Basis trading exploits the price difference between futures contracts and their underlying assets to generate profits, typically involving simultaneous buying of the asset and selling of its futures. Cash-and-carry arbitrage leverages these price discrepancies by buying the underlying asset and selling futures, aiming to lock in risk-free returns when the futures price exceeds the spot price plus carrying costs. Explore the nuances of these strategies to enhance your market understanding and trading efficiency.

Why it is important

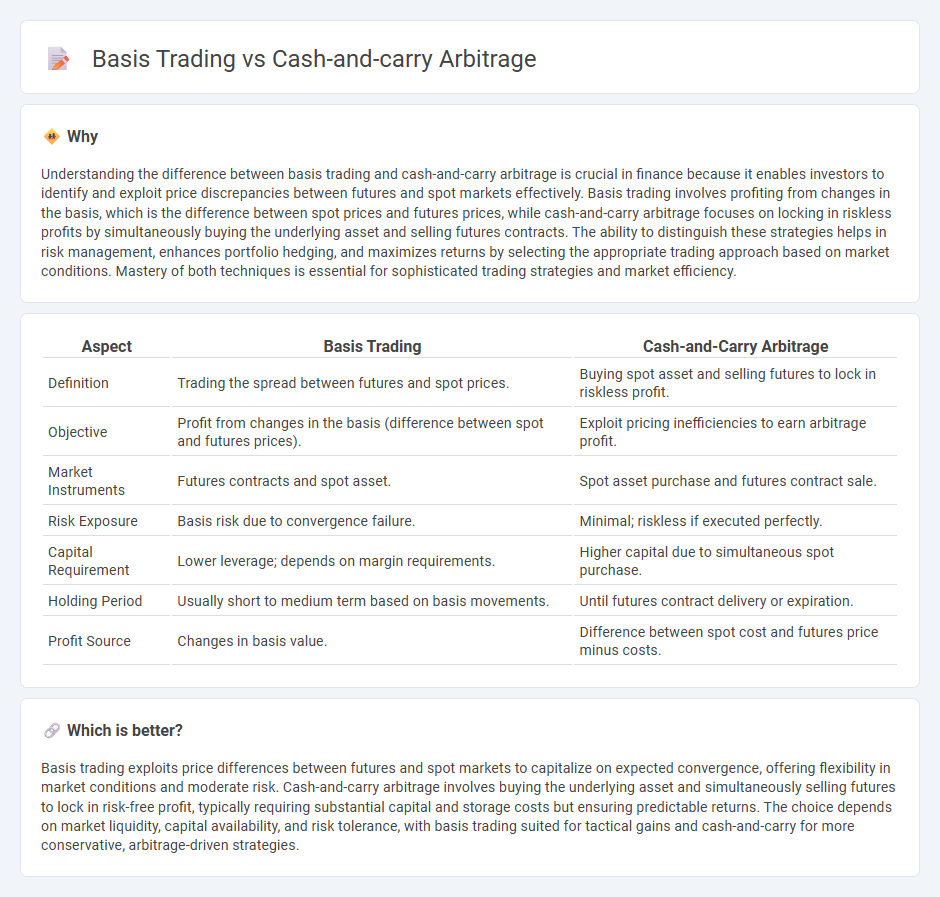

Understanding the difference between basis trading and cash-and-carry arbitrage is crucial in finance because it enables investors to identify and exploit price discrepancies between futures and spot markets effectively. Basis trading involves profiting from changes in the basis, which is the difference between spot prices and futures prices, while cash-and-carry arbitrage focuses on locking in riskless profits by simultaneously buying the underlying asset and selling futures contracts. The ability to distinguish these strategies helps in risk management, enhances portfolio hedging, and maximizes returns by selecting the appropriate trading approach based on market conditions. Mastery of both techniques is essential for sophisticated trading strategies and market efficiency.

Comparison Table

| Aspect | Basis Trading | Cash-and-Carry Arbitrage |

|---|---|---|

| Definition | Trading the spread between futures and spot prices. | Buying spot asset and selling futures to lock in riskless profit. |

| Objective | Profit from changes in the basis (difference between spot and futures prices). | Exploit pricing inefficiencies to earn arbitrage profit. |

| Market Instruments | Futures contracts and spot asset. | Spot asset purchase and futures contract sale. |

| Risk Exposure | Basis risk due to convergence failure. | Minimal; riskless if executed perfectly. |

| Capital Requirement | Lower leverage; depends on margin requirements. | Higher capital due to simultaneous spot purchase. |

| Holding Period | Usually short to medium term based on basis movements. | Until futures contract delivery or expiration. |

| Profit Source | Changes in basis value. | Difference between spot cost and futures price minus costs. |

Which is better?

Basis trading exploits price differences between futures and spot markets to capitalize on expected convergence, offering flexibility in market conditions and moderate risk. Cash-and-carry arbitrage involves buying the underlying asset and simultaneously selling futures to lock in risk-free profit, typically requiring substantial capital and storage costs but ensuring predictable returns. The choice depends on market liquidity, capital availability, and risk tolerance, with basis trading suited for tactical gains and cash-and-carry for more conservative, arbitrage-driven strategies.

Connection

Basis trading exploits the price difference between a futures contract and its underlying asset by taking offsetting positions in both markets, aiming to profit as the basis narrows. Cash-and-carry arbitrage involves buying the underlying asset and simultaneously selling the futures contract, locking in a risk-free profit when futures prices are sufficiently above the spot price plus carrying costs. Both strategies rely on the convergence of spot and futures prices at contract maturity to generate gains from price discrepancies.

Key Terms

Spot Price

Cash-and-carry arbitrage exploits price differences between the spot price of an asset and its futures price by buying the asset in the spot market and simultaneously selling a futures contract to lock in a risk-free profit. Basis trading focuses on the spread or 'basis' between the spot price and futures price, aiming to profit from changes in this spread rather than outright price discrepancies. Explore how spot price dynamics influence both strategies to optimize trading effectiveness.

Futures Price

Cash-and-carry arbitrage exploits price differences between the spot market and futures contracts, locking in risk-free profits when futures are overpriced relative to the spot price plus carrying costs. Basis trading centers on the difference, or basis, between the spot price and futures price, aiming to profit from expected convergence at contract expiration. Explore more to understand the strategic nuances and risk profiles of both trading methods.

Cost of Carry

Cash-and-carry arbitrage exploits price discrepancies between spot and futures markets by buying the asset outright and selling futures contracts, profiting from the cost of carry, which includes storage, financing, and dividends. Basis trading involves capitalizing on the price difference--the basis--between spot and futures prices, focusing on changes in the cost of carry to manage risk and returns. Explore the nuances of cost of carry in these strategies to optimize your trading decisions.

Source and External Links

Cash-and-Carry Arbitrage Strategy in Commodities - Groww - Cash-and-carry arbitrage exploits price differences between the spot and futures markets of an asset to lock in a risk-free profit by buying the asset in the spot market and selling its futures when the futures price is above fair value considering carrying costs.

Cash and Carry Arbitrage - Definition, Example, How It Works - This arbitrage involves going long on the underlying asset and shorting the corresponding futures contract, holding the asset until futures expiration, and delivering it to capture a riskless profit if the futures price exceeds the spot price plus carrying costs.

Cash and Carry Arbitrage: Definition & Examples | Angel One - It occurs when the futures price is higher than the spot price, prompting a trader to buy the underlying asset in the spot market and short the futures contract, holding the asset until futures expiration to profit from the price difference known as the basis.

dowidth.com

dowidth.com