Green bond laddering involves strategically staggering maturities of green bonds to manage liquidity and reinvestment risks while supporting environmentally-friendly projects. Sustainability-linked bonds tie financial performance to achieving specific ESG targets, offering flexibility without earmarking proceeds for designated projects. Explore further to understand which financing strategy aligns best with your sustainable investment goals.

Why it is important

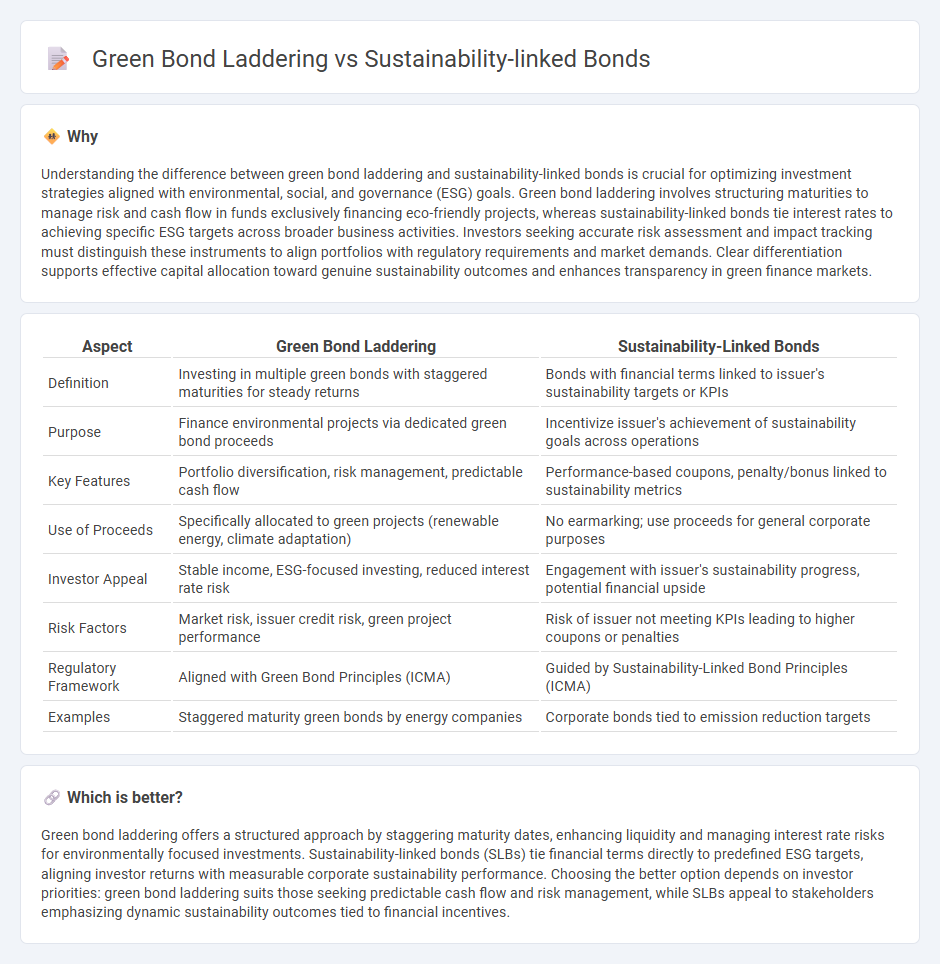

Understanding the difference between green bond laddering and sustainability-linked bonds is crucial for optimizing investment strategies aligned with environmental, social, and governance (ESG) goals. Green bond laddering involves structuring maturities to manage risk and cash flow in funds exclusively financing eco-friendly projects, whereas sustainability-linked bonds tie interest rates to achieving specific ESG targets across broader business activities. Investors seeking accurate risk assessment and impact tracking must distinguish these instruments to align portfolios with regulatory requirements and market demands. Clear differentiation supports effective capital allocation toward genuine sustainability outcomes and enhances transparency in green finance markets.

