Carbon trading involves buying and selling carbon credits to reduce greenhouse gas emissions, creating market incentives for emission reductions. Climate finance refers to investments and funding mechanisms aimed at supporting climate change mitigation and adaptation projects worldwide. Explore how these financial tools drive sustainable environmental solutions.

Why it is important

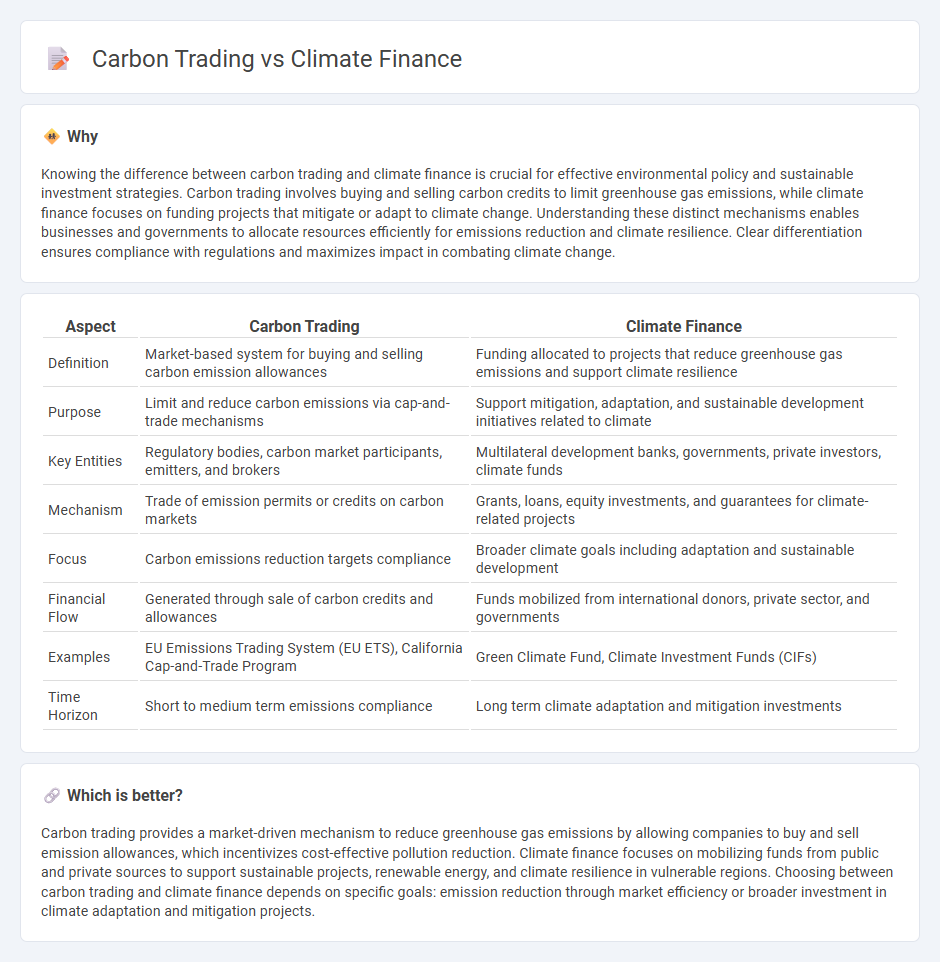

Knowing the difference between carbon trading and climate finance is crucial for effective environmental policy and sustainable investment strategies. Carbon trading involves buying and selling carbon credits to limit greenhouse gas emissions, while climate finance focuses on funding projects that mitigate or adapt to climate change. Understanding these distinct mechanisms enables businesses and governments to allocate resources efficiently for emissions reduction and climate resilience. Clear differentiation ensures compliance with regulations and maximizes impact in combating climate change.

