Hard rug pulls involve fraudulent schemes where developers suddenly abandon a project, stealing investors' funds and causing significant financial losses. Insider trading refers to the illegal practice of trading securities based on non-public, material information, undermining market integrity and fairness. Explore more to understand how these deceptive tactics impact the financial landscape.

Why it is important

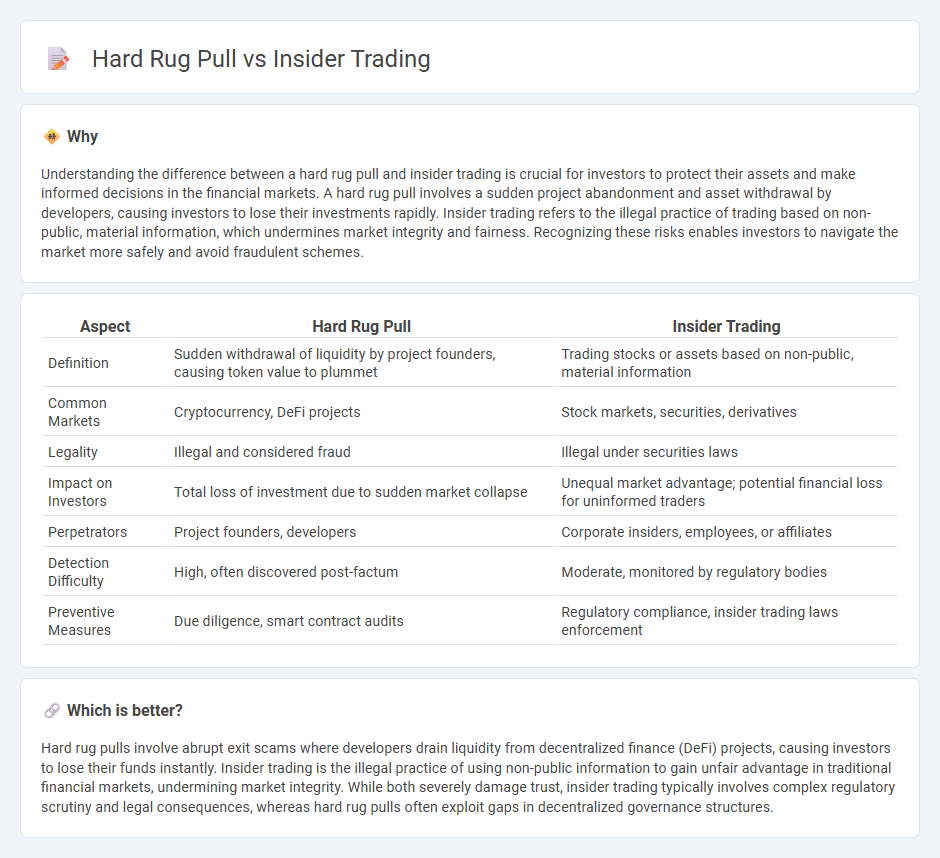

Understanding the difference between a hard rug pull and insider trading is crucial for investors to protect their assets and make informed decisions in the financial markets. A hard rug pull involves a sudden project abandonment and asset withdrawal by developers, causing investors to lose their investments rapidly. Insider trading refers to the illegal practice of trading based on non-public, material information, which undermines market integrity and fairness. Recognizing these risks enables investors to navigate the market more safely and avoid fraudulent schemes.

Comparison Table

| Aspect | Hard Rug Pull | Insider Trading |

|---|---|---|

| Definition | Sudden withdrawal of liquidity by project founders, causing token value to plummet | Trading stocks or assets based on non-public, material information |

| Common Markets | Cryptocurrency, DeFi projects | Stock markets, securities, derivatives |

| Legality | Illegal and considered fraud | Illegal under securities laws |

| Impact on Investors | Total loss of investment due to sudden market collapse | Unequal market advantage; potential financial loss for uninformed traders |

| Perpetrators | Project founders, developers | Corporate insiders, employees, or affiliates |

| Detection Difficulty | High, often discovered post-factum | Moderate, monitored by regulatory bodies |

| Preventive Measures | Due diligence, smart contract audits | Regulatory compliance, insider trading laws enforcement |

Which is better?

Hard rug pulls involve abrupt exit scams where developers drain liquidity from decentralized finance (DeFi) projects, causing investors to lose their funds instantly. Insider trading is the illegal practice of using non-public information to gain unfair advantage in traditional financial markets, undermining market integrity. While both severely damage trust, insider trading typically involves complex regulatory scrutiny and legal consequences, whereas hard rug pulls often exploit gaps in decentralized governance structures.

Connection

Rug pulls and insider trading both exploit asymmetric information and trust violations within financial markets, leading to significant investor losses and market manipulation. Rug pulls involve project insiders abruptly withdrawing liquidity or funds from a decentralized finance (DeFi) platform, while insider trading leverages non-public information for unfair trading advantages. Both practices undermine market integrity, erode investor confidence, and highlight the need for enhanced regulatory frameworks and transparent disclosure mechanisms.

Key Terms

Non-public Information

Insider trading involves the illegal use of confidential, non-public information to gain an unfair advantage in financial markets, often resulting in significant profits or avoidance of losses. A hard rug pull, common in cryptocurrency scams, entails creators abruptly withdrawing all assets, deceiving investors who were unaware of non-public intentions or hidden information. Explore the nuances of insider trading and hard rug pulls to better understand the critical role of non-public information in financial misconduct.

Market Manipulation

Insider trading involves trading stocks or securities based on non-public, material information, constituting a form of market manipulation that undermines market fairness and transparency. A hard rug pull occurs when creators abruptly abandon a project, such as a crypto token, causing its value to plummet and deceiving investors through fraudulent manipulation. Explore deeper insights and regulatory frameworks surrounding these manipulative practices to safeguard investments.

Exit Scam

Insider trading involves illicitly using confidential information for stock market advantage, while a hard rug pull, specifically an exit scam, occurs in crypto where developers abruptly abandon a project, stealing investor funds. Exit scams in decentralized finance (DeFi) are particularly damaging due to lack of regulation and transparency, leading to substantial financial losses. Explore deeper insights into how exit scams undermine market trust and investor security.

Source and External Links

Definition, Examples and Penalties for Insider Trading - Insider trading is the act of buying or selling securities of a publicly-traded company while in possession of material, nonpublic information that could significantly impact an investor's decision, and it is illegal in many jurisdictions.

Insider Trading | Investor.gov - Illegal insider trading involves breaching a fiduciary duty by trading securities based on confidential information, and it applies to corporate insiders, their associates, and others who misappropriate such information, with enforcement a major SEC priority.

Insider trading - Wikipedia - Insider trading laws focus on prohibiting trades made while in possession of material nonpublic information, with exceptions such as pre-planned trades under SEC Rule 10b5-1, and it covers stock trading but has limited application in commodity markets.

dowidth.com

dowidth.com