Dim sum bonds are yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, attracting investors seeking exposure to Chinese currency and economic growth. Samurai bonds, on the other hand, are yen-denominated bonds issued by foreign entities in Japan, offering access to the Japanese capital market with the stability of the yen. Explore the unique features and investment opportunities of dim sum and Samurai bonds to optimize your global fixed-income portfolio.

Why it is important

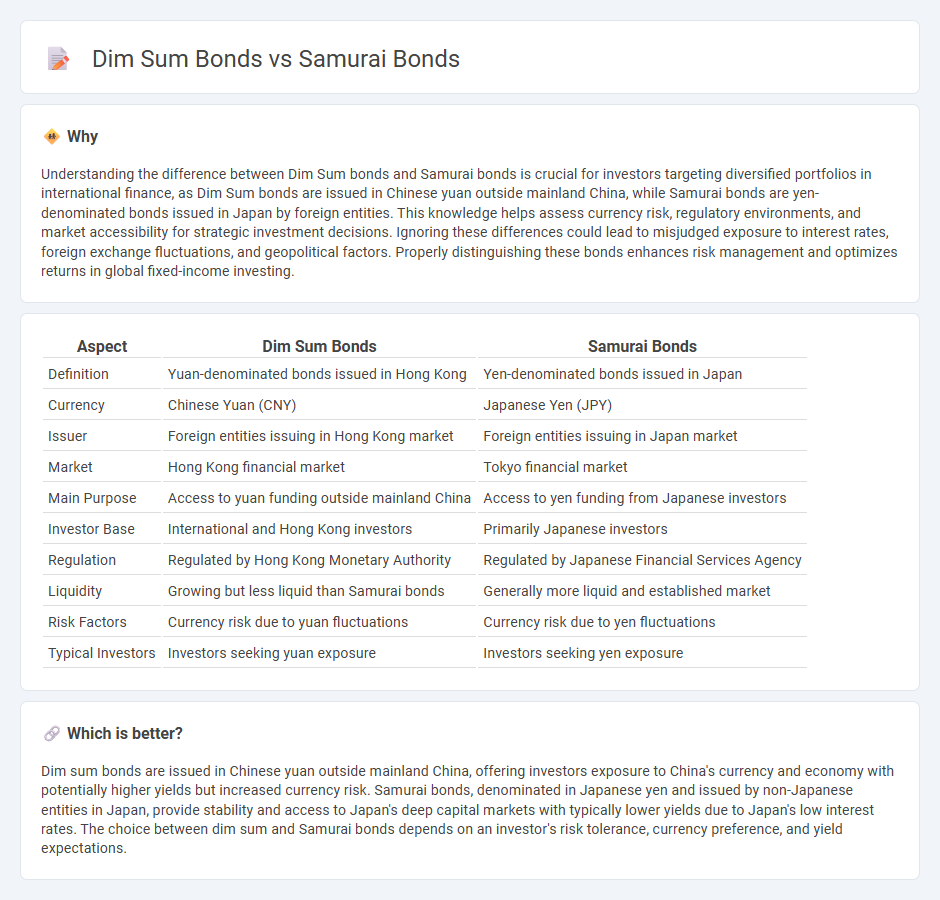

Understanding the difference between Dim Sum bonds and Samurai bonds is crucial for investors targeting diversified portfolios in international finance, as Dim Sum bonds are issued in Chinese yuan outside mainland China, while Samurai bonds are yen-denominated bonds issued in Japan by foreign entities. This knowledge helps assess currency risk, regulatory environments, and market accessibility for strategic investment decisions. Ignoring these differences could lead to misjudged exposure to interest rates, foreign exchange fluctuations, and geopolitical factors. Properly distinguishing these bonds enhances risk management and optimizes returns in global fixed-income investing.