Comparison Table

| Aspect | Carbon Trading | Climate Finance |

|---|---|---|

| Definition | Market-based system for buying and selling carbon emission allowances | Funding allocated to projects that reduce greenhouse gas emissions and support climate resilience |

| Purpose | Limit and reduce carbon emissions via cap-and-trade mechanisms | Support mitigation, adaptation, and sustainable development initiatives related to climate |

| Key Entities | Regulatory bodies, carbon market participants, emitters, and brokers | Multilateral development banks, governments, private investors, climate funds |

| Mechanism | Trade of emission permits or credits on carbon markets | Grants, loans, equity investments, and guarantees for climate-related projects |

| Focus | Carbon emissions reduction targets compliance | Broader climate goals including adaptation and sustainable development |

| Financial Flow | Generated through sale of carbon credits and allowances | Funds mobilized from international donors, private sector, and governments |

| Examples | EU Emissions Trading System (EU ETS), California Cap-and-Trade Program | Green Climate Fund, Climate Investment Funds (CIFs) |

| Time Horizon | Short to medium term emissions compliance | Long term climate adaptation and mitigation investments |

Which is better?

Carbon trading provides a market-driven mechanism to reduce greenhouse gas emissions by allowing companies to buy and sell emission allowances, which incentivizes cost-effective pollution reduction. Climate finance focuses on mobilizing funds from public and private sources to support sustainable projects, renewable energy, and climate resilience in vulnerable regions. Choosing between carbon trading and climate finance depends on specific goals: emission reduction through market efficiency or broader investment in climate adaptation and mitigation projects.

Connection

Carbon trading and climate finance are interconnected mechanisms that drive investment toward reducing greenhouse gas emissions. Carbon trading enables companies to buy and sell emission allowances, creating a financial incentive for lowering carbon footprints, while climate finance mobilizes funds from public and private sectors to support projects aimed at climate change mitigation and adaptation. Both tools work in synergy to channel capital into sustainable initiatives, fostering a low-carbon economy.

Key Terms

**Climate Finance:**

Climate finance involves mobilizing funds from public, private, and alternative sources to support climate change mitigation and adaptation projects globally, especially in developing countries. It prioritizes investment in renewable energy, sustainable infrastructure, and resilience-building initiatives to reduce greenhouse gas emissions and address climate risks. Explore more about how climate finance drives sustainable development and combats global warming.

Green Bonds

Green Bonds are financial instruments designed to raise capital specifically for projects with positive environmental impacts, such as renewable energy and climate adaptation initiatives, playing a crucial role in climate finance by channeling investments into sustainable development. Carbon trading, on the other hand, involves buying and selling emission allowances or credits to limit greenhouse gas emissions, incentivizing reduction efforts through market mechanisms. Explore how Green Bonds uniquely complement carbon trading strategies to drive global climate goals.

Climate Resilience

Climate finance encompasses funding mechanisms targeting climate change mitigation and adaptation, including grants, loans, and investments to enhance climate resilience in vulnerable communities. Carbon trading, a market-based approach, involves buying and selling carbon credits to incentivize emission reductions but does not directly address adaptation efforts critical for climate resilience. Explore how integrating climate finance with carbon trading strategies can more effectively support resilient infrastructure and sustainable development.

Source and External Links

What is climate finance and why do we need more of it? - Climate finance refers to financial resources and instruments supporting climate change action, including grants, loans, green bonds, and carbon trading, essential for transitioning to a low-carbon economy and building resilience, but current flows need to triple to meet Paris Agreement goals.

Climate finance - Wikipedia - Climate finance includes loans, grants, and budget allocations for climate mitigation and adaptation from public and private sources, with a focus on investments reducing emissions and growing support for renewable energy, but faces challenges in tracking flows and ensuring equitable support.

Global Landscape of Climate Finance 2025 - CPI - Global climate finance reached a record USD 1.9 trillion in 2023, with private finance surpassing public investment for the first time, though emerging economies still face barriers to affordable climate capital.

dowidth.com

dowidth.com