Shadow banking encompasses non-bank financial intermediaries engaging in credit intermediation outside regular banking regulations, often involving entities like hedge funds and money market funds. Mutual funds pool investors' money to purchase diversified portfolios of stocks, bonds, or other securities, offering regulated investment vehicles with transparent operations. Explore the distinctions and implications of shadow banking versus mutual funds for a deeper understanding of financial ecosystems.

Why it is important

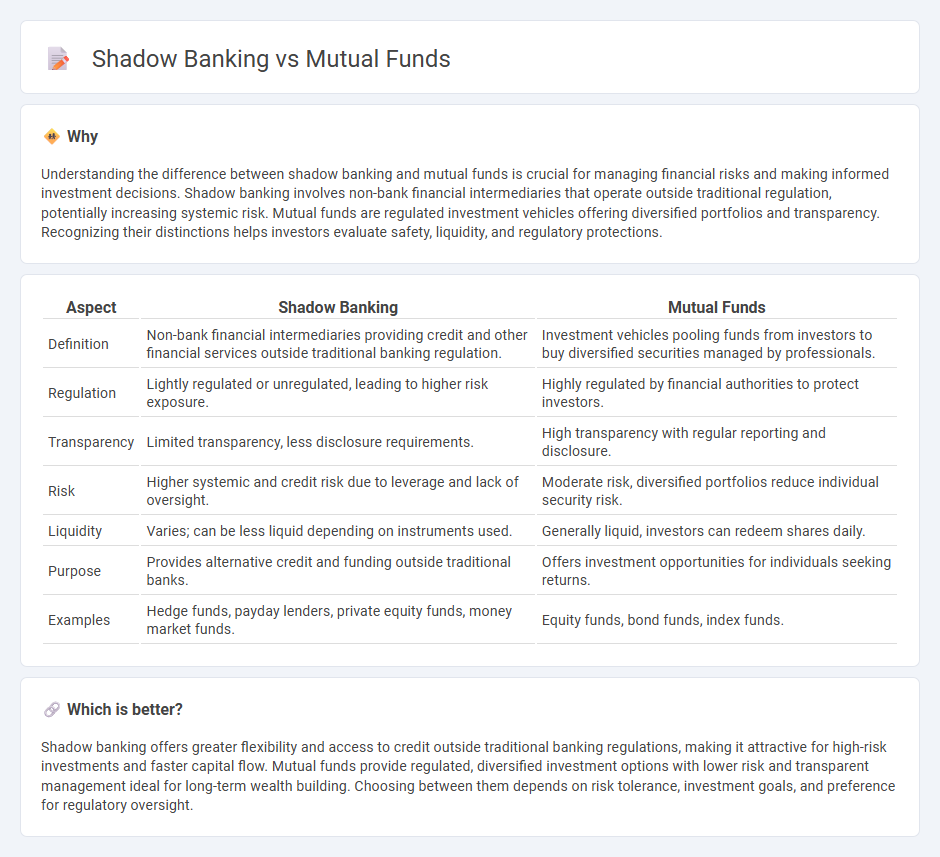

Understanding the difference between shadow banking and mutual funds is crucial for managing financial risks and making informed investment decisions. Shadow banking involves non-bank financial intermediaries that operate outside traditional regulation, potentially increasing systemic risk. Mutual funds are regulated investment vehicles offering diversified portfolios and transparency. Recognizing their distinctions helps investors evaluate safety, liquidity, and regulatory protections.

Comparison Table

| Aspect | Shadow Banking | Mutual Funds |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit and other financial services outside traditional banking regulation. | Investment vehicles pooling funds from investors to buy diversified securities managed by professionals. |

| Regulation | Lightly regulated or unregulated, leading to higher risk exposure. | Highly regulated by financial authorities to protect investors. |

| Transparency | Limited transparency, less disclosure requirements. | High transparency with regular reporting and disclosure. |

| Risk | Higher systemic and credit risk due to leverage and lack of oversight. | Moderate risk, diversified portfolios reduce individual security risk. |

| Liquidity | Varies; can be less liquid depending on instruments used. | Generally liquid, investors can redeem shares daily. |

| Purpose | Provides alternative credit and funding outside traditional banks. | Offers investment opportunities for individuals seeking returns. |

| Examples | Hedge funds, payday lenders, private equity funds, money market funds. | Equity funds, bond funds, index funds. |

Which is better?

Shadow banking offers greater flexibility and access to credit outside traditional banking regulations, making it attractive for high-risk investments and faster capital flow. Mutual funds provide regulated, diversified investment options with lower risk and transparent management ideal for long-term wealth building. Choosing between them depends on risk tolerance, investment goals, and preference for regulatory oversight.

Connection

Shadow banking and mutual funds are interconnected through their roles in providing alternative credit and investment opportunities outside traditional banking systems. Shadow banking entities often rely on mutual funds for liquidity and capital inflows, while mutual funds invest substantial amounts in shadow banking instruments like asset-backed commercial paper and securitized loans. This symbiotic relationship influences market liquidity, credit availability, and systemic risk within the broader financial ecosystem.

Key Terms

Investment Pooling

Mutual funds operate as regulated investment pooling entities that gather capital from multiple investors to invest in diversified portfolios managed by professional fund managers. Shadow banking involves non-bank financial intermediaries that facilitate credit and investment pooling outside traditional regulatory frameworks, often leading to higher risks due to less transparency and oversight. Explore the intricacies of investment pooling in mutual funds and shadow banking to understand their impacts on financial markets.

Regulatory Oversight

Mutual funds operate under stringent regulatory oversight by bodies like the SEC, ensuring transparency, investor protection, and adherence to strict compliance standards. In contrast, shadow banking involves less regulated entities and activities, presenting higher risks due to limited supervision and potential regulatory arbitrage. Explore the differences in regulatory approaches to better understand their impact on financial stability.

Liquidity Risk

Mutual funds provide liquidity by allowing investors to redeem shares at the daily net asset value, while shadow banking entities often involve less transparent and less regulated instruments with higher liquidity risk due to asset illiquidity or redemption restrictions. The opacity and complexity in shadow banking can lead to sudden liquidity shortages during market stress, contrasting with mutual funds' more standardized liquidity profiles. Explore detailed comparisons to understand the implications of liquidity risk in these financial structures.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered open-end investment companies that pool money from many investors to invest in a diversified portfolio of stocks, bonds, and other securities, managed professionally and offering liquidity on any business day.

Mutual fund - Wikipedia - Mutual funds are investment funds pooling money from investors to purchase diversified securities, available as open-end funds bought or sold at net asset value, with advantages including diversification, professional management, and liquidity, but involving fees.

Understanding mutual funds - Charles Schwab - Mutual funds allow investors to pool money to gain diversified exposure to stocks, bonds, and other assets, managed by professionals and offering benefits such as low costs, convenience, and a variety of investment strategies.

dowidth.com

dowidth.com