Green bonds are debt securities specifically issued to fund environmentally sustainable projects, while sovereign bonds are government-issued instruments used to finance public spending and manage national debt. Green bonds appeal to investors seeking to support climate-friendly initiatives and benefit from potential tax incentives, whereas sovereign bonds attract those prioritizing government creditworthiness and stable returns. Explore further to understand how these bond types impact investment strategies and global finance.

Why it is important

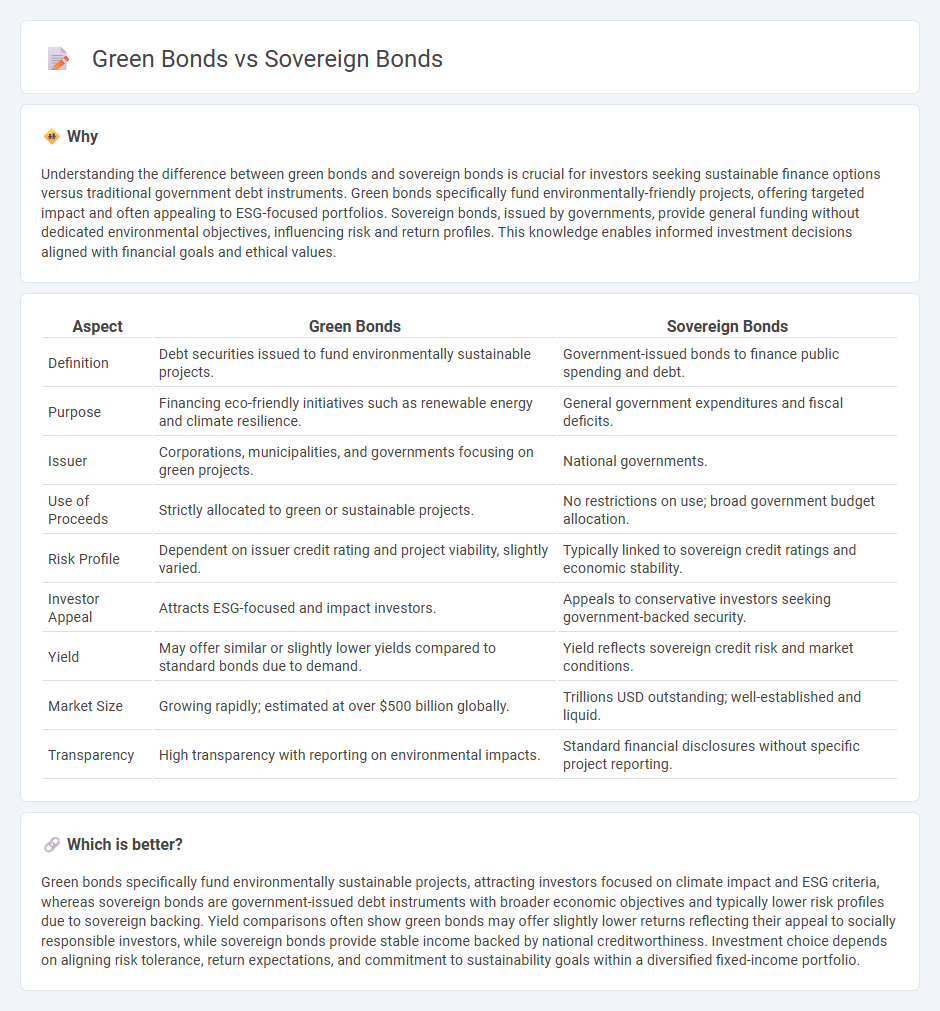

Understanding the difference between green bonds and sovereign bonds is crucial for investors seeking sustainable finance options versus traditional government debt instruments. Green bonds specifically fund environmentally-friendly projects, offering targeted impact and often appealing to ESG-focused portfolios. Sovereign bonds, issued by governments, provide general funding without dedicated environmental objectives, influencing risk and return profiles. This knowledge enables informed investment decisions aligned with financial goals and ethical values.

