Altcoin staking involves locking up cryptocurrencies to earn rewards directly from the network, enhancing asset security and generating passive income. Delegated staking allows token holders to delegate their staking power to validators, optimizing network participation without technical management. Explore the key differences and benefits of altcoin staking versus delegated staking to maximize your crypto earnings.

Why it is important

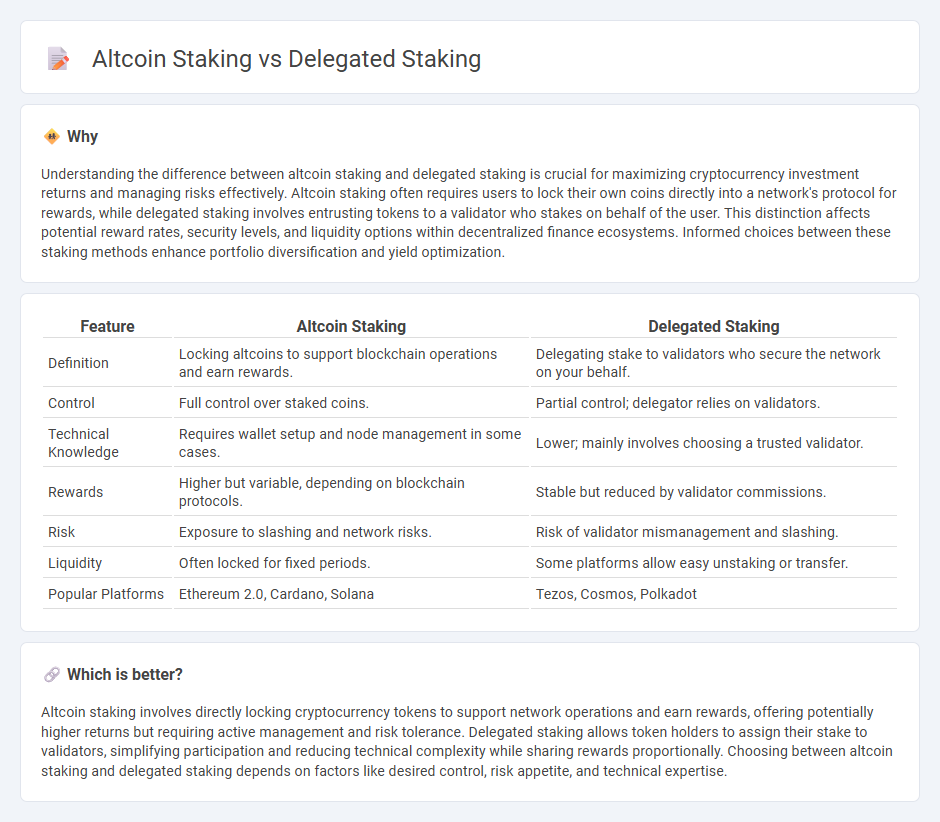

Understanding the difference between altcoin staking and delegated staking is crucial for maximizing cryptocurrency investment returns and managing risks effectively. Altcoin staking often requires users to lock their own coins directly into a network's protocol for rewards, while delegated staking involves entrusting tokens to a validator who stakes on behalf of the user. This distinction affects potential reward rates, security levels, and liquidity options within decentralized finance ecosystems. Informed choices between these staking methods enhance portfolio diversification and yield optimization.

Comparison Table

| Feature | Altcoin Staking | Delegated Staking |

|---|---|---|

| Definition | Locking altcoins to support blockchain operations and earn rewards. | Delegating stake to validators who secure the network on your behalf. |

| Control | Full control over staked coins. | Partial control; delegator relies on validators. |

| Technical Knowledge | Requires wallet setup and node management in some cases. | Lower; mainly involves choosing a trusted validator. |

| Rewards | Higher but variable, depending on blockchain protocols. | Stable but reduced by validator commissions. |

| Risk | Exposure to slashing and network risks. | Risk of validator mismanagement and slashing. |

| Liquidity | Often locked for fixed periods. | Some platforms allow easy unstaking or transfer. |

| Popular Platforms | Ethereum 2.0, Cardano, Solana | Tezos, Cosmos, Polkadot |

Which is better?

Altcoin staking involves directly locking cryptocurrency tokens to support network operations and earn rewards, offering potentially higher returns but requiring active management and risk tolerance. Delegated staking allows token holders to assign their stake to validators, simplifying participation and reducing technical complexity while sharing rewards proportionally. Choosing between altcoin staking and delegated staking depends on factors like desired control, risk appetite, and technical expertise.

Connection

Altcoin staking involves holding specific altcoins in a digital wallet to support blockchain network operations and earn rewards. Delegated staking allows token holders to delegate their staking power to trusted validators, enhancing network security while still receiving staking income. Both processes promote decentralization and incentivize active participation in blockchain ecosystems, directly impacting altcoin value and liquidity.

Key Terms

Validator

Validator roles are central to both delegated staking and altcoin staking, ensuring network security and transaction validation. In delegated staking, users assign their tokens to trusted validators who perform consensus operations on their behalf, while altcoin staking often involves directly running a validator node to earn rewards. Explore how validator dynamics impact staking rewards and network decentralization to optimize your crypto investment strategy.

Staking Pool

Delegated staking involves users delegating their tokens to a staking pool operator who manages validation duties on their behalf, providing rewards proportional to their stake while maintaining network security. Altcoin staking requires holding specific cryptocurrencies directly in personal wallets to participate in consensus mechanisms, often yielding variable returns depending on the coin's staking protocol. Explore the advantages and risks of staking pools to optimize your altcoin investment strategy.

Lock-up Period

Delegated staking typically involves locking up cryptocurrency for a specified period to support network security and earn rewards, with lock-up durations varying by blockchain protocol. Altcoin staking often features customizable lock-up terms depending on the coin's consensus mechanism, impacting liquidity and potential returns. Explore detailed lock-up period comparisons and strategies to optimize your staking rewards effectively.

Source and External Links

Delegated Staking - Forta Docs - Delegated staking allows token holders to delegate all or part of their tokens to node pools that secure the network and share rewards with delegators, with pool owners setting commission rates and stake allocation parameters on-chain.

Understanding Delegated Staking | Constellation Network - Delegated staking involves node operators staking their own collateral and earning all rewards on it, while delegators add stake that increases node rewards, with node operators charging a commission on delegated rewards shared proportionally with delegators.

Delegated Staking: Your Guide to Earning Crypto Rewards - Delegated staking lowers the technical and financial barriers of running a validator by letting users delegate stake to pools, often resulting in more consistent rewards while enhancing network security through broader participation.

dowidth.com

dowidth.com