Liquidity staking offers crypto holders the advantage of earning staking rewards while maintaining asset accessibility, contrasting with money market funds that provide stable returns through short-term debt instruments and high liquidity. Money market funds invest primarily in government securities, certificates of deposit, and commercial paper, ensuring capital preservation and quick redemption. Explore the nuances between these financial options to optimize your investment strategy.

Why it is important

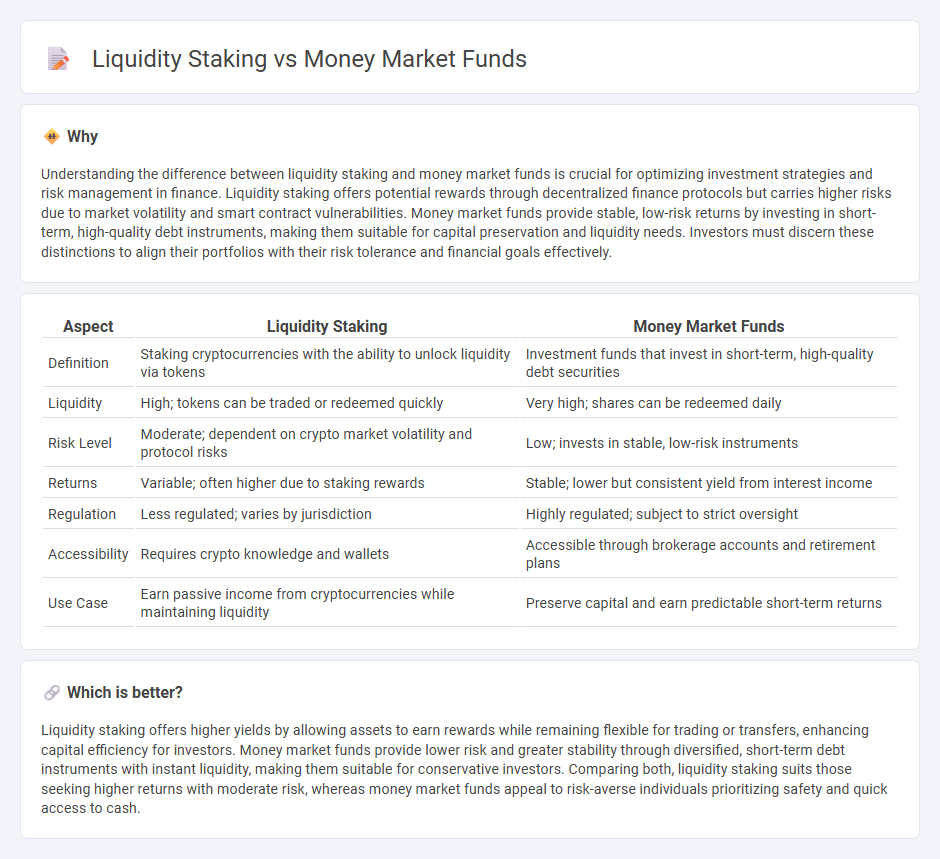

Understanding the difference between liquidity staking and money market funds is crucial for optimizing investment strategies and risk management in finance. Liquidity staking offers potential rewards through decentralized finance protocols but carries higher risks due to market volatility and smart contract vulnerabilities. Money market funds provide stable, low-risk returns by investing in short-term, high-quality debt instruments, making them suitable for capital preservation and liquidity needs. Investors must discern these distinctions to align their portfolios with their risk tolerance and financial goals effectively.

Comparison Table

| Aspect | Liquidity Staking | Money Market Funds |

|---|---|---|

| Definition | Staking cryptocurrencies with the ability to unlock liquidity via tokens | Investment funds that invest in short-term, high-quality debt securities |

| Liquidity | High; tokens can be traded or redeemed quickly | Very high; shares can be redeemed daily |

| Risk Level | Moderate; dependent on crypto market volatility and protocol risks | Low; invests in stable, low-risk instruments |

| Returns | Variable; often higher due to staking rewards | Stable; lower but consistent yield from interest income |

| Regulation | Less regulated; varies by jurisdiction | Highly regulated; subject to strict oversight |

| Accessibility | Requires crypto knowledge and wallets | Accessible through brokerage accounts and retirement plans |

| Use Case | Earn passive income from cryptocurrencies while maintaining liquidity | Preserve capital and earn predictable short-term returns |

Which is better?

Liquidity staking offers higher yields by allowing assets to earn rewards while remaining flexible for trading or transfers, enhancing capital efficiency for investors. Money market funds provide lower risk and greater stability through diversified, short-term debt instruments with instant liquidity, making them suitable for conservative investors. Comparing both, liquidity staking suits those seeking higher returns with moderate risk, whereas money market funds appeal to risk-averse individuals prioritizing safety and quick access to cash.

Connection

Liquidity staking enhances capital efficiency by enabling staked assets to remain liquid and participate in decentralized finance (DeFi) protocols. Money market funds offer low-risk, highly liquid investment options that complement liquidity staking by providing stable returns and quick access to cash. The integration of liquidity staking with money market funds fosters a balanced approach to yield generation while maintaining asset liquidity in financial portfolios.

Key Terms

Yield

Money market funds offer stable returns typically ranging from 3% to 5% annually by investing in short-term, low-risk instruments like Treasury bills and commercial paper. Liquidity staking can yield higher average returns, often between 7% and 15%, by enabling asset holders to earn staking rewards while maintaining liquidity through tokenized derivatives. Explore more to discover which yield strategy aligns best with your financial goals and risk tolerance.

Redemption

Money market funds offer high liquidity with daily redemption options, allowing investors quick access to their funds without significant penalties. Liquidity staking involves locking assets for a specific period, often leading to delayed redemption or potential exit fees, but it compensates with staking rewards. Explore the nuances of redemption features to make an informed choice between money market funds and liquidity staking options.

Underlying Asset

Money market funds primarily invest in short-term, high-quality debt instruments such as Treasury bills, commercial paper, and certificates of deposit, providing stability and liquidity. Liquidity staking involves locking up blockchain-based assets like Ethereum or other cryptocurrencies to support network operations and earn rewards, while maintaining asset accessibility. Explore the distinct risk profiles and potential returns of both to better understand their underlying assets.

Source and External Links

Money market fund - Wikipedia - A money market fund is an open-end mutual fund investing in short-term, highly liquid debt securities such as US Treasury bills, aiming to maintain a stable asset value and provide dividend income while managing credit, market, and liquidity risks, and regulated under the Investment Company Act of 1940 in the US.

What is a money market fund and how do they work? - Vanguard - Money market funds invest in low-risk, short-term debt instruments, offering a safe, liquid investment option with typically higher yields than bank savings accounts and are often used to hold emergency funds or short-term savings.

Money Market Funds | Charles Schwab - Money market funds invest in high-quality short-term securities and come in several types including prime, government/treasury, and municipal funds, offering investors options with varying tax benefits and share price stability.

dowidth.com

dowidth.com