Comparison Table

| Aspect | Green Bonds | Sovereign Bonds |

|---|---|---|

| Definition | Debt securities issued to fund environmentally sustainable projects. | Government-issued bonds to finance public spending and debt. |

| Purpose | Financing eco-friendly initiatives such as renewable energy and climate resilience. | General government expenditures and fiscal deficits. |

| Issuer | Corporations, municipalities, and governments focusing on green projects. | National governments. |

| Use of Proceeds | Strictly allocated to green or sustainable projects. | No restrictions on use; broad government budget allocation. |

| Risk Profile | Dependent on issuer credit rating and project viability, slightly varied. | Typically linked to sovereign credit ratings and economic stability. |

| Investor Appeal | Attracts ESG-focused and impact investors. | Appeals to conservative investors seeking government-backed security. |

| Yield | May offer similar or slightly lower yields compared to standard bonds due to demand. | Yield reflects sovereign credit risk and market conditions. |

| Market Size | Growing rapidly; estimated at over $500 billion globally. | Trillions USD outstanding; well-established and liquid. |

| Transparency | High transparency with reporting on environmental impacts. | Standard financial disclosures without specific project reporting. |

Which is better?

Green bonds specifically fund environmentally sustainable projects, attracting investors focused on climate impact and ESG criteria, whereas sovereign bonds are government-issued debt instruments with broader economic objectives and typically lower risk profiles due to sovereign backing. Yield comparisons often show green bonds may offer slightly lower returns reflecting their appeal to socially responsible investors, while sovereign bonds provide stable income backed by national creditworthiness. Investment choice depends on aligning risk tolerance, return expectations, and commitment to sustainability goals within a diversified fixed-income portfolio.

Connection

Green bonds and sovereign bonds intersect as governments issue sovereign green bonds to fund environmentally sustainable projects, integrating public finance with climate action goals. Sovereign green bonds provide a mechanism for raising capital dedicated specifically to renewable energy, clean transportation, and climate resilience initiatives, aligning fiscal policies with the Paris Agreement targets. This connection enhances transparency and accountability in public investment while attracting ESG-focused investors to sovereign debt markets.

Key Terms

Credit Risk

Sovereign bonds typically carry credit risk tied to a country's economic stability, political conditions, and debt levels, influencing the likelihood of default and affecting investor confidence. Green bonds, while often issued by sovereigns, focus on financing environmentally sustainable projects, and their credit risk depends on both the issuer's creditworthiness and the success of the projects funded. Explore the nuances of credit risk in sovereign and green bonds to make informed investment decisions.

Environmental Impact

Sovereign bonds finance government-led projects without specific environmental criteria, while green bonds are dedicated to funding environmentally sustainable initiatives such as renewable energy, pollution reduction, and conservation efforts. Green bonds are verified through frameworks like the Climate Bonds Initiative, ensuring transparency and accountability in environmental impact. Explore detailed comparisons of sovereign bonds and green bonds to understand their roles in sustainable finance.

Yield Spread

Sovereign bonds typically offer lower yield spreads due to their strong credit ratings backed by governments, while green bonds often present slightly higher yield spreads reflecting their eco-friendly project focus and varying issuer credit qualities. The yield spread difference highlights investor demand for risk-adjusted returns and the growing market preference for sustainable investments. Explore the detailed yield spread dynamics between sovereign and green bonds to enhance your fixed-income portfolio strategy.

Source and External Links

Government bond - Wikipedia - Sovereign bonds are government-issued debt securities to finance public spending, involving periodic interest payments and repayment of face value at maturity, and carry default risk evaluated by credit rating agencies.

Sovereign bonds | Robeco USA - Sovereign bonds are national government debt instruments considered relatively low-risk, used to finance public spending and manage debt, and are assessed by credit rating agencies based on economic and political stability.

Sovereign Bond - Overview, Yields, and Associated Risks - These bonds fund government spending or debt repayment, are issued in local or foreign currencies, and yield rates vary by a country's creditworthiness and economic risks.

dowidth.com

dowidth.com