Digital asset custody involves securing cryptocurrencies and digital tokens through specialized technology platforms designed to prevent unauthorized access and theft. Qualified custodians are regulated entities, such as banks or trust companies, that provide legally compliant safeguarding of client assets, including digital securities, ensuring adherence to financial regulations. Explore the critical differences and regulatory implications between digital asset custody and qualified custodians to enhance your investment security.

Why it is important

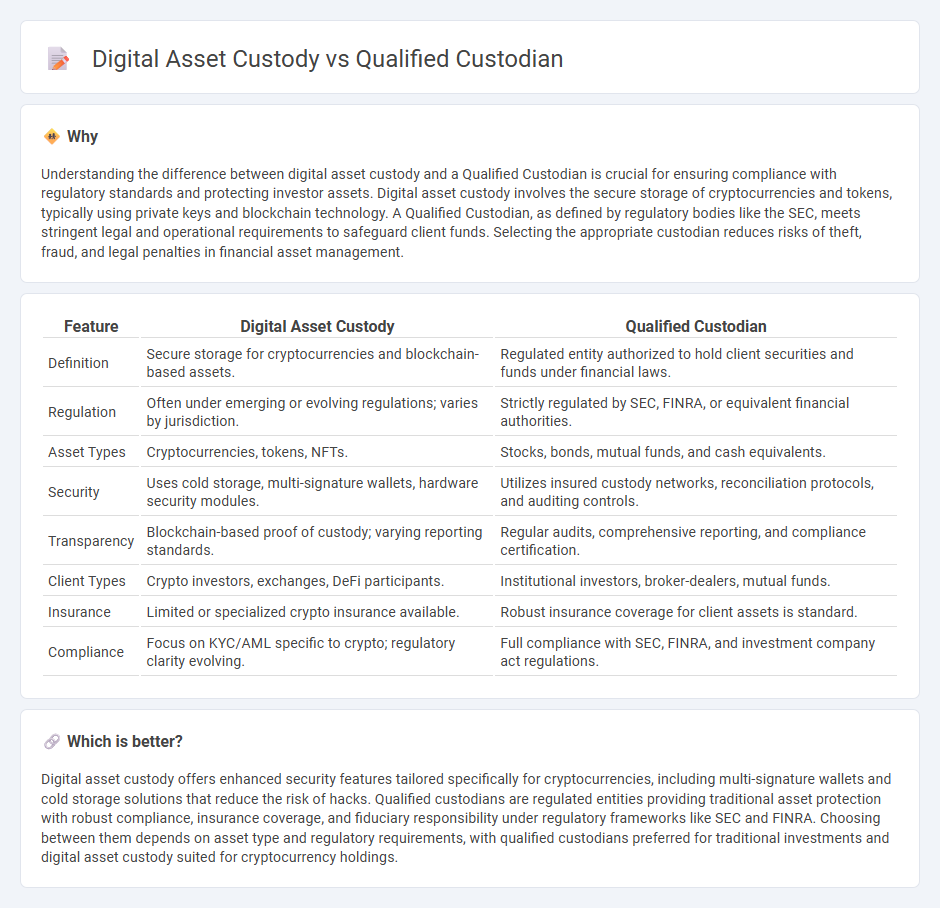

Understanding the difference between digital asset custody and a Qualified Custodian is crucial for ensuring compliance with regulatory standards and protecting investor assets. Digital asset custody involves the secure storage of cryptocurrencies and tokens, typically using private keys and blockchain technology. A Qualified Custodian, as defined by regulatory bodies like the SEC, meets stringent legal and operational requirements to safeguard client funds. Selecting the appropriate custodian reduces risks of theft, fraud, and legal penalties in financial asset management.

