Private credit involves direct lending to companies or individuals without intermediaries, often targeting mid-sized firms seeking flexible capital solutions. Structured finance encompasses complex financial instruments like asset-backed securities and collateralized loan obligations designed to redistribute risk and optimize capital efficiency. Explore how these financing options differ in risk, return, and accessibility to make informed financial decisions.

Why it is important

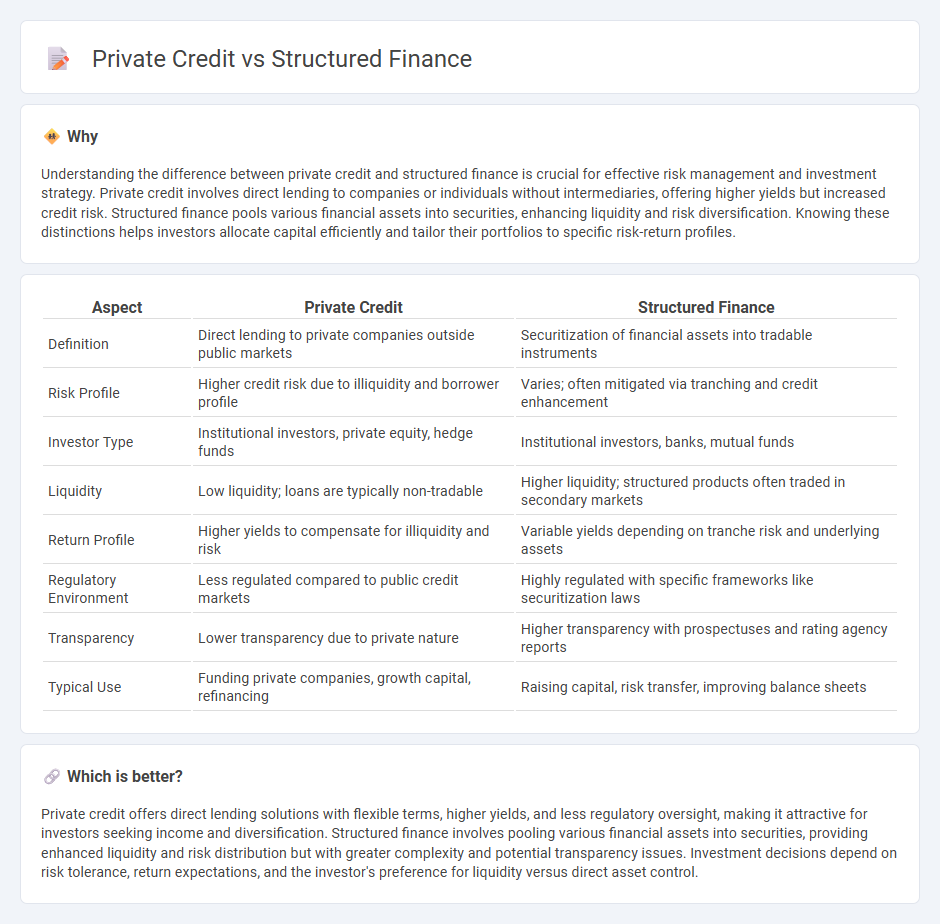

Understanding the difference between private credit and structured finance is crucial for effective risk management and investment strategy. Private credit involves direct lending to companies or individuals without intermediaries, offering higher yields but increased credit risk. Structured finance pools various financial assets into securities, enhancing liquidity and risk diversification. Knowing these distinctions helps investors allocate capital efficiently and tailor their portfolios to specific risk-return profiles.

Comparison Table

| Aspect | Private Credit | Structured Finance |

|---|---|---|

| Definition | Direct lending to private companies outside public markets | Securitization of financial assets into tradable instruments |

| Risk Profile | Higher credit risk due to illiquidity and borrower profile | Varies; often mitigated via tranching and credit enhancement |

| Investor Type | Institutional investors, private equity, hedge funds | Institutional investors, banks, mutual funds |

| Liquidity | Low liquidity; loans are typically non-tradable | Higher liquidity; structured products often traded in secondary markets |

| Return Profile | Higher yields to compensate for illiquidity and risk | Variable yields depending on tranche risk and underlying assets |

| Regulatory Environment | Less regulated compared to public credit markets | Highly regulated with specific frameworks like securitization laws |

| Transparency | Lower transparency due to private nature | Higher transparency with prospectuses and rating agency reports |

| Typical Use | Funding private companies, growth capital, refinancing | Raising capital, risk transfer, improving balance sheets |

Which is better?

Private credit offers direct lending solutions with flexible terms, higher yields, and less regulatory oversight, making it attractive for investors seeking income and diversification. Structured finance involves pooling various financial assets into securities, providing enhanced liquidity and risk distribution but with greater complexity and potential transparency issues. Investment decisions depend on risk tolerance, return expectations, and the investor's preference for liquidity versus direct asset control.

Connection

Private credit and structured finance are interconnected through their roles in providing alternative funding solutions beyond traditional bank loans. Structured finance packages private credit assets, such as loans or receivables, into securities that can be sold to investors, enhancing liquidity and risk distribution. This relationship supports capital market efficiency by enabling tailored financing structures and diversified investment opportunities.

Key Terms

**Structured Finance:**

Structured finance involves complex financial instruments like asset-backed securities (ABS) and collateralized debt obligations (CDOs) designed to manage risk and optimize capital allocation. It leverages underlying assets such as loans or receivables to create tailored investment products that enhance liquidity and credit access for borrowers. Explore how structured finance transforms capital markets and drives efficiency in risk management.

Securitization

Securitization in structured finance involves pooling various financial assets to create marketable securities, enhancing liquidity and risk distribution. Private credit typically bypasses securitization, focusing on direct lending with tailored risk-return profiles for investors. Explore how securitization restructures cash flows and impacts investment strategies in both spheres to understand the nuanced financial dynamics.

Tranching

Structured finance uses tranching to divide financial products into layers with varying risk and return, providing tailored investment opportunities for different risk appetites. Private credit typically involves direct lending without tranching, offering investors a single risk/return profile and fewer liquidity options. Explore the nuances of tranching in structured finance and its impact on investment strategies for a deeper understanding.

Source and External Links

Structured Finance - Overview, Securitization, and Examples - Structured finance involves financial instruments that manage risks related to complex assets, often using securitization to pool assets and create financing solutions for large borrowers with complex needs beyond traditional loans.

Structured finance - Wikipedia - Structured finance uses securitization and tranching to pool assets into different classes of securities, facilitating risk transfer, better capital use, and cheaper funding especially for borrowers with lower credit ratings.

Structured Finance: Deals, Careers, Salaries, and Exit Opps - Structured finance pools loans backed by cash flow into special purpose vehicles, issuing multiple tranches with varying risk and return profiles to provide tailored investment products for diverse asset classes.

dowidth.com

dowidth.com