AI-driven portfolios utilize advanced algorithms and machine learning to analyze vast market data, optimizing asset allocation for enhanced risk management and personalized investment strategies. Growth investing portfolios focus on capital appreciation by targeting stocks with high potential earnings growth, often emphasizing innovative and emerging companies. Explore how these distinct approaches can align with your financial goals and risk tolerance.

Why it is important

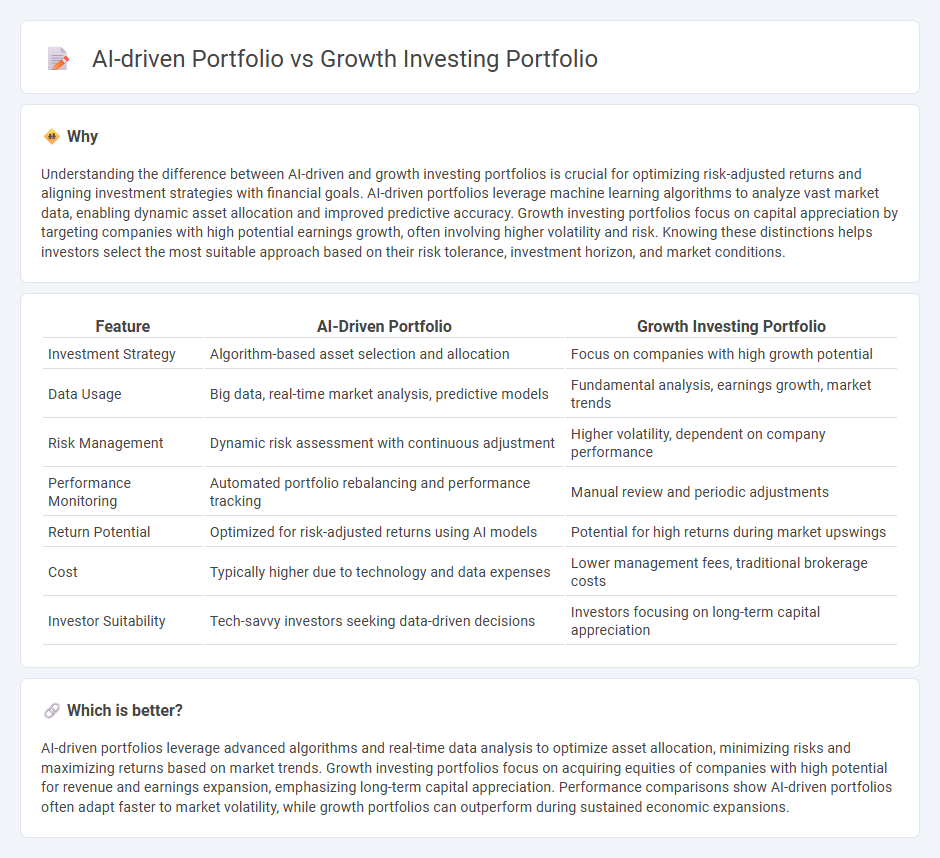

Understanding the difference between AI-driven and growth investing portfolios is crucial for optimizing risk-adjusted returns and aligning investment strategies with financial goals. AI-driven portfolios leverage machine learning algorithms to analyze vast market data, enabling dynamic asset allocation and improved predictive accuracy. Growth investing portfolios focus on capital appreciation by targeting companies with high potential earnings growth, often involving higher volatility and risk. Knowing these distinctions helps investors select the most suitable approach based on their risk tolerance, investment horizon, and market conditions.

Comparison Table

| Feature | AI-Driven Portfolio | Growth Investing Portfolio |

|---|---|---|

| Investment Strategy | Algorithm-based asset selection and allocation | Focus on companies with high growth potential |

| Data Usage | Big data, real-time market analysis, predictive models | Fundamental analysis, earnings growth, market trends |

| Risk Management | Dynamic risk assessment with continuous adjustment | Higher volatility, dependent on company performance |

| Performance Monitoring | Automated portfolio rebalancing and performance tracking | Manual review and periodic adjustments |

| Return Potential | Optimized for risk-adjusted returns using AI models | Potential for high returns during market upswings |

| Cost | Typically higher due to technology and data expenses | Lower management fees, traditional brokerage costs |

| Investor Suitability | Tech-savvy investors seeking data-driven decisions | Investors focusing on long-term capital appreciation |

Which is better?

AI-driven portfolios leverage advanced algorithms and real-time data analysis to optimize asset allocation, minimizing risks and maximizing returns based on market trends. Growth investing portfolios focus on acquiring equities of companies with high potential for revenue and earnings expansion, emphasizing long-term capital appreciation. Performance comparisons show AI-driven portfolios often adapt faster to market volatility, while growth portfolios can outperform during sustained economic expansions.

Connection

AI-driven portfolio management leverages machine learning algorithms to analyze vast datasets, identifying patterns that optimize growth investing strategies. Growth investing portfolios focus on companies with strong potential for capital appreciation, which AI tools enhance by predicting market trends and evaluating risk factors in real time. Integration of AI enables more accurate stock selection and dynamic portfolio adjustments, improving returns and managing volatility in growth-focused investments.

Key Terms

**Growth Investing Portfolio:**

Growth investing portfolios prioritize companies exhibiting above-average earnings growth, often in sectors like technology, healthcare, and consumer discretionary, leveraging fundamental analysis to identify future market leaders. These portfolios typically emphasize reinvestment of earnings for expansion, high price-to-earnings (P/E) ratios, and strong revenue updates, targeting capital appreciation over dividends. Discover the strategic benefits and risks of growth-focused investments to enhance your portfolio's performance.

Earnings Per Share (EPS) Growth

Growth investing portfolios prioritize companies with consistent earnings per share (EPS) growth rates above 15%, indicating robust fundamental expansion and market competitiveness. AI-driven portfolios leverage machine learning algorithms to identify patterns and predict future EPS growth, often uncovering high-potential stocks overlooked by traditional analysis. Explore the advantages of each strategy to optimize your investment approach.

Price-to-Earnings (P/E) Ratio

Growth investing portfolios typically prioritize companies with high Price-to-Earnings (P/E) ratios, reflecting strong future earnings potential and market optimism about expansion prospects. AI-driven portfolios use advanced algorithms and machine learning to analyze vast datasets, dynamically adjusting holdings based on real-time P/E ratio fluctuations alongside other financial indicators. Explore how integrating AI technologies can refine investment strategies and optimize portfolio performance.

Source and External Links

Aggressive Growth Portfolio - Permanent Portfolio Fund - This portfolio aims for high long-term appreciation by investing fully in stocks expected to grow faster than the market, diversified across various industries and market caps, avoiding market timing risks by staying fully invested at all times.

3 Ways to Invest for Potential Growth | Morgan Stanley at Work - Growth investing focuses on stocks expected to grow faster than the market, often in innovative industries, suitable for investors with a longer time horizon and higher risk tolerance aiming for capital appreciation rather than income.

Growth Portfolio - AAII Growth Investing - AAII provides an evidence-based approach to growth investing by targeting secular growth stocks with consistent long-term growth potential and offers a model 20-stock portfolio to subscribers.

dowidth.com

dowidth.com