Connection

Laddered bond ETFs strategically invest in bonds with staggered maturities to manage interest rate risk and provide steady income, creating a structured fixed-income portfolio. Emerging Markets Bond ETFs focus on debt securities issued by developing countries, offering higher yields but with increased credit and geopolitical risk. Combining laddered bond structures within Emerging Markets Bond ETFs can potentially balance risk and reward by diversifying maturity profiles while capitalizing on growth opportunities in emerging economies.

Key Terms

Credit Risk

Emerging Markets Bond ETFs typically carry higher credit risk due to exposure to sovereign and corporate debt from developing countries with less stable economic conditions. Laddered bond ETFs diversify risk by holding bonds with staggered maturities, often in investment-grade credit, which helps mitigate default risk and interest rate fluctuations. Explore our detailed analysis to better understand how credit risk impacts your fixed income investment strategy.

Yield Curve

Emerging Markets Bond ETFs offer higher yield potential by investing in sovereign and corporate debt from developing countries, reflecting varied risk and return profiles. Laddered bond ETFs build a diversified portfolio across maturities, aiming to reduce interest rate risk while providing steady income aligned with the yield curve. Explore the nuances of yield curve strategies in these ETFs to optimize your fixed-income investments.

Diversification

Emerging Markets Bond ETFs offer exposure to sovereign and corporate debt in developing economies, often delivering higher yields with increased risk and currency volatility. Laddered Bond ETFs utilize bonds with staggered maturities to reduce interest rate risk and provide steady income, enhancing stability and predictability in fixed income portfolios. Explore our detailed analysis to understand how diversification strategies differ between these two ETF types.

Source and External Links

Emerging Markets Bonds ETFs - ETF Database - Emerging Markets Bond ETFs invest in debt issued by emerging market countries, including government, quasi-government, or corporate bonds, typically offering higher yields due to lower credit quality compared to developed markets.

EMCB - WisdomTree Emerging Markets Corporate Bond ETF - WisdomTree's EMCB ETF is an actively managed fund investing in USD-denominated corporate bonds of emerging market companies, designed to provide income and capital appreciation with an expense ratio of 0.60% and a yield around 6%, without currency risk.

Invesco Emerging Markets Sovereign Debt ETF (PCY) - This ETF tracks an index of liquid US dollar-denominated government bonds issued by over 20 emerging market countries, with at least 80% of assets invested in the index's portfolio, rebalanced quarterly.

dowidth.com

dowidth.com