Comparison Table

| Aspect | Green Bond Laddering | Sustainability-Linked Bonds |

|---|---|---|

| Definition | Investing in multiple green bonds with staggered maturities for steady returns | Bonds with financial terms linked to issuer's sustainability targets or KPIs |

| Purpose | Finance environmental projects via dedicated green bond proceeds | Incentivize issuer's achievement of sustainability goals across operations |

| Key Features | Portfolio diversification, risk management, predictable cash flow | Performance-based coupons, penalty/bonus linked to sustainability metrics |

| Use of Proceeds | Specifically allocated to green projects (renewable energy, climate adaptation) | No earmarking; use proceeds for general corporate purposes |

| Investor Appeal | Stable income, ESG-focused investing, reduced interest rate risk | Engagement with issuer's sustainability progress, potential financial upside |

| Risk Factors | Market risk, issuer credit risk, green project performance | Risk of issuer not meeting KPIs leading to higher coupons or penalties |

| Regulatory Framework | Aligned with Green Bond Principles (ICMA) | Guided by Sustainability-Linked Bond Principles (ICMA) |

| Examples | Staggered maturity green bonds by energy companies | Corporate bonds tied to emission reduction targets |

Which is better?

Green bond laddering offers a structured approach by staggering maturity dates, enhancing liquidity and managing interest rate risks for environmentally focused investments. Sustainability-linked bonds (SLBs) tie financial terms directly to predefined ESG targets, aligning investor returns with measurable corporate sustainability performance. Choosing the better option depends on investor priorities: green bond laddering suits those seeking predictable cash flow and risk management, while SLBs appeal to stakeholders emphasizing dynamic sustainability outcomes tied to financial incentives.

Connection

Green bond laddering structures staggered maturities of eco-friendly debt, enabling investors to manage cash flow while supporting environmental projects, whereas sustainability-linked bonds tie interest rates to achieving specific ESG targets, creating performance-based incentives. Both instruments drive capital toward sustainable finance by aligning investment returns with environmental and social goals, enhancing market appeal and risk management for green initiatives. Integrating these strategies optimizes portfolio diversification and impact measurement within ESG-focused investment frameworks.

Key Terms

Use of Proceeds

Sustainability-linked bonds (SLBs) link financial performance to predefined environmental, social, or governance (ESG) targets without earmarking funds for specific projects, whereas green bond laddering involves issuing green bonds with proceeds exclusively allocated to environmentally beneficial projects, emphasizing transparency and impact. SLBs focus on incentivizing overall corporate sustainability performance, while green bond laddering ensures diversified and staged investments into verified green initiatives over time. Explore more to understand how these financing tools differ in driving sustainable investments and meeting ESG goals.

Performance Targets

Sustainability-linked bonds (SLBs) set specific, measurable performance targets tied to environmental or social outcomes, encouraging issuers to meet ambitious sustainability goals. Green bond laddering involves issuing a series of green bonds with staggered maturities, providing steady capital for projects aligned with environmental objectives but often without linked performance metrics. Discover how performance target structuring impacts investment strategies and risk management in sustainable finance.

Maturity Structuring

Sustainability-linked bonds (SLBs) focus on issuer-wide ESG performance targets, impacting coupon payments based on achieving specific sustainability KPIs, while green bond laddering structures multiple green bonds with staggered maturities to manage cash flow and investment horizon risks. Maturity structuring in SLBs demands alignment with ESG targets' timelines, emphasizing flexibility and performance monitoring, whereas green bond ladders optimize liquidity and risk diversification across fixed green projects. Explore detailed strategies for maturity structuring in sustainable finance to enhance portfolio resilience and impact.

Source and External Links

Sustainability linked bonds: how they can support net-zero - Sustainability linked bonds (SLBs) are borrowing instruments where financial terms depend on whether issuers meet sustainability or ESG targets, offering incentives such as lower interest rates for achieving goals, and they provide flexibility since the funds are not tied to specific projects, unlike green bonds.

Sustainability-Linked Bond Principles (SLBP) - ICMA - The Sustainability-Linked Bond Principles provide guidelines to ensure transparency, disclosure, and rigorous structuring of SLBs to support their role in funding sustainability commitments across various industries and instruments.

Sustainability-linked bonds | Global law firm | Norton Rose Fulbright - SLBs do not require proceeds to be allocated to green projects specifically; for example, ENEL issued an SLB linked to its target to increase renewable energy capacity, and the bond attracted a significant ESG-focused investor base, with financial benefits such as pricing advantages compared to traditional bonds.

dowidth.com

dowidth.com