Loss harvesting involves strategically selling securities at a loss to offset capital gains taxes, enhancing after-tax portfolio returns. Tax lot selling focuses on selecting specific purchase lots to optimize tax outcomes by minimizing gains or maximizing losses. Explore how these techniques can improve your investment tax strategy.

Why it is important

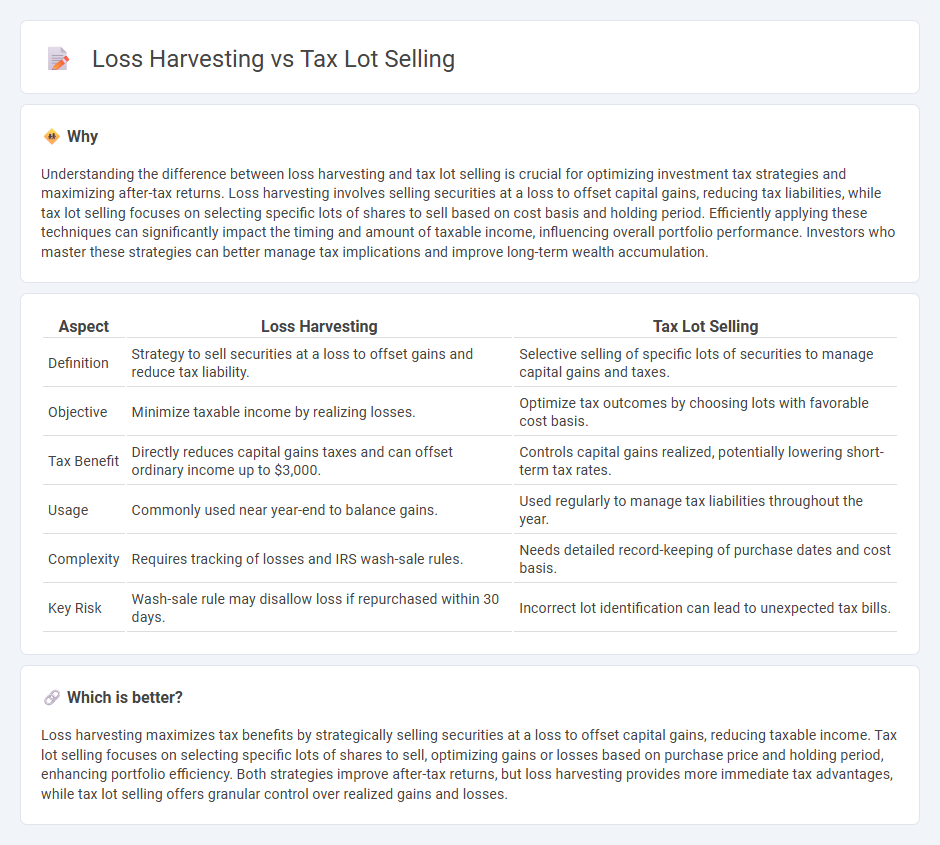

Understanding the difference between loss harvesting and tax lot selling is crucial for optimizing investment tax strategies and maximizing after-tax returns. Loss harvesting involves selling securities at a loss to offset capital gains, reducing tax liabilities, while tax lot selling focuses on selecting specific lots of shares to sell based on cost basis and holding period. Efficiently applying these techniques can significantly impact the timing and amount of taxable income, influencing overall portfolio performance. Investors who master these strategies can better manage tax implications and improve long-term wealth accumulation.

Comparison Table

| Aspect | Loss Harvesting | Tax Lot Selling |

|---|---|---|

| Definition | Strategy to sell securities at a loss to offset gains and reduce tax liability. | Selective selling of specific lots of securities to manage capital gains and taxes. |

| Objective | Minimize taxable income by realizing losses. | Optimize tax outcomes by choosing lots with favorable cost basis. |

| Tax Benefit | Directly reduces capital gains taxes and can offset ordinary income up to $3,000. | Controls capital gains realized, potentially lowering short-term tax rates. |

| Usage | Commonly used near year-end to balance gains. | Used regularly to manage tax liabilities throughout the year. |

| Complexity | Requires tracking of losses and IRS wash-sale rules. | Needs detailed record-keeping of purchase dates and cost basis. |

| Key Risk | Wash-sale rule may disallow loss if repurchased within 30 days. | Incorrect lot identification can lead to unexpected tax bills. |

Which is better?

Loss harvesting maximizes tax benefits by strategically selling securities at a loss to offset capital gains, reducing taxable income. Tax lot selling focuses on selecting specific lots of shares to sell, optimizing gains or losses based on purchase price and holding period, enhancing portfolio efficiency. Both strategies improve after-tax returns, but loss harvesting provides more immediate tax advantages, while tax lot selling offers granular control over realized gains and losses.

Connection

Loss harvesting and tax lot selling are closely connected strategies used in portfolio management to optimize tax outcomes. Loss harvesting involves selling securities at a loss to offset gains and reduce taxable income, while tax lot selling targets specific shares or lots with the highest cost basis to minimize realized gains or maximize deductible losses. Combining these methods enhances tax efficiency by strategically selecting which securities to sell and when, directly impacting an investor's after-tax returns.

Key Terms

Cost Basis

Tax lot selling involves selectively selling specific portions of an investment to optimize tax outcomes based on individual purchase prices or cost basis. Loss harvesting strategically realizes losses by selling securities at a lower price than their cost basis to offset capital gains and reduce tax liability. Explore detailed strategies to maximize tax efficiency by understanding the nuances between tax lot selling and loss harvesting.

Capital Gains

Tax lot selling targets specific shares within a portfolio to manage capital gains by selecting lots with favorable cost bases, reducing taxable income from gains. Loss harvesting involves selling securities at a loss to offset capital gains, minimizing tax liability and improving after-tax returns. Explore detailed strategies to optimize capital gains tax impact and boost investment efficiency.

Wash Sale Rule

Tax lot selling involves selecting specific lots of securities to sell, aiming to manage capital gains efficiently by choosing lots with favorable cost bases. Loss harvesting exploits the Wash Sale Rule by strategically selling securities at a loss to offset gains, but repurchasing the same or substantially identical securities within 30 days triggers the rule and defers the loss deduction. Explore effective strategies to maximize tax benefits while complying with the Wash Sale Rule for optimal investment outcomes.

Source and External Links

Understanding Tax Lot Method: How It Works and Advantages - A tax lot records the details of each purchase of securities separately for tax purposes, allowing investors to choose which specific lots to sell, which can significantly impact tax liabilities when selling shares.

Tax lots | Robinhood - Selling in tax lots allows you to select specific purchase lots to sell in taxable accounts, managing capital gains or losses by choosing shares by purchase date and cost per share.

Tax Strategy: Tax Lot Optimization - Tax lot optimization involves choosing which tax lots to sell to strategically realize losses or gains, helping to reduce current tax liability while managing future tax consequences.

dowidth.com

dowidth.com