Insurtech revolutionizes the insurance industry by leveraging technology to streamline underwriting, claims processing, and risk assessment, enhancing customer experience and operational efficiency. Lendingtech focuses on transforming the lending process through digital platforms, automated credit scoring, and alternative data sources to provide faster and more accessible loans. Discover more about how these two fintech sectors are reshaping financial services.

Why it is important

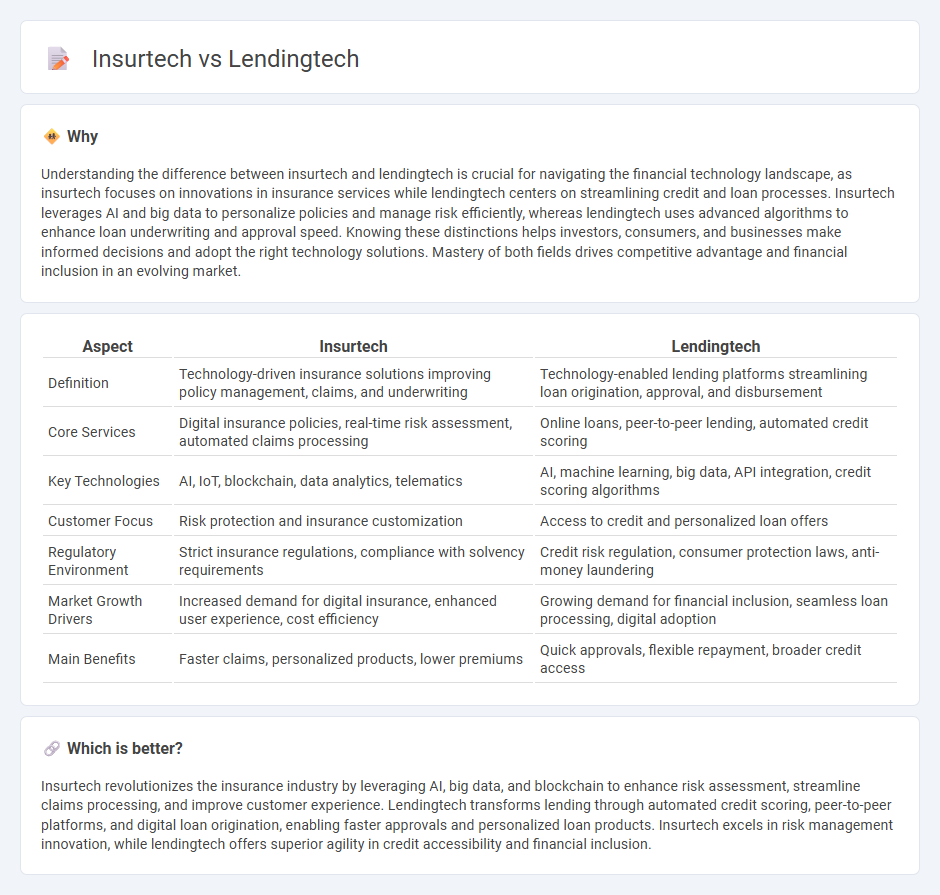

Understanding the difference between insurtech and lendingtech is crucial for navigating the financial technology landscape, as insurtech focuses on innovations in insurance services while lendingtech centers on streamlining credit and loan processes. Insurtech leverages AI and big data to personalize policies and manage risk efficiently, whereas lendingtech uses advanced algorithms to enhance loan underwriting and approval speed. Knowing these distinctions helps investors, consumers, and businesses make informed decisions and adopt the right technology solutions. Mastery of both fields drives competitive advantage and financial inclusion in an evolving market.

Comparison Table

| Aspect | Insurtech | Lendingtech |

|---|---|---|

| Definition | Technology-driven insurance solutions improving policy management, claims, and underwriting | Technology-enabled lending platforms streamlining loan origination, approval, and disbursement |

| Core Services | Digital insurance policies, real-time risk assessment, automated claims processing | Online loans, peer-to-peer lending, automated credit scoring |

| Key Technologies | AI, IoT, blockchain, data analytics, telematics | AI, machine learning, big data, API integration, credit scoring algorithms |

| Customer Focus | Risk protection and insurance customization | Access to credit and personalized loan offers |

| Regulatory Environment | Strict insurance regulations, compliance with solvency requirements | Credit risk regulation, consumer protection laws, anti-money laundering |

| Market Growth Drivers | Increased demand for digital insurance, enhanced user experience, cost efficiency | Growing demand for financial inclusion, seamless loan processing, digital adoption |

| Main Benefits | Faster claims, personalized products, lower premiums | Quick approvals, flexible repayment, broader credit access |

Which is better?

Insurtech revolutionizes the insurance industry by leveraging AI, big data, and blockchain to enhance risk assessment, streamline claims processing, and improve customer experience. Lendingtech transforms lending through automated credit scoring, peer-to-peer platforms, and digital loan origination, enabling faster approvals and personalized loan products. Insurtech excels in risk management innovation, while lendingtech offers superior agility in credit accessibility and financial inclusion.

Connection

Insurtech and lendingtech are interconnected through their reliance on advanced data analytics and AI-driven risk assessment to enhance underwriting accuracy and customer experience. Both sectors leverage digital platforms to streamline processes such as loan approvals and insurance claims, reducing operational costs and increasing accessibility. Integration of these technologies fosters innovative financial products combining insurance coverage with lending solutions, improving financial inclusion and risk management.

Key Terms

Lendingtech:

LendingTech revolutionizes the borrowing process by leveraging AI-driven credit scoring, blockchain for secure transactions, and automated loan underwriting to enhance efficiency and reduce risk. Key players in LendingTech such as Upstart, SoFi, and LendingClub utilize machine learning algorithms to personalize loan offers and improve approval rates. Explore how LendingTech is reshaping the financial landscape and driving inclusive access to credit.

Credit Scoring

LendingTech utilizes advanced algorithms and big data analytics to enhance credit scoring accuracy, improving loan approval processes and minimizing default risks. InsurTech integrates similar credit scoring models to assess insurance applicants' financial reliability, facilitating personalized premium pricing and fraud detection. Explore how these technologies revolutionize financial services by optimizing credit assessment methodologies.

Peer-to-Peer Lending

Lendingtech revolutionizes peer-to-peer lending by providing digital platforms that directly connect borrowers with investors, reducing traditional banking intermediaries and lowering interest rates. Insurtech, while primarily transforming insurance processes through technology, occasionally integrates peer-to-peer models to offer risk-sharing solutions among policyholders. Explore how these technologies reshape financial services by delving deeper into their peer-to-peer lending applications.

Source and External Links

The Rise of LendingTech: Transforming the Lending Industry - LendingTech integrates digital tools such as automated loan applications, AI-powered risk assessment, and scalable infrastructure to streamline lending processes, enhance risk management, and improve data-driven decision-making in financial institutions.

Lending Technology Reveals New Credit Sources & Efficiences | LLR - LendingTech uses sophisticated algorithms and digital channels to improve underwriting, increase loan approval rates, and expand credit access, particularly bridging supply and demand gaps in small business lending.

Lending Tech Solutions | Loan Management & Lending Tech App - Credility provides end-to-end digital lending solutions including loan management apps, customer onboarding, and loan origination software that automate processes to reduce paperwork and accelerate loan approvals for financial institutions.

dowidth.com

dowidth.com