Loss harvesting involves strategically selling securities at a loss to offset capital gains and reduce tax liability, while asset location focuses on placing investments in accounts that optimize tax efficiency based on their characteristics. Implementing both techniques can significantly enhance after-tax returns by minimizing taxable income and leveraging tax-advantaged accounts. Explore how combining loss harvesting with asset location strategies can maximize your investment portfolio's tax efficiency.

Why it is important

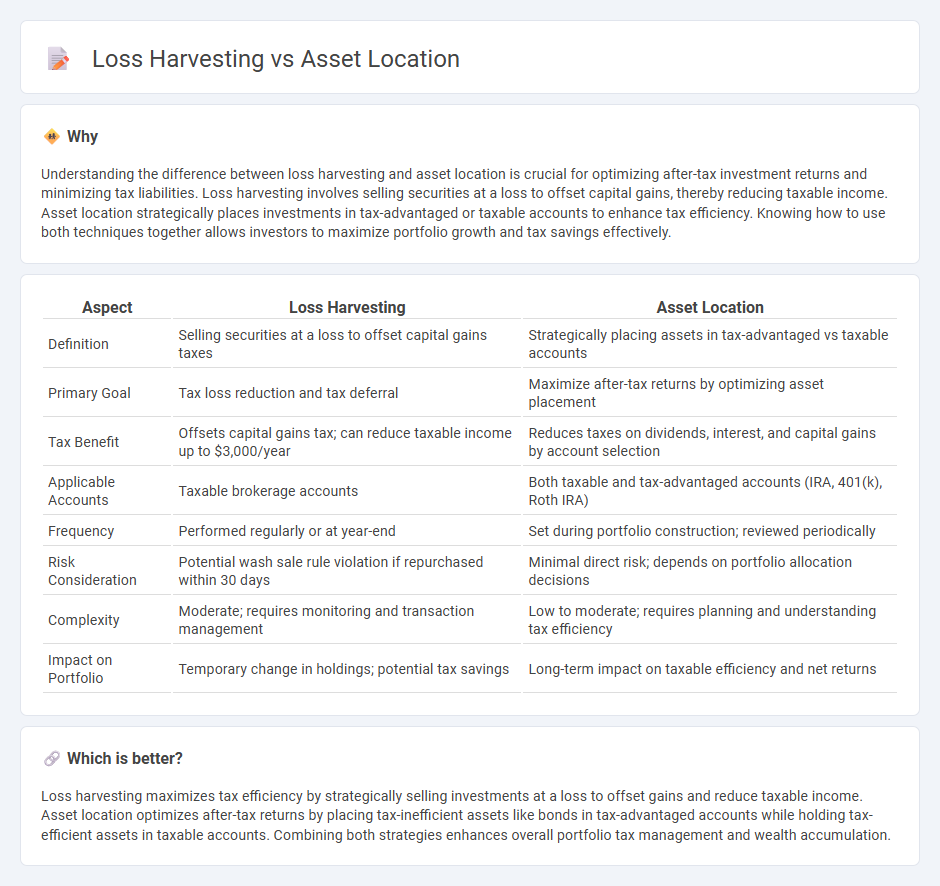

Understanding the difference between loss harvesting and asset location is crucial for optimizing after-tax investment returns and minimizing tax liabilities. Loss harvesting involves selling securities at a loss to offset capital gains, thereby reducing taxable income. Asset location strategically places investments in tax-advantaged or taxable accounts to enhance tax efficiency. Knowing how to use both techniques together allows investors to maximize portfolio growth and tax savings effectively.

Comparison Table

| Aspect | Loss Harvesting | Asset Location |

|---|---|---|

| Definition | Selling securities at a loss to offset capital gains taxes | Strategically placing assets in tax-advantaged vs taxable accounts |

| Primary Goal | Tax loss reduction and tax deferral | Maximize after-tax returns by optimizing asset placement |

| Tax Benefit | Offsets capital gains tax; can reduce taxable income up to $3,000/year | Reduces taxes on dividends, interest, and capital gains by account selection |

| Applicable Accounts | Taxable brokerage accounts | Both taxable and tax-advantaged accounts (IRA, 401(k), Roth IRA) |

| Frequency | Performed regularly or at year-end | Set during portfolio construction; reviewed periodically |

| Risk Consideration | Potential wash sale rule violation if repurchased within 30 days | Minimal direct risk; depends on portfolio allocation decisions |

| Complexity | Moderate; requires monitoring and transaction management | Low to moderate; requires planning and understanding tax efficiency |

| Impact on Portfolio | Temporary change in holdings; potential tax savings | Long-term impact on taxable efficiency and net returns |

Which is better?

Loss harvesting maximizes tax efficiency by strategically selling investments at a loss to offset gains and reduce taxable income. Asset location optimizes after-tax returns by placing tax-inefficient assets like bonds in tax-advantaged accounts while holding tax-efficient assets in taxable accounts. Combining both strategies enhances overall portfolio tax management and wealth accumulation.

Connection

Loss harvesting and asset location are connected through strategic tax management to enhance investment returns. Loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income, while asset location optimizes the placement of assets in taxable, tax-deferred, or tax-exempt accounts to minimize tax liabilities. Together, these techniques maximize after-tax wealth by integrating tax-efficient selling with optimal account use.

Key Terms

Tax Efficiency

Asset location optimizes tax efficiency by strategically placing investments in accounts that minimize tax liabilities, such as holding tax-inefficient assets in tax-deferred accounts and tax-efficient assets in taxable accounts. Loss harvesting involves selling securities at a loss to offset capital gains and reduce taxable income, providing immediate tax relief. Explore techniques to combine asset location and loss harvesting to maximize your overall tax savings.

Capital Gains

Asset location optimizes investment accounts by placing tax-inefficient assets in tax-advantaged accounts to minimize capital gains taxes. Loss harvesting strategically sells securities at a loss to offset capital gains, reducing taxable income in a given year. Explore more about how these strategies can enhance your capital gains tax efficiency.

Portfolio Diversification

Asset location optimizes tax efficiency by strategically placing investments in tax-advantaged or taxable accounts, improving after-tax returns. Loss harvesting involves selling securities at a loss to offset capital gains or reduce taxable income, aiding in tax management without altering asset allocation. Explore how combining asset location and loss harvesting can enhance portfolio diversification and tax efficiency.

Source and External Links

Asset location - Wikipedia - Asset location (AL) refers to how investors distribute their investments across different types of savings vehicles (taxable, tax-exempt, tax-deferred accounts etc.) to maximize benefits like minimizing taxes, distinct from asset allocation which decides what assets to hold.

Revisiting the conventional wisdom regarding asset location - Asset location is the strategic placement of assets into accounts to maximize after-tax returns, with research showing that thoughtful positioning can add 5 to 30 basis points of after-tax return, often recommending placing bonds in traditional IRAs first, then Roth IRAs, and finally taxable accounts.

How Asset Location Can Help Save on Taxes - Charles Schwab - Asset location pairs assets with account types for tax efficiency, with the main accounts being taxable, tax-deferred (e.g. traditional IRAs), and tax-exempt (e.g. Roth IRAs) each having different tax treatments, impacting investment returns and potential tax savings especially for higher-income households.

dowidth.com

dowidth.com