Synthetic assets replicate the performance of real financial instruments through combinations of derivatives, offering tailored exposure without owning the underlying assets. Derivatives, including options, futures, and swaps, derive value from an underlying asset or benchmark and are primarily used for hedging, speculation, or arbitrage. Explore our detailed analysis on how synthetic assets compare to traditional derivatives in risk management and investment strategies.

Why it is important

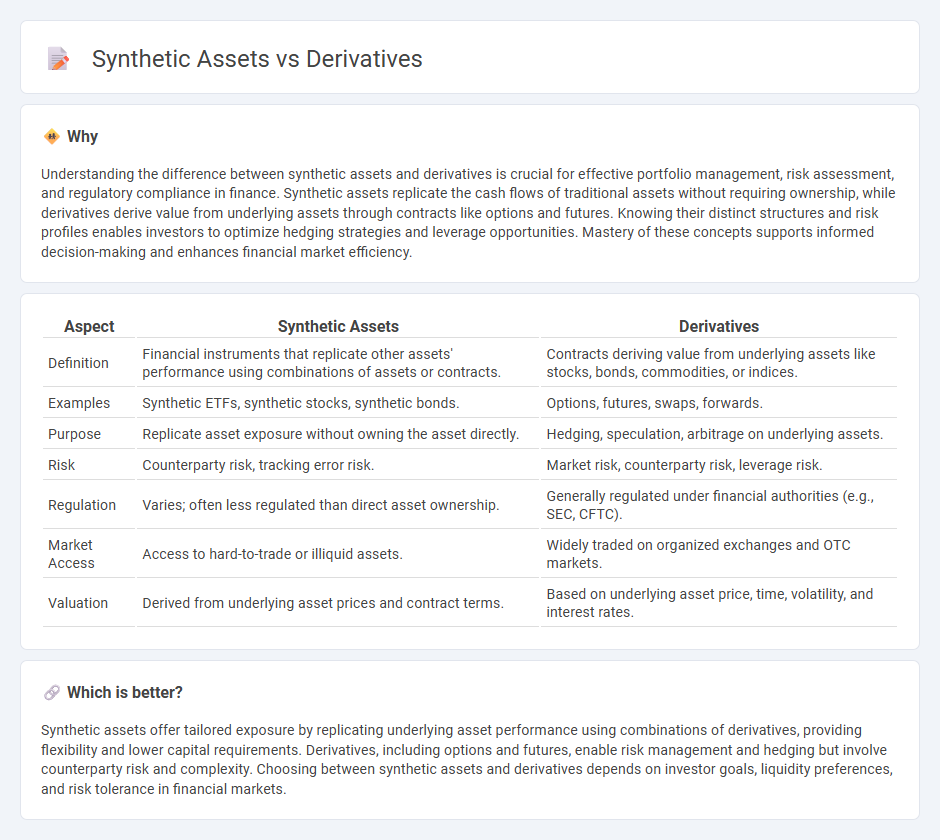

Understanding the difference between synthetic assets and derivatives is crucial for effective portfolio management, risk assessment, and regulatory compliance in finance. Synthetic assets replicate the cash flows of traditional assets without requiring ownership, while derivatives derive value from underlying assets through contracts like options and futures. Knowing their distinct structures and risk profiles enables investors to optimize hedging strategies and leverage opportunities. Mastery of these concepts supports informed decision-making and enhances financial market efficiency.

Comparison Table

| Aspect | Synthetic Assets | Derivatives |

|---|---|---|

| Definition | Financial instruments that replicate other assets' performance using combinations of assets or contracts. | Contracts deriving value from underlying assets like stocks, bonds, commodities, or indices. |

| Examples | Synthetic ETFs, synthetic stocks, synthetic bonds. | Options, futures, swaps, forwards. |

| Purpose | Replicate asset exposure without owning the asset directly. | Hedging, speculation, arbitrage on underlying assets. |

| Risk | Counterparty risk, tracking error risk. | Market risk, counterparty risk, leverage risk. |

| Regulation | Varies; often less regulated than direct asset ownership. | Generally regulated under financial authorities (e.g., SEC, CFTC). |

| Market Access | Access to hard-to-trade or illiquid assets. | Widely traded on organized exchanges and OTC markets. |

| Valuation | Derived from underlying asset prices and contract terms. | Based on underlying asset price, time, volatility, and interest rates. |

Which is better?

Synthetic assets offer tailored exposure by replicating underlying asset performance using combinations of derivatives, providing flexibility and lower capital requirements. Derivatives, including options and futures, enable risk management and hedging but involve counterparty risk and complexity. Choosing between synthetic assets and derivatives depends on investor goals, liquidity preferences, and risk tolerance in financial markets.

Connection

Synthetic assets replicate the performance of real financial instruments using derivatives such as options, futures, and swaps. These derivatives enable investors to gain exposure to underlying assets without owning them directly, enhancing liquidity and risk management. By leveraging derivatives, synthetic assets facilitate tailored investment strategies and efficient market access.

Key Terms

Underlying Asset

Derivatives derive their value directly from an underlying asset such as stocks, commodities, or currencies, enabling investors to hedge risk or speculate on price movements without owning the asset itself. Synthetic assets replicate the performance and payoff of those underlying assets through complex financial engineering, often combining multiple derivatives to mimic ownership or exposure. Explore deeper into how these financial instruments differ and their impact on market strategies.

Hedging

Derivatives such as options and futures provide flexible tools for hedging by enabling investors to lock in prices or transfer risk exposure, effectively mitigating potential losses due to market volatility. Synthetic assets replicate the payoff of traditional financial instruments through combinations of derivatives, allowing tailored hedging strategies without owning the underlying asset. Explore the nuances and applications of derivatives and synthetic assets to enhance your risk management techniques.

Replication

Derivatives such as options and futures derive their value from underlying assets, enabling investors to leverage exposure without owning the asset itself. Synthetic assets replicate the payoff of an asset using a combination of financial instruments, often involving derivatives, to mimic ownership or returns. Explore further to understand how replication strategies optimize portfolio performance and risk management.

Source and External Links

Derivative - In mathematics, a derivative quantifies the sensitivity of a function's output with respect to changes in its input, with higher-order derivatives representing repeated differentiation such as velocity and acceleration in physics contexts.

Derivative (finance) - In finance, derivatives are contracts between parties that derive their value from an underlying asset like stocks or commodities, allowing market risk to be traded without acquiring the asset itself.

Introduction to Derivatives - The derivative of a function is found using the slope formula as the change in y over change in x as Dx approaches zero, and it represents the instantaneous rate of change of the function.

dowidth.com

dowidth.com