Comparison Table

| Aspect | Dim Sum Bonds | Samurai Bonds |

|---|---|---|

| Definition | Yuan-denominated bonds issued in Hong Kong | Yen-denominated bonds issued in Japan |

| Currency | Chinese Yuan (CNY) | Japanese Yen (JPY) |

| Issuer | Foreign entities issuing in Hong Kong market | Foreign entities issuing in Japan market |

| Market | Hong Kong financial market | Tokyo financial market |

| Main Purpose | Access to yuan funding outside mainland China | Access to yen funding from Japanese investors |

| Investor Base | International and Hong Kong investors | Primarily Japanese investors |

| Regulation | Regulated by Hong Kong Monetary Authority | Regulated by Japanese Financial Services Agency |

| Liquidity | Growing but less liquid than Samurai bonds | Generally more liquid and established market |

| Risk Factors | Currency risk due to yuan fluctuations | Currency risk due to yen fluctuations |

| Typical Investors | Investors seeking yuan exposure | Investors seeking yen exposure |

Which is better?

Dim sum bonds are issued in Chinese yuan outside mainland China, offering investors exposure to China's currency and economy with potentially higher yields but increased currency risk. Samurai bonds, denominated in Japanese yen and issued by non-Japanese entities in Japan, provide stability and access to Japan's deep capital markets with typically lower yields due to Japan's low interest rates. The choice between dim sum and Samurai bonds depends on an investor's risk tolerance, currency preference, and yield expectations.

Connection

Dim sum bonds and Samurai bonds both represent forms of foreign currency-denominated bonds issued in specific Asian markets, with dim sum bonds issued in Chinese yuan in Hong Kong and Samurai bonds issued in Japanese yen in Japan. These instruments enable international investors to access regional credit markets while allowing issuers to diversify funding sources and attract capital in local currencies. Both bond types reflect strategic financial tools for cross-border investment and currency risk management in the Asia-Pacific financial landscape.

Key Terms

Currency denomination

Samurai bonds are yen-denominated bonds issued by foreign entities in Japan, while Dim Sum bonds are renminbi-denominated bonds issued outside mainland China, primarily in Hong Kong. Samurai bonds cater to investors seeking exposure to the Japanese yen, whereas Dim Sum bonds provide access to the Chinese currency market with lower regulatory barriers. Explore further to understand the strategic benefits and market dynamics of these distinct bond types.

Issuance location

Samurai bonds are issued in the Japanese market by foreign entities and denominated in Japanese yen, offering access to Japanese investors. Dim sum bonds are issued in Hong Kong by foreign issuers and denominated in Chinese yuan, targeting offshore yuan investors. Explore the distinctions and benefits of these bond types to make informed investment choices.

Target investor base

Samurai bonds are yen-denominated bonds issued in Japan by non-Japanese entities targeting Japanese institutional investors who prefer stable, low-risk investments within their domestic market. Dim sum bonds, on the other hand, are yuan-denominated bonds issued outside mainland China, primarily aiming at international investors seeking exposure to Chinese currency and higher yields. Explore more to understand which bond fits your investment strategy and risk appetite.

Source and External Links

Samurai Bonds Explained: Navigating Japan's Unique Investment - Samurai bonds are yen-denominated debt instruments issued in Japan by foreign entities to access Japanese capital, avoid currency risk, and are typically listed on the Tokyo Stock Exchange after a regulated approval process.

Samurai Bonds | Clifford Chance - Samurai bonds are Japanese-law governed, yen-denominated securities issued by non-Japanese entities mainly to institutional investors, often in large denominations, and usually involve a Commissioned Company for Bondholders if retail investors are targeted.

Guarantee for Privately Placed Samurai Bonds (Sustainability Bonds ... - The Japan Bank for International Cooperation recently guaranteed a privately placed Samurai bond issuance by the government of Cote d'Ivoire, marking the first such guarantee for a Sub-Saharan African nation and supporting sustainability-linked projects in the Japanese bond market.

dowidth.com

dowidth.com