Robo advisory platforms leverage advanced algorithms and AI to provide cost-effective, personalized investment strategies with low minimum balances and automated portfolio rebalancing. Bank wealth management services offer tailored financial planning and dedicated human advisors, often catering to high-net-worth clients with comprehensive, relationship-driven support. Explore the key differences to determine which wealth management approach aligns best with your financial goals.

Why it is important

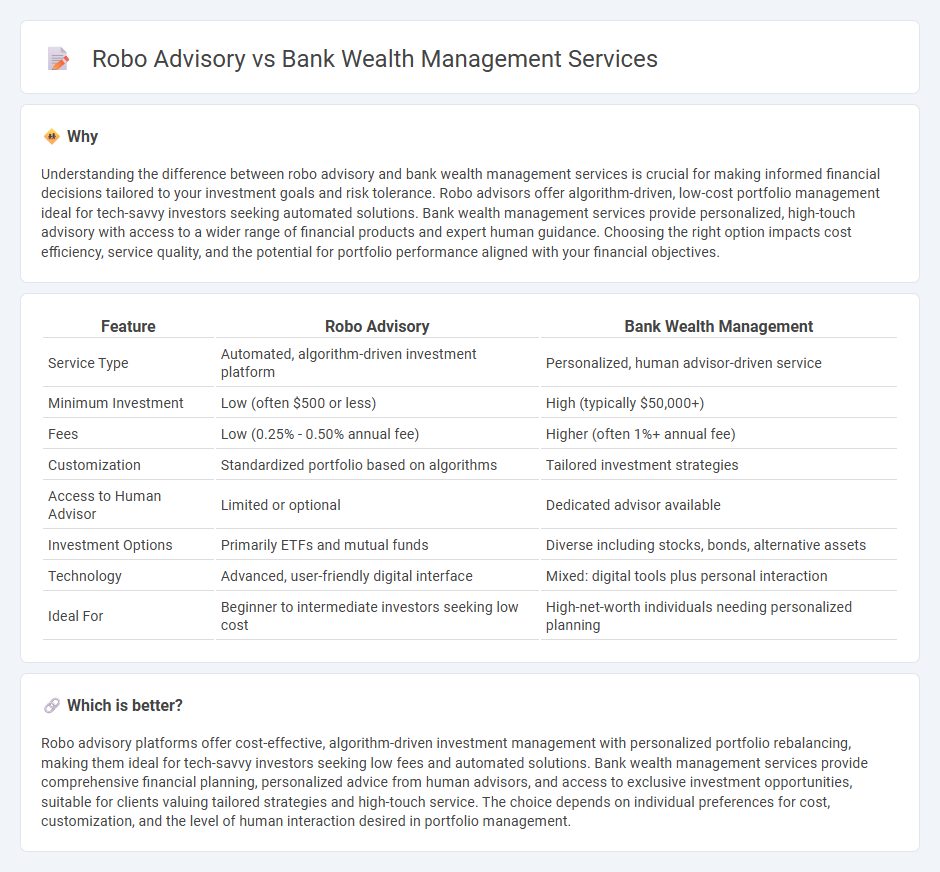

Understanding the difference between robo advisory and bank wealth management services is crucial for making informed financial decisions tailored to your investment goals and risk tolerance. Robo advisors offer algorithm-driven, low-cost portfolio management ideal for tech-savvy investors seeking automated solutions. Bank wealth management services provide personalized, high-touch advisory with access to a wider range of financial products and expert human guidance. Choosing the right option impacts cost efficiency, service quality, and the potential for portfolio performance aligned with your financial objectives.

Comparison Table

| Feature | Robo Advisory | Bank Wealth Management |

|---|---|---|

| Service Type | Automated, algorithm-driven investment platform | Personalized, human advisor-driven service |

| Minimum Investment | Low (often $500 or less) | High (typically $50,000+) |

| Fees | Low (0.25% - 0.50% annual fee) | Higher (often 1%+ annual fee) |

| Customization | Standardized portfolio based on algorithms | Tailored investment strategies |

| Access to Human Advisor | Limited or optional | Dedicated advisor available |

| Investment Options | Primarily ETFs and mutual funds | Diverse including stocks, bonds, alternative assets |

| Technology | Advanced, user-friendly digital interface | Mixed: digital tools plus personal interaction |

| Ideal For | Beginner to intermediate investors seeking low cost | High-net-worth individuals needing personalized planning |

Which is better?

Robo advisory platforms offer cost-effective, algorithm-driven investment management with personalized portfolio rebalancing, making them ideal for tech-savvy investors seeking low fees and automated solutions. Bank wealth management services provide comprehensive financial planning, personalized advice from human advisors, and access to exclusive investment opportunities, suitable for clients valuing tailored strategies and high-touch service. The choice depends on individual preferences for cost, customization, and the level of human interaction desired in portfolio management.

Connection

Robo advisory platforms leverage advanced algorithms and artificial intelligence to provide automated, personalized investment management, complementing traditional bank wealth management services by enhancing portfolio diversification and cost efficiency. Banks integrate robo advisory tools to offer seamless digital experiences, combining automated solutions with human financial advisors to tailor investment strategies for clients. This synergy improves client engagement, optimizes asset allocation, and expands access to sophisticated financial planning for a broader demographic.

Key Terms

Personalization

Bank wealth management services offer highly personalized financial advice through dedicated human advisors who assess clients' unique goals, risk tolerance, and financial situations to tailor investment strategies. Robo advisory platforms use algorithms and automation to provide portfolio management with limited personalization based on predefined risk profiles and client input. Explore detailed comparisons to understand which approach best meets your wealth management needs.

Human Advisory vs. Automation

Bank wealth management services provide personalized human advisory with tailored investment strategies, risk assessments, and continuous relationship management. Robo advisory platforms use algorithm-driven automation to deliver cost-effective, data-driven portfolio management with minimal human intervention. Explore how these contrasting approaches align with your financial goals and preferences.

Fee Structure

Bank wealth management services typically charge a fixed percentage fee based on assets under management, often ranging from 1% to 2%, with possible additional fees for transactions or financial planning. Robo advisory platforms offer lower fees, generally between 0.25% and 0.50%, by using automated algorithms to manage portfolios, minimizing human involvement and operational costs. Explore more to determine which fee structure aligns best with your investment goals and service preferences.

Source and External Links

Personal Wealth Management - Heartland Bank and Trust Company - Offers comprehensive financial planning, portfolio management, and fiduciary services tailored to individual goals and includes business retirement plan customization.

Wealth Management - Merrill Lynch - Provides personalized financial strategies via dedicated advisors, a range of investment solutions (self-directed or guided), and advanced services for complex needs like trust and estate planning.

Wealth Management Banking - U.S. Bank - Delivers personalized banking, lending, and advisory services integrated with overall wealth planning for individuals, families, and business owners.

dowidth.com

dowidth.com