Comparison Table

| Feature | Digital Asset Custody | Qualified Custodian |

|---|---|---|

| Definition | Secure storage for cryptocurrencies and blockchain-based assets. | Regulated entity authorized to hold client securities and funds under financial laws. |

| Regulation | Often under emerging or evolving regulations; varies by jurisdiction. | Strictly regulated by SEC, FINRA, or equivalent financial authorities. |

| Asset Types | Cryptocurrencies, tokens, NFTs. | Stocks, bonds, mutual funds, and cash equivalents. |

| Security | Uses cold storage, multi-signature wallets, hardware security modules. | Utilizes insured custody networks, reconciliation protocols, and auditing controls. |

| Transparency | Blockchain-based proof of custody; varying reporting standards. | Regular audits, comprehensive reporting, and compliance certification. |

| Client Types | Crypto investors, exchanges, DeFi participants. | Institutional investors, broker-dealers, mutual funds. |

| Insurance | Limited or specialized crypto insurance available. | Robust insurance coverage for client assets is standard. |

| Compliance | Focus on KYC/AML specific to crypto; regulatory clarity evolving. | Full compliance with SEC, FINRA, and investment company act regulations. |

Which is better?

Digital asset custody offers enhanced security features tailored specifically for cryptocurrencies, including multi-signature wallets and cold storage solutions that reduce the risk of hacks. Qualified custodians are regulated entities providing traditional asset protection with robust compliance, insurance coverage, and fiduciary responsibility under regulatory frameworks like SEC and FINRA. Choosing between them depends on asset type and regulatory requirements, with qualified custodians preferred for traditional investments and digital asset custody suited for cryptocurrency holdings.

Connection

Digital asset custody involves securely storing cryptocurrencies and blockchain-based tokens, requiring specialized services to protect against theft and loss. Qualified custodians are regulated entities that meet stringent compliance standards, providing trusted safeguarding solutions for digital assets in financial markets. Their role ensures investor protection and regulatory adherence, bridging the gap between digital asset technology and traditional financial oversight.

Key Terms

Regulatory compliance

Qualified custodians adhere to strict regulatory frameworks established by entities such as the SEC and FINRA, ensuring secure handling of digital and traditional assets under compliance guidelines like the Investment Advisers Act. Digital asset custody solutions often incorporate advanced cryptographic security but may face evolving regulatory challenges due to the nascent nature of cryptocurrency regulations across jurisdictions. Explore more to understand how regulatory compliance shapes the future of digital asset security.

Asset segregation

Qualified custodians provide regulated asset segregation ensuring client assets are held separately from the custodian's own holdings, reducing counterparty risk and enhancing security. Digital asset custody leverages blockchain technology for cryptographic protection but may lack standardized regulatory oversight for segregation. Explore how these distinctions impact your asset protection strategy today.

Private key management

Qualified custodians provide regulated, insured storage solutions for digital assets, ensuring compliance with legal frameworks and offering institutional-grade security. Digital asset custody, especially non-custodial models, emphasizes private key management through encryption, multi-signature protocols, and hardware wallets to maintain user control and prevent unauthorized access. Explore advanced private key management techniques to safeguard digital assets effectively.

Source and External Links

SEC Overhaul of Custody Rule: Implications for Qualified Custodians - A qualified custodian is defined as a bank, savings association, registered broker-dealer, registered futures commission merchant, or certain foreign financial institutions that meet specified conditions to safeguard client assets, including segregation of client assets, indemnification for losses due to negligence, and cooperation with independent auditors.

Final Rule: Custody of Funds or Securities of Clients by ... - SEC.gov - Qualified custodians include banks, savings associations, broker-dealers, futures commission merchants, and qualified foreign financial institutions that hold client funds or securities in accounts under the client's or adviser's name as agent or trustee.

Investor Bulletin: Custody of Your Investment Assets - Investment advisers are generally required to maintain client funds and securities with qualified custodians who hold clients' assets in separate accounts under each client's name or under the adviser's name as agent or trustee, ensuring protection and segregation of assets.

dowidth.com

dowidth.com