Liquid staking enables users to earn rewards by staking cryptocurrencies while maintaining the ability to trade or use staked assets, providing flexibility and liquidity in decentralized finance (DeFi). Custodial staking involves entrusting assets to a third-party service, which manages staking operations but limits direct control and may introduce counterparty risks. Explore the differences between liquid and custodial staking to optimize your crypto investment strategy.

Why it is important

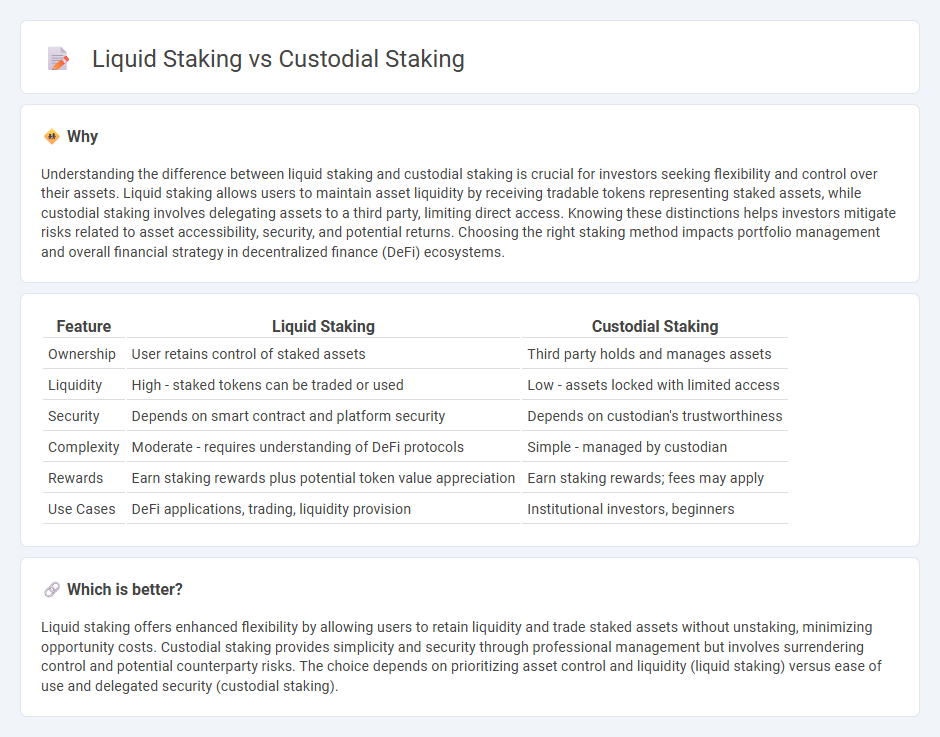

Understanding the difference between liquid staking and custodial staking is crucial for investors seeking flexibility and control over their assets. Liquid staking allows users to maintain asset liquidity by receiving tradable tokens representing staked assets, while custodial staking involves delegating assets to a third party, limiting direct access. Knowing these distinctions helps investors mitigate risks related to asset accessibility, security, and potential returns. Choosing the right staking method impacts portfolio management and overall financial strategy in decentralized finance (DeFi) ecosystems.

Comparison Table

| Feature | Liquid Staking | Custodial Staking |

|---|---|---|

| Ownership | User retains control of staked assets | Third party holds and manages assets |

| Liquidity | High - staked tokens can be traded or used | Low - assets locked with limited access |

| Security | Depends on smart contract and platform security | Depends on custodian's trustworthiness |

| Complexity | Moderate - requires understanding of DeFi protocols | Simple - managed by custodian |

| Rewards | Earn staking rewards plus potential token value appreciation | Earn staking rewards; fees may apply |

| Use Cases | DeFi applications, trading, liquidity provision | Institutional investors, beginners |

Which is better?

Liquid staking offers enhanced flexibility by allowing users to retain liquidity and trade staked assets without unstaking, minimizing opportunity costs. Custodial staking provides simplicity and security through professional management but involves surrendering control and potential counterparty risks. The choice depends on prioritizing asset control and liquidity (liquid staking) versus ease of use and delegated security (custodial staking).

Connection

Liquid staking enhances capital efficiency by allowing stakers to earn rewards while retaining liquidity through tokenized derivatives. Custodial staking involves a third party managing assets, simplifying the staking process but limiting direct control. Combining liquid staking with custodial solutions enables investors to benefit from seamless asset management alongside flexible liquidity options.

Key Terms

Asset Control

Custodial staking requires users to delegate asset control to a third party, which manages private keys and staking processes, potentially increasing counterparty risk and reducing direct ownership. Liquid staking enables users to retain control of their assets by issuing tokenized derivatives representing staked assets, allowing for liquidity and flexibility while earning staking rewards. Explore how these staking methods impact asset security and investment strategies by diving deeper into custodial and liquid staking mechanisms.

Liquidity

Liquid staking offers enhanced liquidity by allowing staked assets to be tokenized and tradeable on secondary markets, unlike custodial staking where assets are locked and inaccessible until the unstaking period ends. Liquid staking protocols such as Lido and Rocket Pool provide users with staking derivatives that retain value and enable participation in DeFi activities. Explore the advantages of liquidity in staking to optimize your crypto asset management.

Yield

Custodial staking typically offers higher yields due to centralized management and reinvestment strategies, while liquid staking provides yield combined with liquidity, allowing users to trade staked assets via derivative tokens. Yield rates vary across platforms; for instance, custodial services like Binance offer around 6-12% APY, whereas liquid staking protocols such as Lido yield approximately 4-7% APY, depending on network conditions. Explore detailed comparisons of staking yields and risks to choose the best strategy for maximizing returns.

Source and External Links

Understanding Custodial Staking: A Secure Way to Earn ... - Custodial staking is a service where a third party, such as a crypto exchange, holds and manages your crypto staking, simplifying the process but requiring trust in the custodian who controls your assets and distributes staking rewards.

Custodial vs. non-custodial staking: which one to choose? - Custodial staking involves relinquishing control of your private keys to a third party who manages the staking and rewards, offering ease of use but increasing risks like hacking, loss of governance rights, and centralization.

Staking - Komainu - Komainu provides custodial staking services tailored for institutional clients, allowing them to earn blockchain staking rewards while the assets remain securely held in custody by Komainu.

dowidth.com

dowidth.com