Digital asset custody involves securing cryptocurrencies and blockchain-based assets using advanced cryptographic technology and decentralized storage solutions, ensuring enhanced security and control for investors. Bank custody traditionally manages physical and digital financial instruments through regulated institutions, offering established legal safeguards and insured asset protection. Explore further to understand the key differences and benefits of digital asset custody versus bank custody.

Why it is important

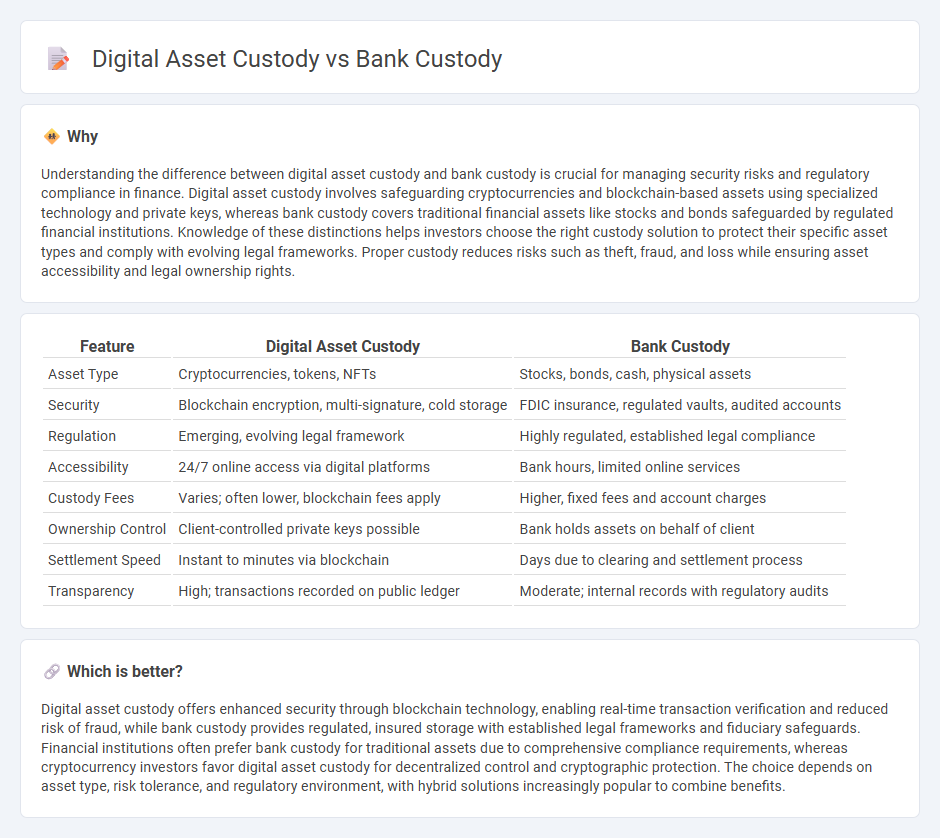

Understanding the difference between digital asset custody and bank custody is crucial for managing security risks and regulatory compliance in finance. Digital asset custody involves safeguarding cryptocurrencies and blockchain-based assets using specialized technology and private keys, whereas bank custody covers traditional financial assets like stocks and bonds safeguarded by regulated financial institutions. Knowledge of these distinctions helps investors choose the right custody solution to protect their specific asset types and comply with evolving legal frameworks. Proper custody reduces risks such as theft, fraud, and loss while ensuring asset accessibility and legal ownership rights.

Comparison Table

| Feature | Digital Asset Custody | Bank Custody |

|---|---|---|

| Asset Type | Cryptocurrencies, tokens, NFTs | Stocks, bonds, cash, physical assets |

| Security | Blockchain encryption, multi-signature, cold storage | FDIC insurance, regulated vaults, audited accounts |

| Regulation | Emerging, evolving legal framework | Highly regulated, established legal compliance |

| Accessibility | 24/7 online access via digital platforms | Bank hours, limited online services |

| Custody Fees | Varies; often lower, blockchain fees apply | Higher, fixed fees and account charges |

| Ownership Control | Client-controlled private keys possible | Bank holds assets on behalf of client |

| Settlement Speed | Instant to minutes via blockchain | Days due to clearing and settlement process |

| Transparency | High; transactions recorded on public ledger | Moderate; internal records with regulatory audits |

Which is better?

Digital asset custody offers enhanced security through blockchain technology, enabling real-time transaction verification and reduced risk of fraud, while bank custody provides regulated, insured storage with established legal frameworks and fiduciary safeguards. Financial institutions often prefer bank custody for traditional assets due to comprehensive compliance requirements, whereas cryptocurrency investors favor digital asset custody for decentralized control and cryptographic protection. The choice depends on asset type, risk tolerance, and regulatory environment, with hybrid solutions increasingly popular to combine benefits.

Connection

Digital asset custody and bank custody are interconnected through the integration of secure storage solutions and regulatory compliance frameworks. Both systems prioritize safeguarding assets, with digital custody utilizing blockchain technology and encryption, while bank custody relies on traditional financial infrastructure and auditing standards. This synergy enhances asset protection, liquidity management, and trust across evolving financial markets.

Key Terms

Safekeeping

Bank custody provides secure, regulated safekeeping of traditional financial assets such as stocks, bonds, and cash, ensuring compliance with established banking standards and regulatory frameworks. Digital asset custody involves safeguarding cryptocurrencies and blockchain-based tokens using advanced cryptographic techniques and multi-signature wallets to protect against cyber threats and unauthorized access. Explore further to understand the key distinctions and benefits of bank custody versus digital asset custody for optimal asset protection.

Private key management

Bank custody traditionally involves centralized control over private keys, relying on institutional security protocols and regulatory oversight to protect assets, whereas digital asset custody emphasizes decentralized management through cryptographic techniques and hardware security modules to safeguard private keys. Private key management in digital asset custody employs multi-signature wallets, cold storage, and biometric authentication, minimizing the risk of unauthorized access compared to bank custody systems. Discover the detailed approaches and security implications of private key management in both bank and digital asset custody by exploring our in-depth analysis.

Settlement

Bank custody involves traditional securities settlement processes through centralized clearinghouses, ensuring regulatory compliance and established risk management protocols. Digital asset custody features blockchain-based settlement mechanisms that enable near-instantaneous transfer and finality without intermediaries, reducing counterparty risk and settlement times. Explore the distinctions in settlement procedures and risk factors between these custody models for a comprehensive understanding.

Source and External Links

What is a bank custodian? What services do they provide? - A bank custodian holds and safeguards clients' financial assets such as cash, stocks, bonds, and other instruments, providing services like trade settlement, income collection, corporate actions processing, and recordkeeping, regulated by the OCC.

Custodian and Depositary Banks | Jersey Finance - Custodian banks safeguard financial assets for clients across various businesses, providing administration, tax support, dividend collection, FX transfers, and transaction settlement, often serving large institutions and offering global custody through local or sub-custodian banks.

Custody Services | J.P. Morgan Private Bank U.S. - Custody services offer a secure, segregated place to hold assets, with transparent reporting and partnerships with investment managers to manage income reporting, corporate actions, proxy voting, and cash management, ensuring safety without lending or rehypothecation of client shares.

dowidth.com

dowidth.com